Summary

In 2023, Malta ranked 3rd among countries with the largest foreign population, following Spain and Luxembourg. That year, 2,511 foreigners became Maltese citizens, according to Malta Independent.

Malta attracts expats worldwide with its Mediterranean lifestyle, affordable cost of living, favorable tax regime, high safety, and diverse residency options.

Learn why Malta is especially appealing to US citizens, and all about immigration opportunities.

14 benefits of relocating to Malta from the US

1. Residency and citizenship opportunities

Malta has a welcoming policy towards non-EU nationals who wish to move to the country and provides a variety of long-term visas and residence permits options.

Here are some of the options:

- Global Residence Programme — for investors seeking a tax-friendly residency option.

- Malta Permanent Residence Programme — for investors looking for residency for life.

- Malta Retirement Programme — for wealthy retirees seeking a favorable tax regime and a high quality of life.

- Malta citizenship for exceptional services by direct investment — for investors needing an ultimate life-long solution.

Malta Citizenship by Naturalisation for Exceptional Services by Direct Investment has been discontinued. As of 2025, a new pathway is available for individuals with recognised achievements in areas such as business, science, culture, sport, or philanthropy, allowing them to apply for Malta citizenship by merit.

Trusted by 5000+ investors

Will you qualify and what timeline and costs should you expect?

2. Favorable tax regime

Malta has a tax treaty with the US that helps prevent double taxation. US citizens in Malta can use the Foreign Tax Credit to offset US taxes on Maltese-sourced income.

Malta does not impose inheritance, wealth, or estate tax. This is beneficial for US citizens looking to minimize taxation on family wealth, especially for assets held abroad. In contrast, the US applies an estate tax of up to 40%.

Individuals qualifying for the Global Residence Programme pay a flat tax rate of 15% on remitted foreign income, with a minimum tax payment requirement of €15,000 annually.

3. Low cost of living

In Malta, a family of four spends around $3,000 per month on essentials like groceries, utilities, and dining, excluding rent. In the US, similar monthly expenses would be at least $4,000.

