Summary

As of May 2025, investors can purchase real estate for at least €250,000 to participate in the Greece Golden Visa Program.

Imagine living by the sea and traveling across the Schengen Area without a visa. That’s exactly what this path offers you and your family, along with a valuable residence permit.

The properties can be rented out or sold after the residency expires or after obtaining citizenship.

9 benefits you get after obtaining Greece residency by investment

1. Visa-free travelling. With a Greek residence permit, you can explore other Schengen countries without the hassle of a visa: stay up to 90 days within any 180-day period and enjoy seamless travel.

2. Additional income from renting. Once you buy property, you can rent it out long-term and potentially earn over 5% in rental returns in 2025.

This is a major advantage for nationals of countries like Türkiye, who normally require a visa to enter the Schengen Area. Learn more about the Greece Golden Visa for Turkish citizens.

3. Favourable tax regime. Thanks to Greece’s Double Taxation Treaties, you won’t have to worry about paying tax twice on the same income.

As a foreign investor, you can tap into Greece’s special tax program and enjoy a fixed rate on your foreign income. You’ll qualify to pay a flat €100,000 in taxes each year, no matter how much foreign income you earn. Just keep your investment active.

4. Low investment threshold . Compared to other EU countries, Greece offers relatively lower investment thresholds for obtaining residency. However, in September 2024, the minimum investment increased to €400,000—800,000 in popular regions.

Elena Kozyreva,

Managing Director for Real Estate projects

We will guide you through every step, helping you find the perfect property for your Greek residence-by-investment journey.

Once you’ve chosen your property and paid the reservation fee, we will take care of the next steps to complete your purchase smoothly.

5. Pathway to citizenship. After 7 years of living in Greece, you and your family can apply for citizenship. This provides a clear and attainable path to becoming an EU citizen, which comes with additional benefits, including the right to live, work, and study anywhere in the EU.

6. No minimum stay requirement. No need to relocate or change your lifestyle. Greece doesn’t require you to live there to keep your residency.

7. Affordable cost of living. Compared to other EU countries, Greece offers an affordable lifestyle without sacrificing quality. For example, living in Athens costs about €830 monthly for a single person without rent, significantly less than in Paris or London, where expenses rise to approximately €1,105 and €1,275, respectively.

You’ll also save a lot on rent. Athens is over 60% cheaper than Paris and more than 55% cheaper than London.

