Summary

Mediterranean living and an English-speaking setting make Malta a natural base for remote work. The Nomad Residence Permit lets third-country nationals live there while working for foreign employers or clients.

This residency route is designed more as a change of scenery than a long-term settlement option. Issued for 1 year, renewable up to 3 times, and not leading to permanent residence, it suits remote professionals seeking flexibility.

Learn how the Malta Nomad Residence Permit works in practice, who it suits, and what to consider before applying.

What is a Malta Digital Nomad Visa?

The Malta Digital Nomad Visa is the informal name for the Malta Nomad Residence Permit, NRP. It is a temporary residence permit issued to third-country nationals who work remotely for non-Maltese employers or clients. Eligible applicants include remote employees, freelancers, and entrepreneurs.

Administration falls under Maltese immigration law and is handled by the Residency Malta Agency, a government entity established to manage residency programmes[1].

Malta NRP is issued for 1 year, renewable 3 times for the same period. Permanent residence or citizenship is not available to digital nomads in Malta[2].

In terms of demand and economic impact, the Malta Digital Nomad Visa received 1,031 applications in 2024. Nomads reported an average annual income of €76,000 and generated an estimated €5 million in local spending, linked to around 542 permit holders[3].

Trusted by 5000+ investors

Does your remote income qualify for Malta’s Nomad Residence Permit right now?

Malta Digital Nomad Visa eligibility

To qualify for the Malta Nomad Residence Permit, applicants must meet nationality, income, employment, and other criteria set by the Residency Malta Agency.

Requirements for the main applicant

Digital nomads must meet the following eligibility criteria:

- be over 18 years of age;

- be a citizen of a country outside the EU, EEA, or Switzerland;

- have no criminal record and not be subject to prosecution;

- not appear on any international sanctions lists;

- have no prior Schengen visa denials;

- not be involved in ongoing civil or criminal proceedings;

- work remotely as an employee of a foreign company, a director of a company registered outside Malta, a freelancer, or self-employed;

- demonstrate a minimum monthly income of €3,500.

Minimum income requirement: €3,500 per month

Applicants for the Malta Nomad Residence Permit must demonstrate a gross monthly income of at least €3,500 from remote work, equivalent to €42,000 per year.

The applicant is required to show that they will have sufficient income for at least 5 months following the date of application, equivalent to €17,500. Immigrant Invest lawyers recommend holding this amount in a bank account at the time of application as supporting evidence.

Permitted work types: employee, freelancer, entrepreneur

The nomad visa for Malta authorises three categories of remote work:

- Employees working remotely for a non-Maltese employer with no fixed base in Malta.

- Self-employed freelancers providing services to non-resident clients without a fixed base in Malta.

- Business owners or entrepreneurs managing a foreign-registered company from Malta.

Permit holders cannot work for Maltese companies, conduct business with Maltese clients, or establish a fixed place of business in Malta.

Only income from professional activities — employment, self-employment, or business ownership — is counted. Passive income such as dividends, interest, and rental income is excluded.

Family members who can join

Eligible family members for the Malta Digital Nomad Visa include:

- spouse in a registered marriage, or a partner in an unregistered partnership lasting at least 2 years, including same-sex couples;

- children under 18, including adopted children, of the main applicant or their spouse;

- children over 18 who are unmarried and financially dependent on the main applicant, or unable to support themselves due to a medical condition or disability[4].

All family members must be included in the initial application; they cannot be added later, with the exception of newborns.

The number of family members on the application does not increase the Malta Nomad Residence Permit minimum income threshold for the main applicant.

Julia Loko,

Investment programs expert

Dependents of Malta Nomad Residence Permit holders may work in Malta, provided they obtain a separate Single Permit through Identità — Malta’s national agency responsible for residence, citizenship, and work authorisations. This permit allows dependents to take up employment with Maltese employers under standard labour and immigration rules.

Accommodation requirement

To qualify for the Malta NRP, digital nomads must secure housing in Malta. The accommodation can be a rental, co-living, or purchased property. There’s no minimum price threshold — an applicant is free to choose any property they like. If the accommodation is rented, then the agreement with the property owner should be signed for at least a year.

The average monthly rent for a 1-bedroom apartment in Malta is around €1,400, while the average purchase price is about €3,130 per square metre[5].