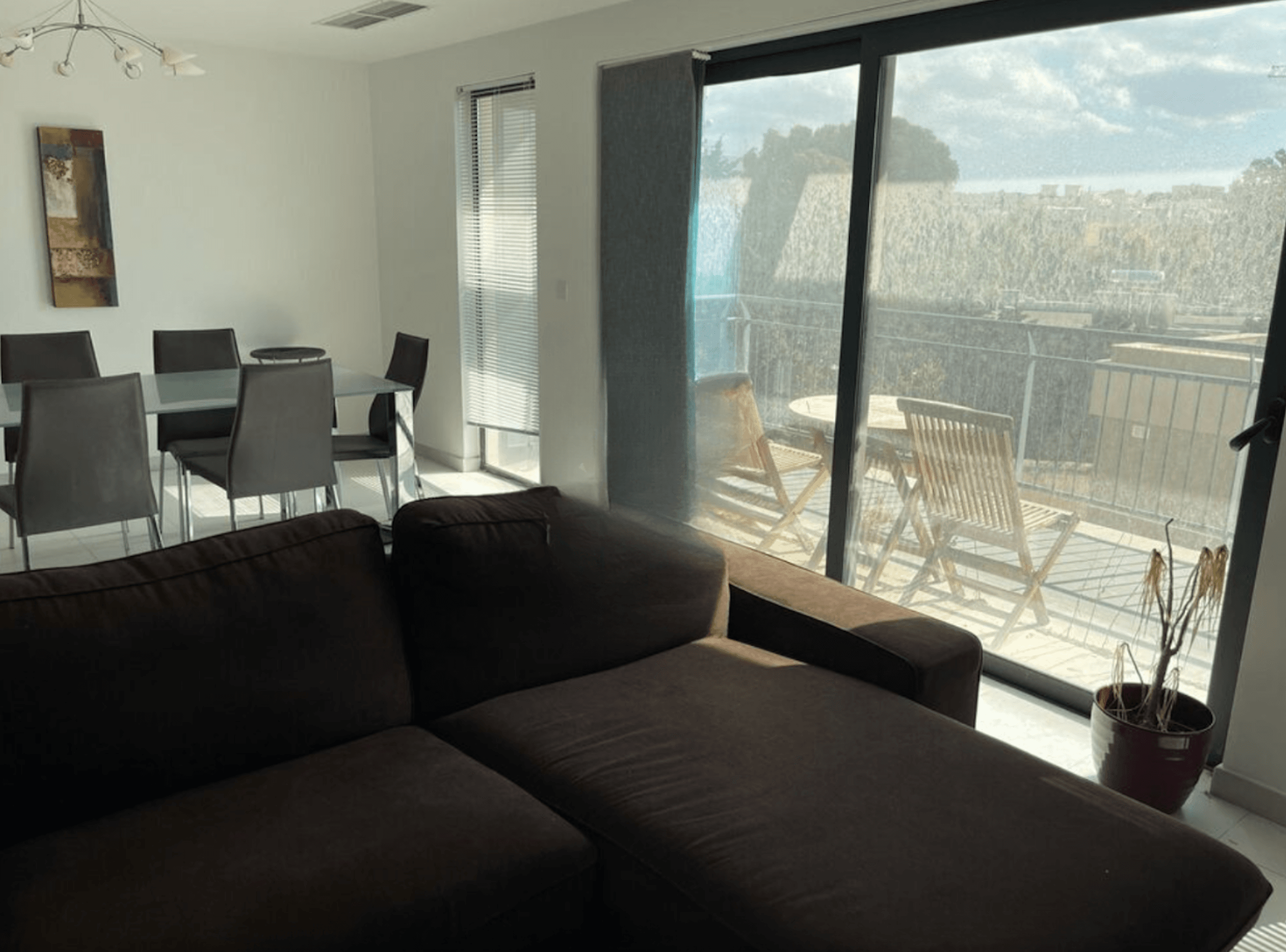

In Malta, rent of a three-bedroom apartment in the city center costs $1,700, while in the US, it would be around $3,000.

4. English-speaking environment

Over 115,000 non-Maltese nationals live in Malta, accounting for more than 22% of Malta’s population.

The island has become a multicultural hub where English is one of the official languages, making it easier for US citizens to integrate. This is beneficial for daily life, professional communication, and paperwork, making the transition smoother.

5. Travel across the EU

Malta’s location in the Mediterranean makes it a convenient hub for traveling to various European destinations, with numerous airlines offering frequent flights.

For example, Rome and Athens are just 1.5 hours away with flights costing €50—120. Cities like Munich, Barcelona, Vienna, and Zurich are around 2.20 hours away, with ticket prices ranging from €60—140.

6. Work and business in the EU

With Malta residence permit or citizenship, US citizens also have the right to work and start businesses across the entire EU.

For professionals in fields like technology, finance, and consultancy, this mobility enables them to take on projects, join European teams, and attend conferences or trade shows throughout the EU without visa concerns.

Malta’s Freeport is the Mediterranean’s busiest transshipment and logistics hub, managing cargo traffic between Europe, Asia, and Africa, and attracting foreign investments in logistics

7. Bank account in the EU

EU residents benefit from streamlined banking and financial services across EU countries. Thanks to the Single Euro Payments Area, SEPA, they can make euro transactions between EU countries as easily as domestic transfers, without international fees.

Access to EU banking and financial services also means US citizens can better manage assets, investments, and even retirement planning within Europe.

8. Education in the EU

With EU residency or citizenship, US citizens can take advantage of educational opportunities in Europe, often at significantly lower tuition rates compared to the US, especially in public universities.

Many EU countries, including Germany, France, and the Netherlands, offer affordable or even free higher education programs for EU residents.

Malta itself has a range of higher education institutions offering high-quality programs, many in English. The American University of Malta provides programs modeled on the American education system, focusing on areas such as business, engineering, and technology. Tuition fees range from €5,000 to 11,000.

9. Access to public healthcare

Unlike the US, Malta has a universal public healthcare system funded through taxes and social security contributions, providing most healthcare services for residents, including expats. Once registered, residents can use the public healthcare system at little to no cost, covering primary care, specialist visits, and emergency services.

EU residents also have the European Health Insurance Card, which entitles them to access healthcare services in other EU countries at reduced costs or sometimes for free, depending on the country.

10. Safety

Malta ranks 12th among 180 countries as one of the safest places to live, according to the Philtr Country Risk Index 2023. Ranking evaluates such factors as violence, health risks, including epidemics, quality of healthcare facilities, air quality, and transportation safety. It also accounts for environmental hazards like earthquakes and flooding.

11. Full legal equality for LGBT couples

For American LGBT couples, Malta offers rare legal and social stability within the EU. Same-sex marriages have been fully recognised since 2017, and couples enjoy equal rights in adoption, property, and taxation.

The country ranks 1st in Europe for LGBT rights, scoring 89% on the ILGA-Europe Rainbow Map, and allows same-sex partners to apply jointly for residency by investment programmes such as the Malta Permanent Residence Programme or the Malta Global Residence Programme.

12. Work-life balance

Many companies in Malta encourage a balanced approach to work, with an emphasis on efficiency rather than long hours. Generally, Maltese companies are less intense about “hustle culture” compared to some other countries, including the US.

Employees in Malta are entitled to at least 25 days of annual leave. Additionally, there are 14 public holidays, one of the highest in Europe. Unlike the US, in Malta, mothers receive 18 weeks of maternity leave, 14 of which are at full pay and 4 partially paid.

