Summary

Maltese legislation allows non-EU citizens to buy and rent real estate in the country.

Foreign investors in Maltese property can obtain temporary or permanent residency. Having rented or purchased housing in Malta is also a prerequisite for getting citizenship by naturalisation for exceptional services by direct investment.

Discover the benefits of being a property owner in Malta and explore the specifics of the Maltese real estate market.

5 reasons to invest in real estate in Malta

1. Residency and citizenship opportunities

Investing in property can lead to eligibility for residency under specific investment programs. Besides, it is one of the conditions for obtaining citizenship under the specific naturalisation procedure for investors.

Getting the status of a resident provides additional benefits such as the right to live, work, and study in Malta.

2. Prospects for price growth

Malta’s residential property prices continue to grow, reflecting a resilient market despite broader economic fluctuations.

As of the final quarter of 2024, the Residential Property Price Index reached 165.22, marking a 5.2% annual increase compared to the same period in 2023. This growth is consistent with the trend observed in previous years, where property prices have shown steady appreciation.

3. Solid investment

Real estate in Malta is considered a secure and tangible asset. The country’s small size and growing population drive high demand for property, which supports the increase in property prices.

4. Getting a rental income

Real estate investors can rent out their properties. Malta’s buoyant rental market, driven by a steady influx of expatriates and tourists, provides opportunities for stable rental income throughout the year.

According to the study by the Housing Authority of Malta published in March 2024, the average gross rental income in the country is €12,000 per year.

5. Lifestyle and location

Malta’s Mediterranean climate, rich history, and vibrant culture make it a desirable living location. The island also boasts a low crime rate and a high living standard, attractive to investors and residents.

Malta is recognised as the third most relaxed country in Europe, after Iceland and Ireland. The country’s relaxation score is 7.8 out of 10, which is significantly higher than those of Norway, Denmark, Switzerland, and Finland. Factors contributing to Malta’s high score include the number of hiking trails, spas, yoga, or pilates centres, and national parks per 100,000 people.

Features of the Malta real estate market

Booming construction sector

Despite its small size, Malta has a robust and active construction industry, with many ongoing projects, particularly in the northern region. Every six months, tens of thousands of square metres of new housing are added to the market, often within large residential complexes.

Although building space is limited on the 316-square-kilometre island, construction remains a constant presence — cranes dot the skyline, reflecting both strong demand and steady supply.

Long-term price growth

Property prices in Malta have steadily increased over the years, with average annual appreciation around 10%. Price drops have been rare and typically reflect short-term market corrections rather than sustained declines.

The market gained notable momentum after Malta joined the EU in 2004, when a one-time amnesty allowed the repatriation of undeclared funds. This influx of capital helped fuel large-scale developments such as Tigne Point and laid the groundwork for a thriving real estate sector.

Even during the COVID‑19 pandemic, Malta’s real estate market remained resilient. While the sales market held steady, rental prices saw a temporary dip due to travel restrictions. However, the rental sector rebounded quickly and, by 2022, demand had surged. Today, renting for less than €1,000–1,200 a month is becoming increasingly difficult.

Factors driving demand

The continued rise in property prices is driven by limited land, strong foreign investment — especially through citizenship and residency schemes — and Malta’s appeal to British retirees. High demand is further fueled by booming tourism, with around 3 million visitors annually — six times the local population.

Foreign investmentsin Malta’s real estate sector is actively encouraged. The country has designated more than 15 Special Designated Areas, SDAs, where non-residents can purchase property without restrictions and legally rent it out. These developments are particularly attractive to investors seeking Maltese citizenship, permanent residency, or temporary residence permits.