Examples of real estate in Malta

Covering additional expenses

In addition to proving sufficient income, an applicant for Malta Nomad Residency must cover the associated costs for everyone included in the application, including:

- Translation and certification of documents — €2,000+.

- Administrative fee — €300 per person.

- Residence permit card fee — €100 per person.

- Health insurance — €500 per person.

Overall, the total cost for a single applicant under the Malta NRP is approximately €19,700, including a 12-month lease.

Banned countries

The Residency Malta Agency does not accept applications from nationals of countries subject to visa restrictions or security concerns. The following nationalities are currently ineligible:

- Afghanistan;

- Belarus;

- Democratic Republic of Congo;

- Iran;

- North Korea;

- Russia;

- Somalia;

- South Sudan;

- Sudan;

- Syria;

- Venezuela;

- Yemen[6].

In addition, individuals who are not citizens but reside in, conduct business with, or maintain significant ties to these countries are not eligible to participate.

How to apply for Malta Digital Nomad Visa: step-by-step procedure

The Malta Digital Nomad Visa follows a structured application process that begins with compliance checks and concludes with the collection of residence cards in Malta. The overall processing time takes around 2 months.

The Malta Nomad Residence Permit is issued for 1 year and may be renewed up to 3 times for the same period.

1 day

Preliminary Due Diligence

Before signing a services agreement, Immigrant Invest carries out an initial compliance review of the applicant. This confidential check helps confirm eligibility for the residence permit and identify any potential risks that could affect approval.

Before signing a services agreement, Immigrant Invest carries out an initial compliance review of the applicant. This confidential check helps confirm eligibility for the residence permit and identify any potential risks that could affect approval.

2+ weeks

Preparation of documents

All documents are collected remotely. Income can be confirmed through an official bank statement, either in electronic format downloaded directly from a banking app or as a stamped paper statement issued by a bank. Screenshots are not accepted.

Immigrant Invest lawyer supports the applicant throughout the process, including certification and translation. Translations are typically arranged in Malta to meet local requirements. If completed abroad, translations must be apostilled or legalised.

All documents are collected remotely. Income can be confirmed through an official bank statement, either in electronic format downloaded directly from a banking app or as a stamped paper statement issued by a bank. Screenshots are not accepted.

Immigrant Invest lawyer supports the applicant throughout the process, including certification and translation. Translations are typically arranged in Malta to meet local requirements. If completed abroad, translations must be apostilled or legalised.

2+ months

Application submission and Due Diligence by the Agency

The applicant does not need to be physically present in Malta at this stage. All forms are signed remotely and submitted in scanned form.

For submission, a temporary address is sufficient, such as a 1-month hotel reservation. After approval, long-term accommodation must be secured for the full 12-month validity of the permit.

The complete application package is submitted to the Residency Malta Agency, which usually completes its review within two months, assuming no documents are missing.

The applicant does not need to be physically present in Malta at this stage. All forms are signed remotely and submitted in scanned form.

For submission, a temporary address is sufficient, such as a 1-month hotel reservation. After approval, long-term accommodation must be secured for the full 12-month validity of the permit.

The complete application package is submitted to the Residency Malta Agency, which usually completes its review within two months, assuming no documents are missing.

Within 1 month from the issue of the Letter of Approval in Principle

Meeting approval conditions

The Residency Malta Agency issues a Letter of Approval in Principle. The applicant must then arrange valid health insurance in Malta and confirm temporary accommodation. Once these requirements are met, the Final Letter of Approval is issued.

The Residency Malta Agency issues a Letter of Approval in Principle. The applicant must then arrange valid health insurance in Malta and confirm temporary accommodation. Once these requirements are met, the Final Letter of Approval is issued.

Within 3 months from the approval date

Travel to Malta

The main applicant and any included dependents must travel to Malta to submit biometric data and apply for their residence cards.

If an entry visa is required, the Central Visa Unit at Identità will contact the applicant with further instructions. Visa processing usually takes 2 to 3 weeks.

The main applicant and any included dependents must travel to Malta to submit biometric data and apply for their residence cards.

If an entry visa is required, the Central Visa Unit at Identità will contact the applicant with further instructions. Visa processing usually takes 2 to 3 weeks.

Up to 3 weeks

Collection of residence cards

Residence permit cards are issued within 2 to 3 weeks. Applicants receive an e-mail notification and must collect the cards in person by presenting a valid passport.