Malta has adapted to remote and flexible working, especially in sectors like tech, finance, and gaming, with many companies supporting hybrid work models. Malta ranks 8th among 38 nations as one of the best countries for digital nomads. With Malta Nomad Residence Permit, digital nomads can live and work in Malta legally.

13. Mediterranean lifestyle

Malta’s island lifestyle promotes a slower pace and a strong work-life balance, encouraging people to savor life and enjoy meals with family and friends. The close-knit community means Maltese people often know and support their neighbors, creating a welcoming and interconnected environment.

Thanks to the island’s favorable climate, traditional farming practices, and access to the Mediterranean Sea, Malta offers fresh seasonal food year-round. Fish, including sea bass, swordfish, tuna, and the popular lampuki, is widely available.

Tomatoes, zucchini, peppers, olives, and potatoes are commonly grown, and local farms use minimal pesticides, focusing on natural growing methods.

14. Mild climate

Malta’s Mediterranean climate means mild winters and hot summers, ideal for those who enjoy warm weather, with plenty of opportunities for outdoor activities like sailing, diving, and exploring historical sites. Most famous are the "Silent City" in Mdina, which is an ancient fortified city, and Valletta, Malta’s capital and UNESCO World Heritage Site.

Dwejra Cliffs in San Lawrenz, Gozo, Malta, overlook Dwejra Bay, a scenic coastal area famous for its dramatic landscapes

Ways to move to Malta from the US: requirements to obtain citizenship and residency

Relocating to Malta offers several clear pathways for Americans who want to establish long-term residence in Europe. Investors, remote workers, and individuals seeking favourable living conditions can choose between different residence options depending on their goals, budget, and lifestyle preferences.

Citizenship

Malta citizenship for exceptional services by direct investment is the fastest way for obtaining a Maltese passport as a foreigner. It requires fulfilling three investment conditions:

- contribution to the National Development and Social Fund, NDSF;

- donating to a non-governmental organization;

- buying or renting a residential real estate.

Malta citizenship is acquired by naturalization. First, investors get Malta residency and maintain the status for 1 or 3 years depending on the contribution amount.

If the applicant contributes €600,000 to the NDSF, they become eligible for Malta citizenship in 3 years. If the applicant contributes €750,000, the citizenship is available in 1 year.

To apply for Malta citizenship for exceptional services by direct investment, investors have two real estate options: renting or purchasing a property.

For those opting to rent, the process involves two stages. First, the investor signs a lease for the time of their residence — 1 or 3 years. The minimum price for that time is €12,000 per year. Then, when applying for citizenship, the investor concludes a new leasing agreement for at least €16,000 per year. At this point, the requirement is to rent housing for at least 5 years.

In case of purchasing property, the investor needs to buy real estate worth at least €700,000, regardless of the contribution amount.

A spouse or a registered partner, children under 29, parents and grandparents over 55, are also eligible for Malta citizenship with the main investor.

Malta citizenship costs for a single applicant

Permanent residency

The Malta Permanent Residence Programme allows investors to obtain permanent residency in Malta for life. In comparison with Malta citizenship, permanent residency requires less investments.

To acquire the status, investors buy or rent real estate, pay government fees, and make donations. It is also required to confirm assets of at least:

- €500,000, where €150,000 are liquid financial assets;

- or €650,000, where at least €75,000 are liquid financial assets.

If investors decide to rent real estate, they need to lease an agreement for 5 years. The minimum rental price is €14,000 per year.

Additional expenses include:

- €60,000 — administrative fee;

- €37,000 — contribution fee;

- €2,000 — charitable donation;

- €5,000 — translation and apostille of documents, notary fees;

- €500 — health insurance.

In total, investors need at least €169,000 including all the fees, to qualify for permanent residency through renting housing.

In case of property purchase, the minimum investment is €375,000.

Additional expenses include:

- €60,000 — administrative fee;

- €37,000 — contribution fee;

- €2,000 — charitable donation;

- €5,000 — translation and apostille of documents, notary fees;

- €500 — health insurance.

In total, permanent residency through buying property requires €474,000+ including fees and donations.

The investor must own the property for a minimum of 5 years after obtaining permanent residence. Then, they are allowed to sell it and return a part of the invested money.

A spouse, children of any age, parents, and grandparents are also eligible for Malta permanent residency with the main applicant.

Digital Nomad Visa

The Malta Digital Nomad Visa is a residence permit for foreign remote workers. Employees and the management of foreign companies, freelancers, and self-employed can qualify. Digital nomads can stay in the country for up to 4 years.

To get a residence permit, applicants confirm a monthly income of at least €3,500 outside Malta. Digital nomads also need to buy or rent housing within Malta for the entire validity period of a residence permit.

Residency is issued for 12 months. It can be extended three times for the same period. Malta Digital Nomad Visa does not lead to permanent residency or citizenship.

A spouse and children are also eligible for Malta residence permit with the digital nomad.