Types of real estate in Malta

Apartments

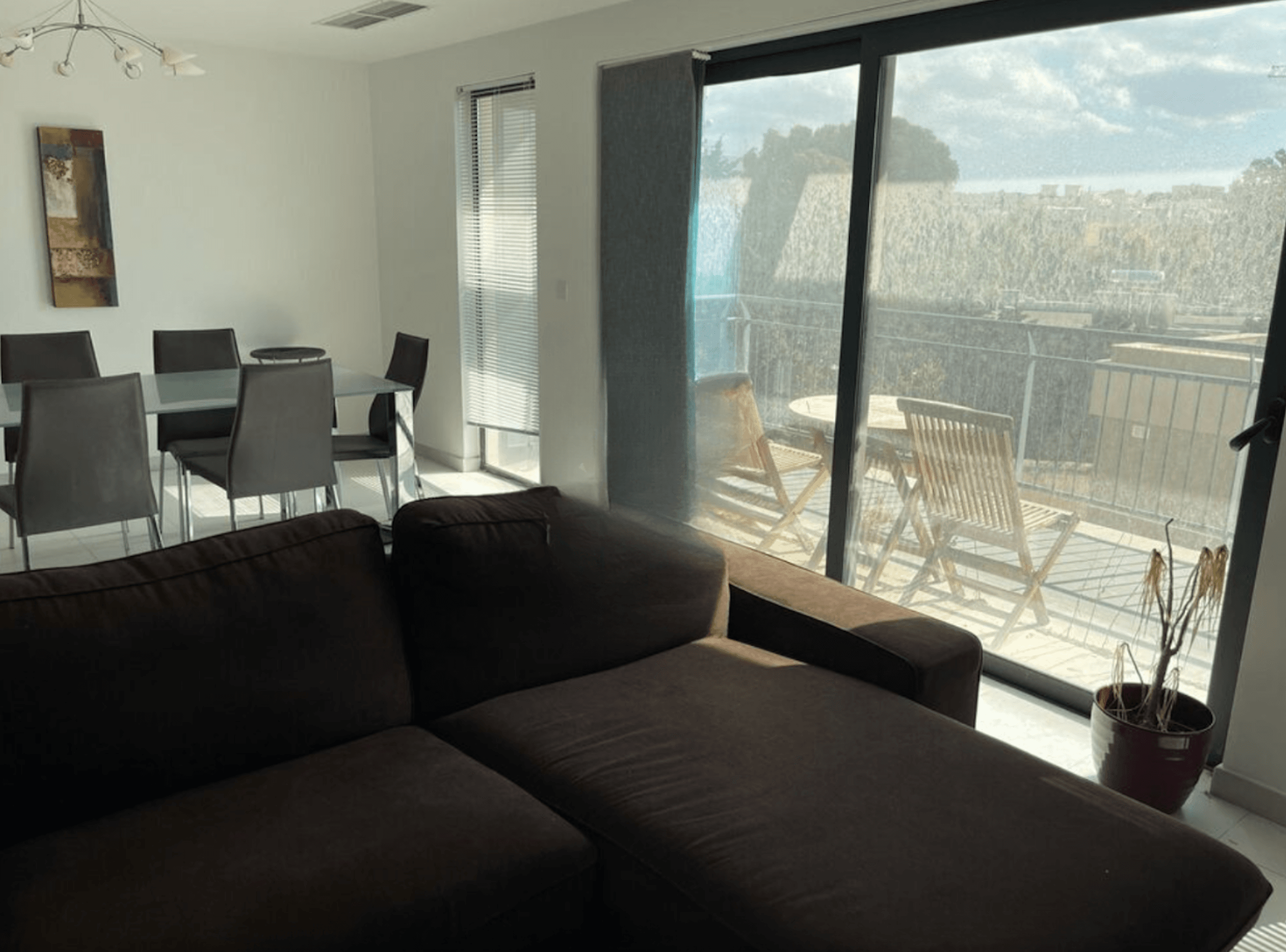

Apartments are the most common type of property in Malta. More significant new buildings often feature terraces to enhance comfort and light. Apartments are usually located on one floor, but duplexes and triplexes exist.

Apartments share common elements like an entrance, staircase, and elevator. Maintenance and cleaning costs for these common areas are shared among the building’s apartment owners.

Maisonettes

Maisonettes are similar to apartments. The key difference is that the main entrance leads directly outdoors rather than to a common hallway. Maisonettes tend to be smaller than apartment buildings.

Duplex maisonettes consist of two stacked units; the lower unit often includes a small garden or courtyard, while the upper unit may utilise part of the roof. Single maisonettes frequently exist within larger buildings, typically with garages situated on the ground floor.

Townhouses

Townhouses or detached dwellings are located in the older parts of cities or villages. Townhouses with a double frontage have a more expansive frontage or face two streets. Distinctive features of townhouses include original wooden openings, patterned shingles, and a small back garden or a courtyard.

Farmhouses

Traditional Maltese farmhouses, located in old villages or on the outskirts of towns, once belonged to Maltese farmers. These buildings, which can be up to 500 years old, have been modernised to include contemporary amenities while preserving their historic charm.

Character houses

Character houses are similar to farmhouses but are often located in urban settings. They may have multiple stories and showcase traditional architectural features, such as stone arches, traditional Maltese patterned tiles, and large windows. Like farmhouses, they can also be centuries old.