Residence permit cards are issued within 2 to 3 weeks. Applicants receive an e-mail notification and must collect the cards in person by presenting a valid passport.

Documents required for the Malta Nomad Residence Permit

The Residency Malta Agency requires a comprehensive set of documents to verify identity, employment, income, and family relationships.

Documents for the main applicant:

- Completed application form with personal details and employment information, filled in online in English.

- Valid passport.

- Curriculum vitae listing employment history and educational background.

- Motivation letter explaining the reason for applying for the Malta Nomad Residence Permit and detailing income sources, including salary, bonuses, and freelance fees.

- Employment or business documents, such as employment contracts confirming remote work, or service agreement and contracts with clients.

- Bank statement for the previous 3 months showing an average monthly income of at least €3,500.

Contracts and agreements must guarantee an average monthly income of €3,500+ for at least 5 months from the date of application submission.

Bank statements must be downloaded as PDFs from the applicant’s banking portal or provided as scanned paper documents. The Residency Malta Agency does not accept screenshots or edited files.

For each family member applying for a permit, the following documents are required:

- spouse — marriage certificate;

- unregistered partner — documents confirming cohabitation for at least 2 years, such as joint lease agreements, bank statements showing a joint account, notarised certificates from neighbours, or mutual financial transfers;

- minor children — birth certificates;

- adult children — notarised certificate confirming financial or physical dependency on the main applicant;

- adopted children — court decision on guardianship or adoption.

If one parent is applying alone with a child, the Residency Malta Agency may request additional documents, such as a court decision determining the child’s place of residence after divorce. If the main applicant or a family member has changed their name, a certificate of name change is required. If a spouse changed their surname upon marriage, the marriage certificate is sufficient.

All documents must be translated into English and notarised. Foreign public documents and their translations must be apostilled or fully legalised, unless they originate from an EU member state and fall under EU Regulation 2016/1191[7].

An apostille is issued by the competent authority in the country where the document was issued, typically a Ministry of Foreign Affairs or designated government office under the Hague Apostille Convention.

Malta Nomad Residence Permit duration and renewal

The Malta Nomad Residence Permit is valid for 1 year from the date of issuance and may be renewed at the discretion of the Residency Malta Agency. Renewal eligibility requires the permit holder to spend at least 5 months in Malta during the validity period.

Applicants must submit the renewal application at least 2 months before the current Nomad Residence Permit expires. After receiving the Letter of Approval in Principle, all required documents must be provided within 21 days before the permit’s expiry date.

Permit holders may renew the Malta Nomad Residence Permit up to three times, each for 1 year, provided they continue to meet all eligibility criteria. The Residency Malta Agency assesses renewal requests on a discretionary basis; approvals are not automatic.

Julia Loko,

Investment programs expert

The Malta Nomad Residence Permit is a temporary residence authorisation and does not lead to permanent residence or citizenship. Time spent in Malta under the Nomad Residency Permit does not count towards eligibility for long-term residence under EU Directive 2003/109/EC.

Applicants seeking a pathway to permanent residence or citizenship in Malta must consider alternative residence routes, such as the Malta Permanent Residence Programme. It may lead to long-term status after meeting investment and residence requirements.

Tax obligations of Malta Nomad Residence Permit holders

Taxation for Malta Nomad Residence Permit holders is governed by the Nomad Residence Permits Income Tax Rules, 2023, which introduced a simplified 10% flat rate on income from authorised work[8].

10% flat tax

Under Malta’s Digital Nomad Residence Permit, income linked to authorised remote work can qualify for 12 months of tax relief. After that period, it becomes taxable at a 10% flat rate.

Authorised work covers employment with a non-resident employer or self-employment for non-resident clients, as long as the employer or client does not have a fixed base in Malta.

Income not derived from authorised work — such as dividends, interest, and passive income — is taxed under the general rules of Malta’s Income Tax Act at progressive rates reaching 35%.

Malta’s non-domicile tax regime can strengthen this advantage. If a digital nomad later becomes a Maltese tax resident while remaining non-domiciled under Maltese law, the remittance basis may also apply to other foreign income, separate from the qualifying remote-work income.

183-day rule

Under Malta’s Income Tax Act and general international tax principles, spending 183 days or more in Malta during a calendar year may result in tax residency. In this case, when receiving income other than from authorised activity, the individual may become liable to tax in Malta on worldwide income.