Residence permit

The Malta Global Residence Programme requires renting or buying real estate, paying an administration fee and the minimum annual tax. The first Malta residence permit card needs to be changed after a year, and the following are issued for two years.

If the investor rents property, it is required to sign a lease for a year. The rental cost depends on the property location:

- €8,750 per year in the south of Malta or the island of Gozo;

- €9,600 in the north and center of Malta.

In total, including all the fees, applicants would need at least €34,150.

If purchasing property, minimum expenses also depend on the real estate location:

- €220,000 in the south of Malta or the island of Gozo;

- €275,000 in the north or center of Malta.

In total, including all the fees, investors would spend €270,200+.

A spouse, children under 25, siblings, parents, and grandparents can also qualify for residency.

The benefit of the programme is the opportunity for participants to enjoy a special tax regime:

- 15% on the income earned abroad and transferred to Malta;

- 0% on global income not transferred to Malta;

- 35% of the income earned in Malta.

The minimum tax payment for a family is €15,000 per annum. There are no additional taxes for the investor’s family members and inheritance.

How to move to Malta from the US: a step-by-step procedure

Malta offers foreigners four ways to obtain citizenship and residency. Here is the example of acquiring a Malta permanent residence permit, based on the experience of lawyers Immigrant Invest.

The whole process of obtaining permanent residency in Malta takes around 6—8 months.

1 day

Preliminary Due Diligence

Investors are checked in the databases to ensure that they are eligible to participate in the MPRP. The check is confidential. Preliminary Due Diligence helps reduce the clients’ rejection risk to 1%.

Investors are checked in the databases to ensure that they are eligible to participate in the MPRP. The check is confidential. Preliminary Due Diligence helps reduce the clients’ rejection risk to 1%.

2+ months

Preparation of the application and obtaining a temporary residence permit

Before submitting the full MPRP application, the main applicant and their dependants may get a 1-year temporary residence permit. This gives them access to residency benefits while the permanent application is being processed.

Applicants must travel to Malta to submit biometrics. The first part of the administrative fee of €15,000 and a government fee of €100 per residence card are paid.

Immigrant Invest lawyers prepare the welfare history, translate documents into English, notarise copies, and fill out application forms. The lawyers submit the application to the Residency Malta Agency.

Before submitting the full MPRP application, the main applicant and their dependants may get a 1-year temporary residence permit. This gives them access to residency benefits while the permanent application is being processed.

Applicants must travel to Malta to submit biometrics. The first part of the administrative fee of €15,000 and a government fee of €100 per residence card are paid.

Immigrant Invest lawyers prepare the welfare history, translate documents into English, notarise copies, and fill out application forms. The lawyers submit the application to the Residency Malta Agency.

4—6 months

Due Diligence

The Residency Malta Agency processes the application and conducts Due Diligence. The application processing time is 4—6 months.

The Residency Malta Agency processes the application and conducts Due Diligence. The application processing time is 4—6 months.

Up to 8 months

Fulfillment of the investment conditions

The investor pays the remaining €45,000 of the administration fee within two months after receiving approval. The government contribution, charitable donation, and real estate requirements, must be completed within eight months.

Additionally, the investor and their family obtain health insurance with coverage exceeding €30,000 per person.

The investor pays the remaining €45,000 of the administration fee within two months after receiving approval. The government contribution, charitable donation, and real estate requirements, must be completed within eight months.

Additionally, the investor and their family obtain health insurance with coverage exceeding €30,000 per person.

1+ days

Fingerprinting in Malta

All applicants are required to visit Malta for fingerprinting with the Residency Malta Agency. This step occurs after they receive approval in principle but can be completed before they meet the full investment requirements.

All applicants are required to visit Malta for fingerprinting with the Residency Malta Agency. This step occurs after they receive approval in principle but can be completed before they meet the full investment requirements.

1 month

Getting final approval

Once the investment conditions are met, the Residency Malta Agency reviews the additional documents submitted. Following this review, Immigrant Invest receives final approval, confirming that applicants will receive their permanent residency cards.

Once the investment conditions are met, the Residency Malta Agency reviews the additional documents submitted. Following this review, Immigrant Invest receives final approval, confirming that applicants will receive their permanent residency cards.

2 weeks

Obtaining Malta PR cards

The Residency Malta Agency issues a Certificate of Residence and PR cards that are sent to Immigrant Invest’s legal team in Malta. The investor receives these documents via courier, eliminating the need for an in-person visit to Malta.

The Residency Malta Agency issues a Certificate of Residence and PR cards that are sent to Immigrant Invest’s legal team in Malta. The investor receives these documents via courier, eliminating the need for an in-person visit to Malta.

Annually for the first 5 years of residency

Review of compliance with the programme's terms

The Residency Malta Agency checks if the investor follows the programme’s rules: rents or buys housing and keeps assets of €500,000. This check is conducted annually in the first five years after the investor gets Malta permanent residency by investment.