Terraced houses

Terraced houses are usually two-storied. Such houses may include a porch, a modest garden, a patio, or a garage. Many terraced houses were built between the 1960s and 1980s.

Villas

Villas are detached homes with extensive grounds, swimming pools, and comfortable outdoor and indoor living spaces. Villas are frequently found in affluent areas such as Santa Maria Estate in Mellieha or High Ridge and Madliena in Swieqi.

Penthouses

Penthouses are built on top of apartment buildings and encompass all living space on a single level. Duplex penthouses are spread over two levels, connected by an internal staircase, and the topmost floors often feature amenities like terraces, barbecue areas, or swimming pools.

Investment properties in Malta

Characteristics affecting housing demand and property prices

Several factors significantly influence demand, both in the sales and rental markets:

-

architectural style;

-

quality of design and finishes;

-

whether the property is new;

-

location.

Properties in demand

Malta’s pleasant climate encourages outdoor living, making larger terraces or balconies especially desirable. Newer buildings are increasingly designed with this in mind, often offering generous outdoor spaces while slightly reducing interior living areas. Bedrooms in new properties tend to follow broader European trends, with more compact room sizes.

Modern finishes and contemporary design are now top priorities for buyers and renters alike. As a result, developers are placing greater emphasis on high-quality interiors, driving noticeable improvements in property finishing across the market.

Brand-new properties are particularly popular, as many clients prefer never-used spaces — from the bed to the bathroom fittings. Older properties still find tenants or buyers, but not as quickly or at the same price point as their modern, newly built counterparts.

Real estate prices

Unsurprisingly, a prestigious address continues to command a premium, pushing prices even higher.

In prime areas such as Sliema and Valletta — known for their upscale apartments and dynamic urban lifestyle — the average price per square metre can reach around €6,500. In contrast, areas like Gozo or more suburban parts of St Julian’s offer more affordable options, averaging around €4,500 per square metre, and appeal to those seeking a quieter, more relaxed environment.

Property prices in Malta by region

How much can you earn on real estate in Malta?

The profitability of a property in Malta depends on several key factors:

-

its type,

-

level of development,

-

location,

-

overall condition.

Property value growth

While property values have been steadily rising, the pace varies. Over the past five years, house prices have increased by an average of 30%, according to Eurostat. In some cases, prices have even doubled within that period, particularly in high-demand areas.

Rental market returns

The rental market shows a similar trend. Rental prices have surged across the board, with especially strong growth in smaller units like one- and two-bedroom apartments. Larger properties such as villas and penthouses have also seen notable increases.

For example, apartments that rented for €600 per month five years ago now typically go for around €1,000—a near doubling in value. As for luxury properties, renting a villa for €10,000 per month used to be rare; today, it’s not unusual for modern, fully equipped villas in prime locations.

Rental yields generally range from 5 to 10% annually, with premium areas like St Julian’s, Sliema, and Swieqi offering returns of up to 15% due to their central locations, upscale amenities, and proximity to the sea and nightlife.

Buying Malta real estate for rent

Malta’s dynamic rental market is fueled by its growing tourism industry and expanding expatriate community. Properties are in high demand for both short-term holiday rentals and long-term leases, appealing to tourists, international professionals, and retirees alike.

Over the next four years, the rental market is projected to grow at an annual rate of 3.94%, reaching a total volume of $456.90 million by 2028.

Shifting investment hotspots

Historically, investors focused on the North Harbour Area — especially Sliema and St Julian’s — for reliable rental income. These areas remain top performers, with many rental agreements exceeding €2,000 per month. However, the market is evolving.

Demand has surged across central and southern regions as well. The centre of Malta, in particular, has seen a boom in both residential and commercial rentals, offering better value for money. Meanwhile, areas closer to the airport in the south are gaining traction, with investors beginning to recognise their potential.

Top letting locations

Among the most popular towns for tenants are St Paul’s Bay, with over 7,000 registered rental contracts, Sliema with over 4,000, and Msida with over 3,000.

Other high-demand areas with more than 1,000 active contracts include Gzira, St Julian’s, Marsascala, Birkirkara, Swieqi, San Ġwann, Mellieħa, Mosta, Naxxar, Birżebbuġa, and Ħamrun.

For investors seeking fast returns and higher rental rates, the North Harbour remains the most competitive. For those prioritising long-term growth and better purchase value, Malta’s central and emerging southern districts are increasingly promising.