If a Malta Nomad Residence Permit holder becomes a tax resident of Malta, they may face double taxation in both Malta and their country of citizenship or prior residence, unless relief is available under a tax treaty. Malta has signed over 70 double taxation agreements with numerous countries, including the US, allowing relief from double taxation under Malta’s tax treaties[9].

Key benefits of Malta residence permit for digital nomads

The Malta Digital Nomad Visa offers the benefit of living in Malta for up to 4 years while working remotely. It combines Schengen mobility, access to services, and a comfortable Mediterranean lifestyle.

1. Living in a safe country

Malta is widely regarded as a safe country to live in. It shows strong everyday safety and public order, with very low levels of violent crime and little reliance on violence to resolve disputes. This is reflected in the World Justice Project Rule of Law Index 2024, where Malta ranks 10th out of 142 countries for Order and Security[10]. Malta also records the lowest number of intentional homicides in the EU[11].

2. Access to healthcare and education

Digital nomads in Malta have access to both public and private healthcare services. Public healthcare is centred around Mater Dei Hospital, one of the largest and best-equipped hospitals in the Mediterranean. Private healthcare includes modern clinics and hospitals with short waiting times and English-speaking medical staff.

Children of digital nomads can study in Malta, but tuition fees apply. At universities, tuition for non-EU students ranges from €8,500—26,000 per academic year. In schools, education is also fee-based, with private and international schools charging around €4,800—13,500 per year.

The leading education institutions in Malta are:

- Universities: University of Malta and Malta College of Arts, Science and Technology.

- Schools: Verdala International School and St Edward’s College.

Julia Loko,

Investment programs expert

If at least one parent obtains a Maltese work permit, their children may apply for a fee exemption under the Single Permit Regulations and the Education Act. If granted, this exemption allows access to free primary and secondary education in Malta’s public schools.

3. Access to banking services

The Malta Nomad Residence Permit holders may open bank accounts with local and international banks operating in Malta, such as Bank of Valletta, HSBC Malta, and APS Bank. Account opening requires:

- valid passport or Maltese residence card;

- proof of a Maltese address;

- source-of-funds evidence;

- recent bank statements.

Most banks in Malta offer full online and mobile banking services, including international transfers, SEPA payments, and card management, which suits remote professionals. In addition, holding a Maltese residence permit may facilitate account opening in other Schengen states, although acceptance remains subject to each institution’s internal compliance policies.

4. Visa-free travel in the Schengen Area

Holders of the Malta Nomad Residence Permit may travel visa-free to other Schengen countries for short stays of up to 90 days within any 180-day period.

The same travel freedom applies to family members holding dependent permits. Travel within the Schengen Area is straightforward, with regular flights from Malta to European destinations and ferry connections to Italy, making both work and leisure travel across Europe convenient.

5. English-speaking environment

Malta is a bilingual country, with English and Maltese as its official languages. English is widely used in daily life, business, and government services, including healthcare, banking, and education. This linguistic environment makes integration easier for international residents, particularly those relocating from the US and the UK.

6. Relatively affordable cost of living

The cost of living in Malta is about 30—50% lower than in the US and UK, with rent being up to twice as high in those countries. On average, monthly expenses in Malta include:

- mobile connection: €23 per month;

- internet: €31 per month;

- monthly fitness club — €60;

- lunch in a restaurant: €15;

- cappuccino: €2.45.

Excluding rent, monthly living expenses are estimated at approximately €760 per person. A 1-bedroom apartment outside the city centre costs around €800 per month on average[12].

7. Developed coworking spaces and internet infrastructure

Malta has a well-established coworking ecosystem that supports its digital nomad community. Coworking spaces operate across Valletta, Sliema, and St Julian’s, with flexible daily, weekly, and monthly membership options. Average coworking access costs around €30 per day.

Telecommunications infrastructure in Malta is equally developed. The main providers — Melita, Epic, and Go — offer prepaid and postpaid data plans, including 5G coverage in urban centres. WiFi is also available in most cafés and restaurants across the island.

8. Wide expat community

Malta is home to a large international community, with 173,781 foreign-born residents, or roughly 30% of the population[13]. This level of diversity supports easier relocation, with established expat networks, English-speaking workplaces, and active social scenes in key areas.

Digital nomads can benefit from multiple online communities, including Facebook groups and forums that share practical advice on housing, coworking, events, and local services.