The Residency Malta Agency checks if the investor follows the programme’s rules: rents or buys housing and keeps assets of €500,000. This check is conducted annually in the first five years after the investor gets Malta permanent residency by investment.

Cost of living in Malta vs the US

Malta’s cost of living is approximately 23.7% lower than the US, excluding rent, and about 29.6% lower, including one. Monthly costs for a family of four in Malta generally range from $3,000 to 3,700, depending on location and lifestyle.

In the US, costs vary widely by region. According to the Economic Policy Institute, a family of four would need approximately $4,700 to 7,500 per month to maintain a moderate standard of living.

Local purchasing power is 48.5% lower in Malta than in the US, meaning expenses are generally lower, but so are wages, which impacts affordability for high-end purchases and services. This is especially beneficial for Americans living in Malta but earning an income in dollars or a stronger currency.

Rental prices

Rental prices in Malta are on average 41.5% lower than in the US, with central areas in Malta being more affordable compared to similar US locations. In Malta, a one-bedroom apartment in the city center costs $840—1,260 per month. Rent for a similar apartment in the US generally ranges from $1,500 to 3,000.

Cost for residential property

The average cost for residential property in Malta is about $3,240 per square meter but it can range from $1,600 to 5,900, depending on the location. High-demand areas, like Sliema, St Julian’s, and Valletta, tend to be on the higher end, while areas like Gozo are more affordable.

In the US, the average price per square meter varies widely by location, exceeding $10,000 per square meter in high-demand urban areas like New York City and San Francisco and $1,000—5,000 in mid-tier and rural regions.

In Maltese prime areas like Sliema or St Julian’s, a two-bedroom apartment averages $320,000 to 540,000. Luxury or seafront apartments can exceed $1 million. In more affordable regions like Gozo, a two-bedroom apartment may cost $160,000 to 320,000.

Examples of real estate in Malta

Monthly utility costs in Malta for an 85 m² apartment are around $95, covering electricity, heating, cooling, water, and garbage collection. In the US, similar utilities range from $150 to 200 per month.

Transportation

Public transport monthly passes in Malta cost $28, while in the US, they are $70—120 in most cities. Taxi rates in Malta start with a base fare of $3.80. Taxi rates in the US vary widely, with major cities like New York or San Francisco charging a base fare of around $3—4.

Cars in Malta are relatively expensive due to import taxes. A used compact car can start around $5,940, while a mid-range vehicle like a Toyota Corolla may cost around $19,440 for recent models. In the US, car prices are more competitive, with a new compact car like a Honda Civic or Toyota Corolla averaging $25,000. Used cars tend to be less expensive, with older compact models often available under $10,000.

Gasoline, 1 gallon, is $5.90 in Malta, and around $3.80 in the US.

Rental prices for compact cars in Malta range $23—40 per day, with weekly rentals around $142—198. Rental cars in the US cost between $40 to 70 per day, depending on location and car type.

Eating out and groceries

Inexpensive restaurant meals in Malta are around $16, while in the US — $20. In mid-range restaurants, for 2 or 3 courses, it is around $75 in both Malta and the US. Cappuccino typically costs $2.50 in Malta and $5.10 in the US.

Groceries in Malta are around 46% cheaper than in the US.

Prices for groceries in Malta and the US

Employment in Malta

Malta offers a stable and dynamic job market with strong demand for skilled professionals, making it an attractive destination for those seeking employment in Europe. Its low unemployment rate, EU membership, and thriving industries such as technology, finance, tourism, and healthcare create favorable conditions for career growth and international opportunities.

Unemployment rate

Malta’s unemployment rate stands at around 3.2%. It is considered very low compared to EU averages, showing a stable job market with high demand in sectors such as technology, iGaming, finance, tourism, and healthcare. In comparison, the unemployment rate in Spain is 12.2%, in Portugal — 6.4%, in Italy — 6.2%, in the US — 4.3%

The country’s EU membership attracts multinational companies and foreign investments, offering expats diverse job opportunities. Skilled English-speaking professionals are highly valued, especially in Malta’s thriving gaming and fintech sectors.

Work permit

EU and EEA citizens can work in Malta freely without a permit. Non-EU citizens require a work permit, often arranged through their employer, who must demonstrate that no EU citizen could fill the role.

For investors, neither Malta permanent residency, nor Malta temporary residence permit, let get employed in the country. Investors are required to receive permission to work in the country.

To obtain the work permit, the employer submits the Single Permit Application, including a job description, employment contract, and proof of applicant qualifications. The application takes about 4—8 weeks, handled by Malta’s Identity Malta agency.

Work permits are generally valid for one year, with the option to renew annually.

With Malta citizenship for exceptional services by direct investment, foreigners can run business and work in Malta without needing a separate work permit.