Best places to buy real estate in Malta

The ideal location to buy real estate in Malta varies based on personal preferences, lifestyle, and investment goals. Urban areas like Valletta, Sliema, and St Julian’s offer vibrant city living with strong rental markets, while places like Mdina, Rabat, and Gozo provide a more tranquil and historical setting.

Valletta

Valletta is the capital city of historical significance and has a vibrant culture. It boasts a robust rental market driven by tourism and business travellers. It has a high potential for property appreciation, making it attractive to investors seeking high rental yields and cultural enthusiasts.

Sliema

Sliema is a popular residential and commercial area with modern amenities, excellent waterfront properties, and shopping districts. Its strong expatriate community appeals to families, professionals, and investors desiring a dynamic urban environment.

St Julian’s

St Julian’s is renowned for its nightlife, dining, and entertainment options. Home to luxury developments and high-end properties, this area is ideal for investors focusing on rental income and for individuals who enjoy an active social scene.

Mdina and Rabat

Mdina and Rabat offer historic and tranquil settings with charming, character-filled properties and rich cultural heritage. Their scenic views and lower density attract those seeking a quieter lifestyle amidst historical allure.

Gozo

Gozo’s rural and relaxed atmosphere contrasts with mainland Malta. It features stunning landscapes and traditional properties, and it is increasingly popular among expatriates, retirees, and those looking for a peaceful retreat or holiday home.

Each area offers distinct advantages, making Malta a diverse and appealing destination for real estate investment.

Most buildings in Gozo are constructed from the island’s native limestone, known for its warm, honey-coloured hue

Conditions and requirements for buying property in Malta by non-residents

Restrictions on the purchase of real estate

As a general rule, citizens of other countries, including the European Union, can buy only one property in Malta. Unrestricted property purchases are available only to Maltese citizens and EU citizens who have lived in Malta for a minimum of five years.

Such restrictions help prevent foreigners' unlimited acquisition of real estate and mitigate the risk of distorting local property prices.

Obtaining a permit for property purchase

To buy a property in Malta, a foreigner must obtain an Immovable Property Permit, AIP, at the AIP section of the Capital Transfer Duty Department.

The permit process typically takes 35 days. The fee for issuing the permit is €233, irrespective of the property’s value.

To obtain an AIP permit, the buyer selects the property, fills out an AIP application form, and submits a copy of the promise of sale or a preliminary contract if already in place.

To be granted an AIP permit, applicants must meet several conditions:

-

The property will be used exclusively for residential purposes and, therefore, cannot be rented.

-

After publication, a copy of the final notary deed must be submitted to the AIP department.

-

The property may not be subdivided or sold as multiple dwelling units.

Property purchase without a permit

No permit is neededif the property in Malta is located in Specially Designated Areas, known as SDAs. In such areas, luxury residential complexes have security, closed yards, swimming pools, gyms, and other recreational facilities.

Buying an SDA residential property

Special Designated Areas in Malta, or SDAs, are specific zones designated by the Maltese government where foreign nationals can purchase property without the usual restrictions applied to non-Maltese buyers. These areas are intended to attract foreign investment in real estate and promote economic growth.

Individuals and companies can buy real estate in an SDA, and the sale transaction can be completed in two months instead of four or six months. Demand for housing in SDAs is steadily increasing, with prices rapidly rising even during construction.

Malta’s SDA regions

There are 14 SDAs in Malta and Gozo. Of these, two SDA complexes are under construction, and two are planned, according to the data released for 2024.

The list of SDA regions in which foreign investors can purchase apartments, penthouses, and villas under a simplified procedure is as follows:

-

Portomaso Development plus Extension I, St Julian’s, Malta.

-

Cottonera Development, Malta.

-

Tas-Sellum Residence, Mellieha, Malta.

-

Madliena Village Complex, Malta.

-

Smart City, Malta.

-

Fort Cambridge Zone, Sliema, Malta.

-

Ta' Monita Residence, Marsaskala, Malta.

-

Pender Place and Mercury House Site, plus Extensions I, II, III, IV, and V, St Julian’s, Malta.

-

Quad Business Towers, Mriehel, Malta.

-

Southridge, Mellieha, Malta.

-

Mistra Heights, Mellieha, Malta.

-

Fort Chambray, Mellieha, Gozo.

-

Kempinski Residences, San Lawrenz, Gozo.

-

Vista Point, Marsalforn, Gozo.