9. Mediterranean climate and developed infrastructure

Malta has a mild Mediterranean climate, with warm summers and mild winters. Summer temperatures range between +19—31°C, while winter temperatures stay between +9—17°C.

The country offers a well-developed public transport system. Buses operate both within cities and across the island, with prepaid Tallinja Cards providing discounted fares. Ferry services connect Valletta with Sliema and the Three Cities, while a fast ferry links Valletta’s Grand Harbour with Mġarr in Gozo.

Malta’s compact size, around 27 km by 12 km, allows easy movement across the island.

Malta’s climate supports outdoor living throughout the year, allowing residents to enjoy swimming, sailing, diving, cycling, and hiking

Best cities for digital nomads in Malta

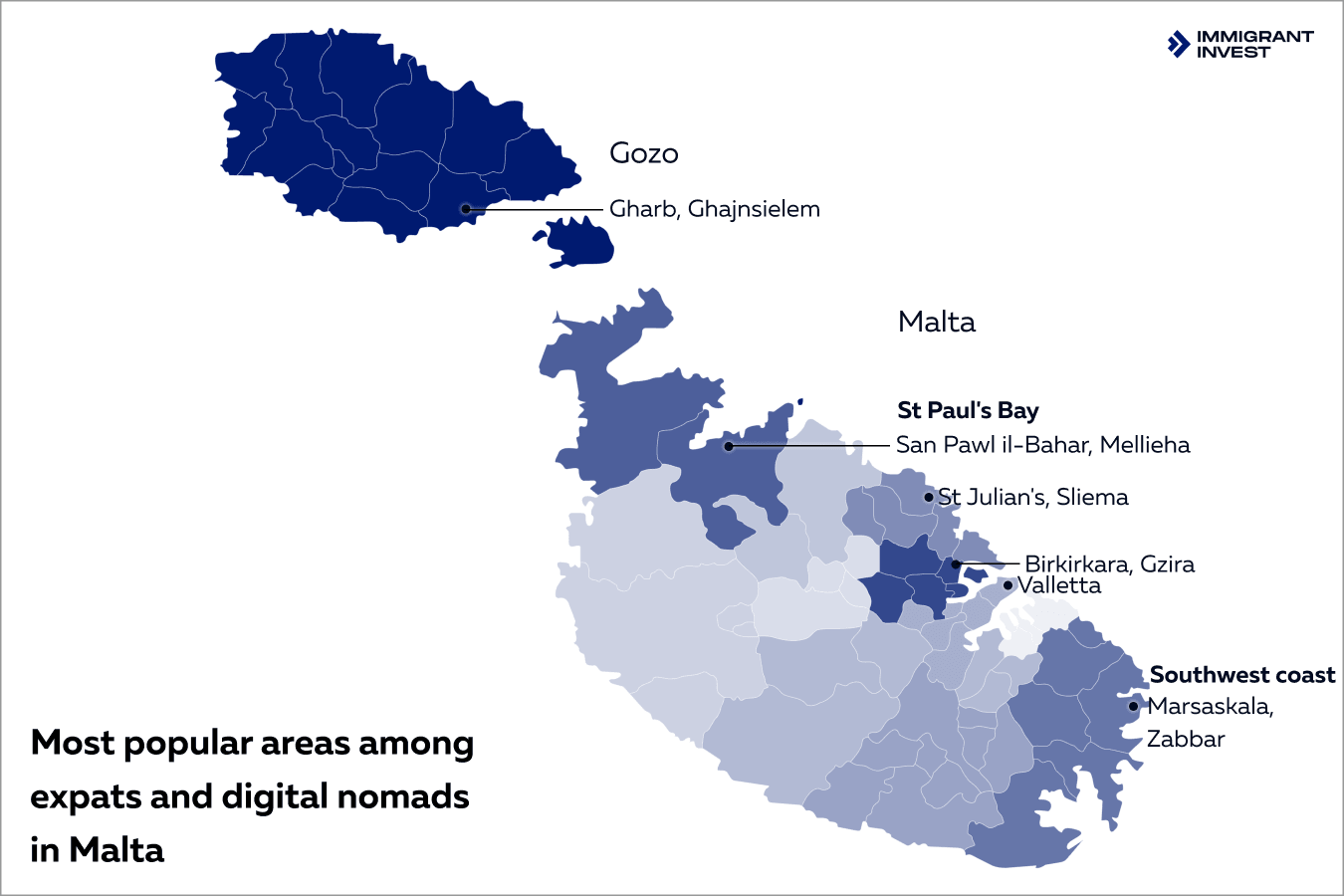

Malta offers a variety of locations for digital nomads, from the historic capital to quieter coastal towns and the sister island of Gozo.