Digital nomads cannot work for a Maltese company or provide services to clients based in Malta. Digital Nomad Visa is specifically designed for individuals who are employed by, or conduct business activities for, companies registered abroad, or who offer freelance or consulting services to clients whose permanent establishments are outside of Malta.

Salaries

Malta’s minimum wage is €835 per month, offering basic income security, though higher cost areas like Sliema and Valletta may require salaries above minimum levels for comfortable living.

Average wages are generally lower than in the US or Northern Europe, but the cost of living is moderate, making wages reasonable for local expenses. IT and iGaming are among the highest-paying in Malta. Positions like software developers, data analysts, and gaming operations specialists often earn €30,000 to 60,000 per year.

Accountants, auditors, and finance managers generally earn between €25,000 and 50,000 annually. Financial analysts and senior finance roles can earn above €50,000.

Experienced professionals in leadership positions such as management earn around €50,000—100,000 annually, depending on the company and expertise required.

Specialized healthcare roles earn upwards of €40,000 per year, while nurses and allied health professionals earn around €20,000 to 30,000.

Taxes in Malta

Personal income tax ranges from 0 to 35%. Rates apply based on income level and vary for single, married, and parent taxpayers.

Personal income tax in Malta

Remittance-based tax system for non-domiciled residents. Malta taxes non-domiciled residents only on income sourced in Malta or foreign income remitted to Malta. Foreign capital gains, even if brought to Malta, are exempt from Maltese tax.

Domiciled individuals in Malta are considered those who have Malta as their permanent home. “Home” refers to the place where a person belongs and implies stronger ties with a country than residence.

The standard corporate tax rate is 35%. Foreign shareholders of Maltese companies may claim refunds on tax paid. Commonly, a 6/7 refund applies, bringing the effective tax rate down to 5% for trading income. A 5/7 refund applies for passive interest or royalties, resulting in an effective rate of 10%.

Both employees and employers contribute to Malta’s social security system, supporting healthcare and pensions. Contributions are around 10% of gross earnings, up to a cap.

Standard VAT rate is 18%, with reduced rates for certain goods and services, such as 5% for electricity and health services.

Capital gains tax for Maltese residents applies to property sales and some securities, typically taxed at 8—12%.

Inheritance, estate, and wealth are exempt from taxes.

Healthcare in Malta

Malta offers a well-structured healthcare system that combines comprehensive public services with accessible private care, ensuring residents have a wide range of medical options. The public system provides essential healthcare at little to no cost for residents, while private facilities offer shorter wait times and greater flexibility, making healthcare in Malta both reliable and affordable.

Public healthcare system

Funded by social security contributions, public healthcare services are accessible to Maltese citizens and residents who contribute to the system.

Public healthcare provides free access to primary care, specialist services, hospital care, maternity services, and emergency treatment.

Wait times in Malta’s public healthcare system can be long, especially for non-urgent procedures and specialist consultations. Waiting periods for dermatology or orthopedic consultations can range from a few weeks to several months. Wait times for elective surgeries can extend to months for certain procedures.

Major facilities include Mater Dei Hospital, Malta’s largest public hospital with modern equipment, and Gozo General Hospital, which provides a range of essential services, including general surgery, maternity care, and emergency services. Sir Paul Boffa Hospital, previously Malta’s main cancer treatment center, now specializes in dermatology and palliative care services.

Malta residents obtain the European Health Insurance Card, EHIC. It provides temporary healthcare coverage for EU, EEA, and Swiss citizens while traveling or living in other EU countries. EU residents must apply for the EHIC through their home country’s health authority before leaving. It is typically valid for several years and should be renewed upon expiration.

The EHIC provides access to medically necessary treatment, including doctor visits, hospital treatment, and emergency care. However, the EHIC does not cover private healthcare, elective treatments, or services outside the public system. For non-urgent care or elective procedures, having additional insurance is recommended.

Private healthcare system

Many expats choose private healthcare for shorter wait times and more flexibility in provider choice. Private facilities are known for high standards and faster access to specialist care. In most cases, appointments and treatments are available within days to weeks, depending on the facility.

Major private hospitals include St James Hospital in Sliema and St Thomas Hospital in Marsascala, both providing a range of treatments. St James Hospital is known for general and specialist care, including outpatient services, elective surgeries, and diagnostic imaging. St Thomas Hospital offers a range of services, including dental, cosmetic, and specialized procedures.

Private healthcare costs are generally affordable compared to the US. A doctor’s visit ranges from €20 to 40, while specialist consultations cost €50 to 100. Costs for surgeries and procedures vary by complexity, with minor procedures starting at €300—500 and major surgeries running into thousands.

Many expats purchase private insurance to cover these costs. Major providers like Bupa, Cigna, and Globality offer plans that range from €300—600 for basic plans to €1,200—2,500 for comprehensive coverage.