SDA complexes are planned to combine the convenience of urban and resort life. They are located on or near the coast and close to historical areas.

Benefits of SDA property

SDA residential property benefits include the following:

-

no need to obtain permission from the authorities of Malta to purchase housing, which reduces the purchasing process to 2—3 months and saves the buyer time and money;

-

opportunity to buy multiple properties at the same time;

-

higher return on investment due to the right to hold and rent out several properties;

-

prospect of selling the property with an income in future due to dynamic growth of real estate prices in SDAs: the price of an SDA property bought at the construction stage often increases by 8—10% per annum compared to price growth of 3—5% per annum for residential real estate in Malta outside SDAs;

-

opportunity to obtain temporary or permanent residency in Malta.

Selection of prominent projects for investors

Most notable investment project are concentrated on one coast of Malta

Fortress Gardens

Fortress Gardensis a prestigious residential complex located within Tigné Point, Malta’s most exclusive neighborhood. Nestled on the Sliema peninsula, Tigné Point is just a 10-minute drive from St. Julian’s and a short ferry ride from Valletta, the island’s historic capital.

At the heart of Tigné Point lies Pjazza Tigné, a vibrant piazza lined with upscale boutiques, chic cafés, and fine dining restaurants. Nearby, you’ll find The Centre, a premium-grade office building, and The Point, Malta’s largest shopping mall. Surrounding these landmarks are several luxury residential developments, with Fortress Gardens standing as the final and most iconic tower within the Tigné Point master plan.

The development offers high-quality living with features such as central heating, enhanced thermal and acoustic insulation between floors, and seamless ceilings with integrated, concealed air-conditioning systems. Bathrooms come equipped with underfloor heating, and most apartments include private balconies.

Close to the southern shoreline, residents enjoy access to a private open-air swimming pool overlooking the Mediterranean Sea.

Property prices reflect the premium lifestyle offered. A one-bedroom seafront apartment, measuring approximately 87 square meters, is priced between €675,000 and €725,000. Three-bedroom units, with an area of around 188 square meters, range from €1,550,000 to €1,700,000, with higher floors commanding premium prices. Capital appreciation is projected at 5 to 10% annually.

Rental yields are strong, with three-bedroom apartments achieving up to €7,500 per month. Other units are commonly rented for €2,000 to €4,000 monthly.

Aerial view of The Tigne Point complex in Sliema

Shoreline project

The Shoreline project is a landmark waterfront development located in SmartCity, an SDA near the charming town of Kalkara, just 1.5 kilometers south of Valletta, Malta’s capital. The neighborhood offers excellent connectivity, with Malta International Airport only a 10-minute drive away. The project includes the shopping mall, which is to become the largest in Malta.

Apartment prices at The Shoreline are as follows:

-

€280,000 to €560,000 for one-bedroom units;

-

€495,000 to €850,000 for two-bedroom units;

-

€990,000 to €1,900,000 for three-bedroom units.

The Shoreline will be offering a communal pool and garden area overlooking the Mediterranean Sea

Portomaso

Portomaso is a prestigious SDA located in the heart of St. Julian’s, one of Malta’s most vibrant coastal towns. The development features the iconic 23-storey Portomaso Business Tower and the exclusive Laguna Project, offering luxury apartments with direct access to a private yacht marina.

Portomaso is renowned for its comprehensive lifestyle amenities, which include a spacious underground car park, private swimming pool and landscaped gardens, a variety of restaurants, a spa and fitness centre, a shopping complex, supermarket, casino, and a conference centre.

Perched on the 22nd floor of the Business Tower is Club 22, one of Malta’s most stylish and sought-after nightlife destinations, offering panoramic views of the island.

Property prices reflect the area’s high-end appeal. A one-bedroom apartment measuring 80 square meters is available from €650,000, while a three-bedroom residence of 220 square meters can be purchased for €1,800,000, inclusive of a private car space.

Rental demand is equally strong, with two- and three-bedroom units commanding up to €7,000 per month.

Aerial view of the Marina Bay and Portomaso Tower in St. Julians city

Mercury Towers

Mercury Towers is a striking SDA development in St. Julian’s, just an 11-minute drive from Malta International Airport. Designed to stand out on the skyline, the project features a pair of sculptural, twisting towers with panoramic sea views.

At the heart of the development is a boutique hotel, flanked by 40- and 25-storey towers that house both residential and commercial units, along with five levels of underground parking. Residents enjoy access to a range of upscale amenities, including a fully equipped gym, spa, swimming pools, a radio bar, restaurants, and an on-site shopping mall.