Valletta: capital with UNESCO heritage and coworking hubs

Valletta is Malta’s capital and a UNESCO World Heritage site, known for its baroque architecture, historic fortifications, and cultural institutions. The city is compact and walkable.

Valletta is well connected by public transport and ferry services, making it convenient for travel within Malta and to other Schengen countries via Malta International Airport.

Sliema and St Julian’s: expat favourites with nightlife

Sliema and St Julian’s are adjacent coastal towns, located 4—5 km from Valletta. These areas offer a wide range of restaurants, bars, and entertainment options, proximity to the seafront and promenades, and higher concentration of modern buildings.

Rental costs in Sliema and St Julian’s are higher than the Maltese average, with 1-bedroom apartments costing €1,000—1,500 per month.

Gozo: 40% lower rent, quieter island lifestyle

Gozo is Malta’s sister island, accessible by a short ferry ride from Malta. It offers a quieter, more rural lifestyle compared to the main island, with lower rental costs: 40% less than the Maltese average, with 1-bedroom apartments available for €500—900 per month.

The island is known for its natural beauty, including beaches, cliffs, and historic sites, as well as its slower pace of life, which appeals to digital nomads seeking focus and tranquillity.

Gozo is well connected to Malta by regular ferry services. A fast ferry from Valletta’s Grand Harbour to Mġarr in Gozo takes 45 minutes, with tickets costing €6—7.50 per adult.

Other notable locations

Gzira is a quieter alternative near Sliema, offering affordable accommodation and good access to the seafront.

St Paul’s Bay in the north of the island offers a more relaxed atmosphere, appealing to those who prefer a quieter environment outside the main urban centres.

Mellieħa in the northwest is a coastal village with stunning views, a slower pace of life, and access to some of Malta's best beaches.

Darker shading indicates areas with a higher concentration of expat residents

Risks and common pitfalls of the Malta Nomad Residence Permit

Applicants considering the Malta Nomad Residence Permit should be aware of several structural risks and recurring issues that may affect approval, compliance, and long-term planning.

Discretionary decisions and no stated reasons for refusal

The Residency Malta Agency’s decision is final. If an application is refused, the Agency does not provide a specific reason for the refusal. There is no formal right of appeal.

Julia Loko,

Investment programs expert

Digital nomads may submit a new application after a 1-year waiting period. This interval allows applicants to fully address compliance gaps, restructure income sources, and strengthen documentation before reapplying. It also provides time to clarify tax positioning and resolve any prior immigration issues.

Common compliance issues: income proof, Schengen bans

Whilst the Residency Malta Agency does not publish statistics on rejection rates, common reasons for refusal in discretionary residence permit programmes typically include:

- insufficient income proof;

- ineligible employment;

- previous Schengen entry bans or overstays;

- incomplete or incorrect documentation.

Applicants should ensure all documents are complete, correctly translated, notarised, and apostilled before submission. It is advisable not to overstay any existing visa during the application process, as the Malta Nomad Visa processing time application does not extend the period of lawful stay.

Minimum stay and renewal timing risk

The Nomad Residence Permit requires a physical presence of at least 5 months per year. Renewal is discretionary and depends not only on meeting this threshold but also on submitting the application and documents within strict deadlines — at least 2 months before the current permit expires. Once the Letter of Approval in Principle is issued, all supporting documents must be filed no later than 21 days before the permit’s expiry date.

Tax residency triggered unintentionally

Spending 183 days or more in Malta within a calendar year triggers Maltese tax residency. It can activate obligations to declare and potentially pay tax on worldwide income in Malta. It creates exposure to both Maltese tax liabilities and potential double-taxation issues in their home country.

Income source and structure constraints

The Malta NRP is designed strictly for individuals earning income from outside Malta. Applicants who operate a Maltese-registered company, serve Maltese clients, or receive income routed through Malta are ineligible.