Mater Dei is known for its state-of-the-art facilities and serves as the primary center for acute care, diagnostics, and specialized treatments

Best cities for settling in Malta

Malta offers a variety of places to live, each with its own character, pace, and advantages. Whether drawn to the historic charm of Valletta, the lively urban energy of Sliema and St Julian’s, or the slower, nature-filled rhythm of Gozo, newcomers can choose a location that best suits their lifestyle and priorities.

Valletta

Valletta is a cultural and historic gem with stunning architecture, museums, and theaters. While smaller and quieter at night, this city is perfect for those who appreciate history and a scenic urban atmosphere. It is compact, offering everything within walking distance, from shopping to cafes and cultural sites.

Valletta is well-connected by Malta’s extensive bus network, with many buses converging at Valletta’s main bus terminal. Ferries run from Valletta to neighboring Sliema and the Three Cities, Vittoriosa, Senglea, and Cospicua.

Valletta is a UNESCO World Heritage Site with beautifully preserved architecture dating back to the 16th century. Its popular cultural destinations are St John’s Co-Cathedral, Grandmaster’s Palace, National Museum of Archaeology, Fort St Elmo, and the National War Museum.

One of the oldest working theaters in Europe, the Manoel Theatre, hosts a variety of performances, from classic and modern plays to concerts and operas, appealing to culture enthusiasts. Spazju Kreattiv is a cultural center which showcases contemporary art exhibitions, independent films, and live performances.

Valletta hosts several annual events, including the Valletta Baroque Festival, the Malta Jazz Festival, and Notte Bianca, an all-night cultural festival. The city has a mix of high-end boutiques, artisanal shops, and open markets like the Merchant Street Market, where one can find everything from local crafts and souvenirs to fresh produce.

Maltese people enjoy spending time outdoors, particularly at Upper and Lower Barrakka Gardens, which offer breathtaking views of the Grand Harbour

Sliema

Sliema is a bustling, modern area known for its shopping, restaurants, and waterfront promenade, offering a lively urban lifestyle. It’s popular with expats, especially young professionals and families who enjoy a mix of city amenities and seaside relaxation. By the end of 2023, 5,327 non-EU nationals lived in Slima, making up around 25% of the whole population.

Sliema hosts annual festas, including the Feast of Our Lady of Mount Carmel, which is celebrated with street processions, fireworks, and local music. The largest shopping center in Malta, Tigné Point, features international brands, boutiques, cafes, and supermarkets.

Sliema has a well-developed infrastructure with a range of modern apartment buildings, hotels, coworking spaces, and healthcare facilities. Many residential buildings come with sea views. Sliema is a very walkable area, especially along the promenade stretching from Sliema to St Julian’s.

Sliema’s coastline provides opportunities for water sports like paddleboarding, kayaking, and scuba diving. Boat excursions, including harbor cruises and trips to Gozo and Comino, are readily available from Sliema’s ferry terminal.

The Sliema coastline features a scenic promenade lined with benches, parks, cafes, and views of the Mediterranean

St Julian’s

St Julian’s is the heart of Malta’s nightlife, with Paceville being the epicenter of clubs, bars, and lounges. It attracts a young, social crowd, including locals and tourists, and is ideal for those who enjoy a lively nightlife scene. St Julian’s is popular among younger expats and those working in the tech and gaming sectors.

St Julian’s is a mix of upscale apartment complexes, luxury hotels, and stylish office buildings, especially around areas like Portomaso and Paceville. Taxi services and popular rideshare options like Bolt and Uber are widely available, making it easy to get around, especially at night when public transport may be limited.

Located in the heart of St Julian’s, Eden Cinemas is one of Malta’s largest cinema complexes, showing international blockbusters, independent films, and special screenings. St Julian’s has various entertainment options beyond cinema, including bowling alleys, arcades, and escape rooms.

Spinola Bay is a charming area to explore known for its traditional Maltese fishing boats and waterfront cafes. Portomaso Marina, an upscale marinam, surrounded by luxury residences, hotels, and restaurants, is a popular destination for dining and social events.

Balluta Bay is known for its iconic Carmelite Church and beach area

Gozo

Gozo, Malta’s smaller sister island, offers a slower pace of life with stunning natural landscapes and a close-knit community. Victoria, the capital of Gozo, and Xlendi, a picturesque coastal village, are popular choices for those seeking a tranquil lifestyle. The ferry between Malta and Gozo operates regularly, with trips talking about 25 minutes.

Gozo is more rural than Malta, with villages, traditional stone houses, and a few modern apartment complexes. Most towns have essential services, supermarkets, cafes, and shops. Gozo is popular for outdoor activities like hiking, diving, and exploring historical sites. Best for retirees, remote workers, or those who prefer a rural, serene lifestyle with easy access to beaches and nature.

Gozo has a smaller but functional bus network that connects major towns and villages. Buses are the main form of public transport, though they are less frequent than on Malta, making it more convenient to have a car. Many towns and villages in Gozo are walkable, and biking is common.