The project is ideal for short-term investment, with high interest from both local and international buyers. While most units have already been sold, a limited number have returned to the market as resale opportunities. For example, a two-bedroom apartment of 112 square meters on the 30th floor is currently available for €1,800,000.

The Mercury Towers is an iconic development set to establish Malta’s place in the global design and architectural sphere

Qawra

In Qawra, a coastal area within St. Paul’s Bay in Malta’s Northern Region, investors can find affordable entry points into the property market. The area is well-suited for both short-term holiday rentals and long-term leasing, making it ideal for those seeking budget-friendly investment opportunities.

Two-bedroom apartments measuring approximately 90 square meters are available from as little as €245,000, offering excellent value in a steadily growing market.

Jerma

Jerma is an upcoming hotel and residential development in Marsascala, already generating significant buzz. Despite not being publicly listed, the project has seen a remarkable volume of pre-market apartment sales, reflecting strong investor confidence and demand.

Set on the former site of the iconic Jerma Palace Hotel, which closed its doors over 15 years ago, the project aims to transform the area into a vibrant coastal destination.

The development features two hotels offering a combined total of 140 rooms, alongside 259 serviced apartments. In addition, a separate residential block houses 155 apartments, complemented by seven retail outlets and six restaurants. A key highlight of the project is its public open space, designed to create a seamless connection to the sea, enhancing both livability and visitor appeal.

Villas

Villas in Malta typically start from €1 to €1.5 million, offering luxury living in some of the island’s most desirable locations. However, the supply of completed villas is limited, with many properties being sold at the planning stage, reflecting the high demand for this exclusive segment of the market.

A standout example is a semi-detached villa in Madliena, priced at €2,750,000. This exquisite home is finished to the highest standards, featuring marble flooring and premium Italian furnishings throughout.

The villa includes a welcoming entrance hall, a fully fitted kitchen with a breakfast area, a study, spacious living and dining rooms, and direct access to a generous patio, ideal for outdoor entertaining. The layout comprises three bedrooms, each with en-suite shower rooms, a guest bathroom, and a two-car garage. Additional features include solar panels for energy efficiency and a private lift servicing all levels from the basement to the top floor.

Complementing this villa is a large swimming pool and deck area ideal for entertaining

How to buy a property in Malta: step-by-step procedure

Buying a property in Malta takes from a few weeks to 3 months.

There is no need to come to the country and participate in the registration if the investor arranges a power of attorney for lawyers to conduct the transaction.

2—4 weeks

Property selection

Immigrant Invest will help you find the right property and contact the seller or estate agent to view it or discuss the sale details.

Immigrant Invest will help you find the right property and contact the seller or estate agent to view it or discuss the sale details.

10 days

Hiring a notary

The notary does the essential work:

-

apply for a purchase permit;

-

perform the basic duties of the transaction;

-

represent your interests before the seller’s notary;

-

draft the purchase agreement.

Only the notary has the right to certify transactions, keep the deposit and be the intermediary for fees and taxes.

The notary does the essential work:

-

apply for a purchase permit;

-

perform the basic duties of the transaction;

-

represent your interests before the seller’s notary;

-

draft the purchase agreement.

Only the notary has the right to certify transactions, keep the deposit and be the intermediary for fees and taxes.

2+ weeks

Signing the preliminary agreement for the sale of real estate

When the investor has made his choice, their notary contacts the seller or their real estate agent. The notary verifies that the selected property is legally clear and free of encumbrances and obstacles. Then the notary draws up a preliminary contract of sale with the seller or their lawyer.

The purchase agreement must contain the following terms:

-

Price of the property.

-

Technical condition and description of the property.

-

Land taxes.

-

Any repairs or other work to be done by the seller before the final sale.

-

Furniture and appliances, if included in the transaction price.

-

Contract term: most often 3 months, less often 6 to 12 months. Until that time, the seller must complete all agreed-upon work.

-

The purpose of the purchase. The document should reflect the record if the investor buys real estate for permanent residence or citizenship. Then, if the investor is denied this status, they can cancel the transaction without loss.

When the investor has made his choice, their notary contacts the seller or their real estate agent. The notary verifies that the selected property is legally clear and free of encumbrances and obstacles. Then the notary draws up a preliminary contract of sale with the seller or their lawyer.

The purchase agreement must contain the following terms:

-

Price of the property.