Document formalities and certification gaps

Malta’s application process enforces strict rules on document format:

- bank statements must be original, not screenshots or print-to-PDF exports;

- foreign-language documents require certified translation into English;

- certain documents, such as birth or marriage certificates, must carry an apostille or consular legalisation.

Underestimating lead times for police clearance certificates, notarised translations, and apostilles, can lead to multi-week delays or outright rejection of incomplete dossiers. Expired documents submitted at the time of application are another frequent cause of refusal.

Work-permission misconceptions

The Malta Nomad Residence Permit allows legal residence in Malta but does not confer the right to work for Maltese employers or provide services to Maltese clients. Any form of local employment or freelancing without a separate work or single permit may lead to status violations, financial penalties, and revocation of the permit.

Malta Permanent Residence Programme: a lifelong route to settling in Malta

Digital nomads seeking a pathway to permanent residence in Malta may consider alternative residence programmes that lead to long-term status.

The Malta Permanent Residence Programme, MPRP, grants lifelong permanent residence to third-country nationals. The status allows the inclusion of a spouse, children under 29, as well as parents and grandparents.

To qualify for the MPRP, investors must meet the following mandatory requirements:

- Rent or purchase real estate in Malta.

- Make a government contribution of €37,000.

- Pay administration fee of €60,000 for the main applicant, plus €7,500 for each dependent over 18, excluding the spouse.

- Donate to a registered Maltese NGO of €2,000.

When renting property, the minimum annual rent is €14,000, and the lease must be maintained for at least 5 years, resulting in total rent of €70,000+.

When purchasing property, the minimum purchase price is €375,000, and the property must also be held for at least 5 years. Additional property-related taxes and legal fees amount to approximately €26,250.

In both cases, the property must be retained for 5 years. After this period, a registered residential address in Malta must still be maintained.

As a result, the minimum total investment under MPRP starts at approximately €169,000 under the rental option and €474,000 under the purchase option.

The MPRP allows holders to conduct business and work in Malta. Besides, the residence status is granted for life, with only the residence card renewed every 5 years.

How Immigrant Invest can help with Malta Digital Nomad Visa

Immigrant Invest has operated since 2006, advising clients on obtaining residency and citizenship across multiple jurisdictions. We maintain a dedicated office in Malta, with in-house lawyers based locally. The Maltese team works directly with national authorities, applies the law in practice, and monitors legislative updates to ensure applications meet current requirements.

Immigrant Invest supports digital nomads in Malta through a structured process that includes the following key elements:

- preliminary Due Diligence before submission;

- structured document preparation, including obtaining a Tax Identification Number, TIN;

- assistance with Maltese ID cards for applicants and family members;

- post-approval support, including renewals and status changes;

- referrals to qualified tax and legal specialists in complex cases.

Government licences for European and Caribbean programmes authorise Immigrant Invest to act as an official intermediary, including Malta.

Key takeaways about Malta Digital Nomad Visa

- Malta offers a Nomad Residence Permit to third-country nationals earning at least €3,500 per month from remote work.

- The permit allows residence in Malta for up to 4 years, subject to renewal, provided the holder spends at least 5 months per year in the country.

- Digital nomads in Malta can include a spouse and children in the application.

- The Malta Nomad Residence Permit grants access to Schengen travel, a 10% flat tax on qualifying income, as well as healthcare and banking services in Malta.

Immigrant Invest is a licensed agent for citizenship and residence by investment programs in the EU, the Caribbean, Asia, and the Middle East. Take advantage of our global 15-year expertise — schedule a meeting with our investment programs experts.

Sources

- Source: Residency Malta — Nomad Residence Permit

- Source: Residency Malta — Nomad Residence Permit application process

- Source: Malta Independent — 33,455 first time residence permits were issued to TCNs in 2024

- Source: Residency Malta — Policy on Family Members of Nomad Residence Permit Applicants

- Source: Numbeo — Cost of living in Malta

- Source: Residency Malta — Nomad Residence Permit questions and answers

- Source: Identità — Policy for the Recognition of Foreign Public Documents

- Source: Malta Legislation S.L. 123.210 — Nomad Residence Permits (Income Tax) Rules

- Source: Government of Malta — Double Taxation

- Source: World Justice Project Rule of Law Index 2024

- Source: Eurostat — 3 930 intentional homicides recorded in the EU in 2023

- Source: Numbeo — Cost of living in Malta

- Source: Trading Economics — Malta foreign-born population