Like in Malta, each Gozitan village has its own festa celebrating its patron saint with fireworks, processions, and music, drawing the community together for lively celebrations throughout the summer months. Located in Victoria, the Astra and Aurora Theatres are traditional venues for local music and cultural events, including operas and plays. They bring a touch of classical arts to Gozo and serve as focal points for cultural life on the island.

Gozo is known for its artisanal crafts, such as lace, handwoven textiles, and glassware. Victoria’s It-Tokk Market is a great place to find fresh produce, local cheeses, and traditional crafts.

The Blue Hole on the island of Gozo, a natural limestone formation, is a circular pool about 10 meters wide and 15 meters deep leading to a tunnel that opens up to the open sea

Tips for expats immigrating to Malta from the US

Relocating to Malta involves more than securing a residence permit. It requires careful planning to make the transition smooth and stress-free. From organising shipping and adapting to local housing standards to following pet import regulations and arranging health insurance, practical preparation can make settling into life on the island much easier.

Transferring personal belongings

Moving household goods to Malta involves either air freight, which is faster but more expensive, or sea freight, which is more affordable but slower. Major shipping companies include DHL, FedEx, and UPS.

In case of sea freight, items are shipped in containers via sea, loaded into either a Full Container Load, FCL, for exclusive use, or a Less than Container Load, LCL, where space is shared. LCL is budget-friendly for smaller shipments. Shipping from the US to Malta generally costs between $2,000 to 6,000 for a standard container, with delivery times ranging from 4 to 8 weeks.

Air freight is used for smaller, time-sensitive shipments due to its higher cost. The items are packed securely in crates or boxes and sent via cargo planes. Air freight can cost around $5,000 to 15,000 per ton, depending on the weight and dimensions of the shipment. Delivery is fast, taking 1 to 3 weeks on average.

US citizens should also take into consideration that Malta’s homes usually have smaller dimensions than American homes, and power outlets use 230V with British plug types. In case of bringing appliances, converters and possibly transformers are required.

Moving with pets

Malta has strict pet import regulations to protect against rabies and other diseases. The maximum number of pet animals which may be moved for non-commercial purposes is up to 5.

Expat’s pet must be microchipped with an ISO-compliant 15-digit microchip for identification. Besides, pets need a rabies vaccination administered after microchipping. The vaccination must be at least 21 days old before entering Malta and cannot exceed the vaccine’s expiration date.

US pet owners must obtain an EU Pet Health Certificate from a USDA-accredited veterinarian within 10 days before travel. This certificate must be endorsed by the USDA.

Dogs require tapeworm treatment within one to five days before entry.

If all regulations are followed, quarantine is not typically required. However, if the paperwork is incomplete, a pet may be subject to quarantine at the owner’s expense.

Direct flights to Malta may be limited, so expats should consider routing their pet through other EU countries. If Malta is the first EU entry point, the pet must arrive through Malta International Airport.

Vaccines and health Insurance

Malta does not require any special vaccinations for US citizens, but it is advisable to ensure routine vaccinations are up to date, such as Tetanus, Hepatitis B, MMR.

Many US citizens and expats choose private health insurance for faster access and more comprehensive care. Popular private insurers in Malta include Bupa, Globality, and Allianz. These plans vary widely in cost based on coverage level and age. Basic coverage plans start at around €300—600 per year. Comprehensive plans, with full hospital, specialist, and elective treatment coverage range from €1,200—2,500 annually.

Some providers like Cigna and Allianz offer international plans that cover care in both Malta and the US, which is useful if you anticipate traveling frequently or returning to the US for care.

Conclusion: what should US citizens know before moving to Malta?

- Investors can move to Malta thanks to three options: Malta citizenship for exceptional services by direct investment, Malta Permanent Residence Programme, and Malta Global Residence Programme.

- Minimum investment to acquire Malta citizenship is €726,000.

- Minimum investment to obtain Malta permanent residence is €169,000. It is also required to confirm assets of €500,000.

- Minimum investment to become a Maltese temporary resident is €34,150.

- Digital nomads benefit from Malta Nomad Residence Permit. They need to confirm income of at least €3,500 from sources outside Malta.

- Malta offers several tax benefits such as a remittance-based tax system for non-domiciled residents.

- Cost of living in Malta is around 29.6% lower than the US including rent.

- Malta shows a stable job market with high demand in sectors of technology, iGaming, finance, tourism, and healthcare.

- Public healthcare is accessible to Maltese citizens and residents. Private healthcare services are 70—80% cheaper than in the US.

- Best cities to settle in Malta are Valletta, Sliema, St. Julian’s, and the island Gozo.

Immigrant Invest is a licensed agent for citizenship and residence by investment programs in the EU, the Caribbean, Asia, and the Middle East. Take advantage of our global 15-year expertise — schedule a meeting with our investment programs experts.