-

Technical condition and description of the property.

-

Land taxes.

-

Any repairs or other work to be done by the seller before the final sale.

-

Furniture and appliances, if included in the transaction price.

-

Contract term: most often 3 months, less often 6 to 12 months. Until that time, the seller must complete all agreed-upon work.

-

The purpose of the purchase. The document should reflect the record if the investor buys real estate for permanent residence or citizenship. Then, if the investor is denied this status, they can cancel the transaction without loss.

Up to 5 days

Payment of stamp duty and deposit

The buyer deposits 10—15% of the transaction price. All transfers in a real estate transaction shall be executed at the notary. At this stage, we help the investor arrange a mortgage if they buy the property with borrowed funds.

After signing the preliminary contract, the notary then submits a notice of the pending transaction and remits the stamp duty of 1% of the property’s value to the Malta Internal Revenue Department, IRD. The IRD confirms that the transaction is registered.

The buyer deposits 10—15% of the transaction price. All transfers in a real estate transaction shall be executed at the notary. At this stage, we help the investor arrange a mortgage if they buy the property with borrowed funds.

After signing the preliminary contract, the notary then submits a notice of the pending transaction and remits the stamp duty of 1% of the property’s value to the Malta Internal Revenue Department, IRD. The IRD confirms that the transaction is registered.

2+ weeks

Signing the real estate purchase agreement

The notary prepares the final sale contract. The buyer pays the remaining stamp duty of 4% of the property price, notary, and registration fees. If a buyer needs a permit to purchase the property, the notary executes the AIP Permit.

The notary delivers the original contract to the Central State Archive of Malta, and the buyer and the seller keep a copy.

The notary prepares the final sale contract. The buyer pays the remaining stamp duty of 4% of the property price, notary, and registration fees. If a buyer needs a permit to purchase the property, the notary executes the AIP Permit.

The notary delivers the original contract to the Central State Archive of Malta, and the buyer and the seller keep a copy.

Additional costs that property owners bear: fees and taxes

Stamp duty and transaction costs

When purchasing property in Malta, buyers are typically required to pay a stamp duty of 5% on the purchase price. However, first-time buyers who intend to use the property as their sole residence are eligible for a stamp duty exemption on the first €200,000, with the standard 5% rate applying only to the remaining balance.

Legal fees associated with the purchase generally amount to around 1.5% of the property’s value, though this can vary depending on the extent of legal searches the notary is required to perform.

In total, transaction costs typically amount to approximately 6.5% of the property’s purchase price.

Mortgage-related costs

When purchasing a property with a mortgage, buyers are required to take out both buildings insurance and life insurance as part of the loan conditions.

Buildings insurance typically costs between €100 and €150 per year for an apartment, and at least €500 per year for a house. The policy should provide sufficient coverage to replace furniture and appliances and cover repair costs in the event of damage or loss.

Life insurance premiums generally range from €70 to 220 annually, depending on factors such as the buyer’s age, health status, and the value of the mortgage.

SDA maintenance costs

When a person owns a property in an SDA, there is usually a maintenance cost. For standard properties, this cost is relatively modest, usually ranging from €300 to 600 per year. However, in residential complexes with premium amenities such as swimming pools, landscaped gardens, or shared recreational spaces, maintenance fees can rise to around €3,000 annually, depending on the size and type of property.

Overall, these costs are considered relatively low by international standards, especially given that Malta does not impose council taxes or recurring charges like waste collection or local service taxes, which are common in many other countries.

Tax on rental income

When renting out a property in Malta, owners are subject to a flat income tax rate of 15% on rental income. In addition, property management fees may apply, ranging from 5 to 15% of the rental income, depending on the services provided.

Property sale taxes

When selling a property, tax is calculated on the selling price, not on the profit made.

If the property served as the seller’s primary residence for at least three years, the sale is exempt from tax. For secondary residences, the following tax rates generally apply:

-

5% if sold within the first five years of ownership;

-

8% if sold after five years.

Inheritance tax rules

In cases of inheritance, taxation depends on how the property was used. If the inherited property was the family home, it is exempt from tax. However, if it was a secondary property, duty or tax may apply, depending on its value and the relationship between the deceased and the heir.

How much to invest in Maltese property to obtain citizenship or residency?

Investors in Malta may obtain one of three residency or citizenship statuses: a temporary residence permit, a permanent residence permit, or citizenship by naturalisation. All three options require applicants to have a residential address in Malta, which means they must rent or purchase property on the island.

The property investment requirements vary depending on the type of status being sought. Among the three, citizenship carries the highest real estate investment threshold, reflecting its more exclusive nature and long-term benefits.

Malta citizenship

Malta citizenship can be obtained through naturalisation for exceptional services by direct investment, a pathway designed for individuals who make a significant contribution to the country.

To qualify, applicants must either rent a property with a minimum annual lease of €16,000 or purchase one valued at no less than €700,000. In addition to securing a residential address, the investor is required to contribute at least €600,000 to Malta’s state fund and donate €10,000 to a registered Maltese charity.

The most crucial step in the process is passing the Eligibility Test, which includes comprehensive Due Diligence to ensure the applicant’s integrity and suitability.

Those who are granted Maltese citizenship enjoy one of the world’s most powerful passports, allowing visa-free or visa-on-arrival access to over 180 countries, including the European Union, the United Kingdom, and the United States.

Malta Global Residence Program

The Malta Global Residence Program offers eligible applicants the opportunity to obtain a renewable one-year residence permit. To qualify, you can rent housing for €8,750 a year in the south of Malta or Gozo or for €9,600 a year in the north or centre of the country.

If you go for buying, the property purchased in the south of Malta or Gozo must cost at least €220,000 and €275,000 in the north or centre of the country.

Other expenses under the program comprise the following: administration fee of at least €5,500, minimum income tax of €15,000 a year, medical insurance, and notary fees.

Holders of a residence permit under this program enjoy visa-free travel within the Schengen Area for up to 90 days in any 180-day period and benefit from a favorable tax regime. Foreign income that is remitted to Malta is taxed at a flat rate of 15%, offering significant advantages for global earners.

Malta Permanent Residence Program

The Malta Permanent Residence Program offers investors the opportunity to obtain lifelong residency status in Malta. To qualify, you can rent housing for €14,000 per annum or purchase real estate for at least €375,000.

Other conditions of the investor program:

- Pay the administration fee of €60,000.

- Pay the contribution fee of €37,000.

- Donate €2,000 to charity.

- Prove ownership of €500,000 assets.

Investors can include spouses, children under 29, parents, and grandparents in the application.

Minimum investment amounts

Property investment minimums to apply for Malta citizenship or residency are the following:

-

temporary residence permit — €220,000;

-

permanent residency — €375,000;

-

citizenship — €700,000.

Property as a long-term investment

Purchasing property in Malta can be a profitable long-term investment, but the buying process may delay your residency application by up to four months. To avoid this, many applicants start with the faster rental option and later switch to ownership — a flexibility allowed under the investment programs.

After five years of continuous residence, whether through renting or owning, property value requirements are lifted. If you’ve bought a property, you’re free to sell it without affecting your residency. You must still maintain a residential address in Malta, but after five years, you’re free to rent or buy at any price point.

Our partners are available to help you manage your property and support a smooth exit strategy when you’re ready. Property management services can include short- or long-term rentals, maintenance, mail collection, and other customised services as agreed. We can also connect you with experienced accountants, tax consultants, and legal advisors to assist with any specific matters you may need help with.

If you’re considering relocating to Malta, we’re here to guide you — not only through the residency process, but also with support on education and schooling, relocation logistics, and even yacht chartering for those looking to enjoy Malta’s coastal lifestyle to the fullest.

Main points about Malta real estate investment

-

Non-EU citizens can purchase property in Malta and qualify for citizenship or residency. This offers benefits such as the right to live, work, and study in Malta.

-

Maltese real estate has shown consistent price growth over the years, making it a solid investment. The limited availability of land and high demand from international investors contribute to this upward trend.

-

The buoyant rental market in Malta, driven by a steady influx of expatriates and tourists, provides lucrative rental income opportunities. Areas like Sliema and St Julian’s offer particularly high rental yields.

-

Real estate prices vary significantly by location, with central areas like Valletta and Sliema being more expensive than regions like Gozo. Purchasing real estate involves additional expenses, including stamp duty, notary fees, and transaction costs.

-

Buying property in Malta involves selecting the property, hiring a notary, signing a preliminary agreement, paying a deposit and stamp duty, and signing the purchase agreement. The transaction typically takes a few weeks to three months.

Immigrant Invest is a licensed agent for citizenship and residence by investment programs in the EU, the Caribbean, Asia, and the Middle East. Take advantage of our global 15-year expertise — schedule a meeting with our investment programs experts.