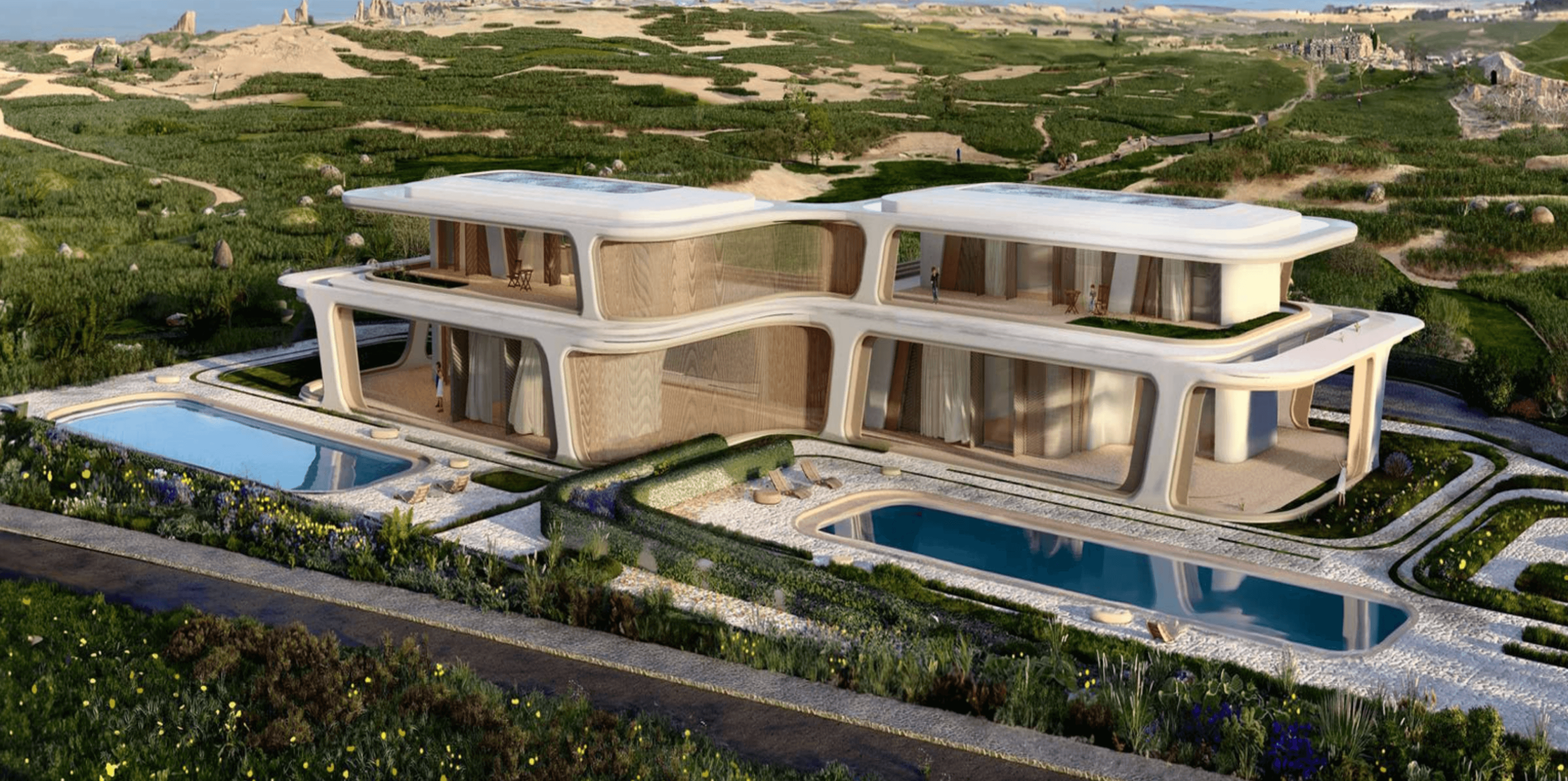

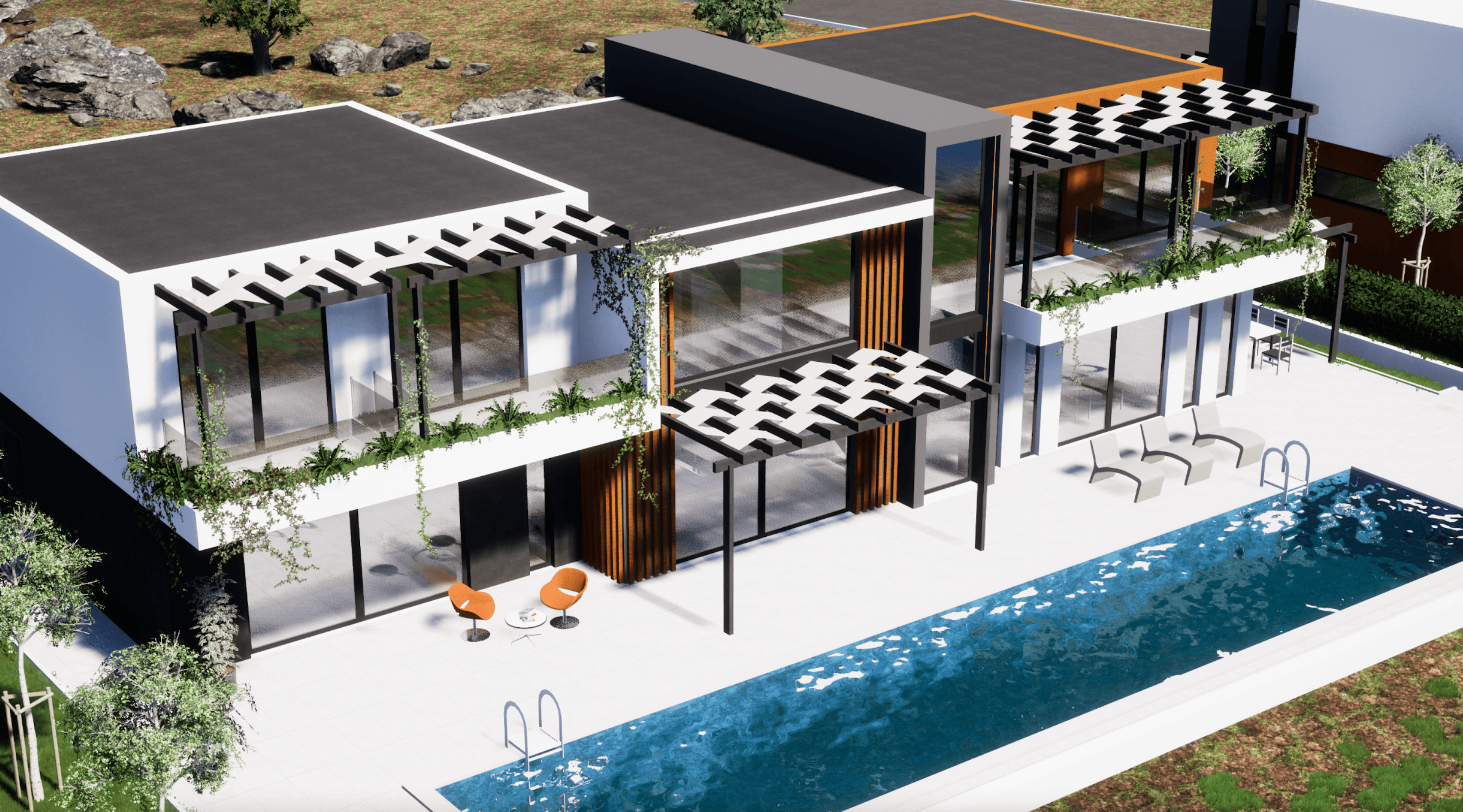

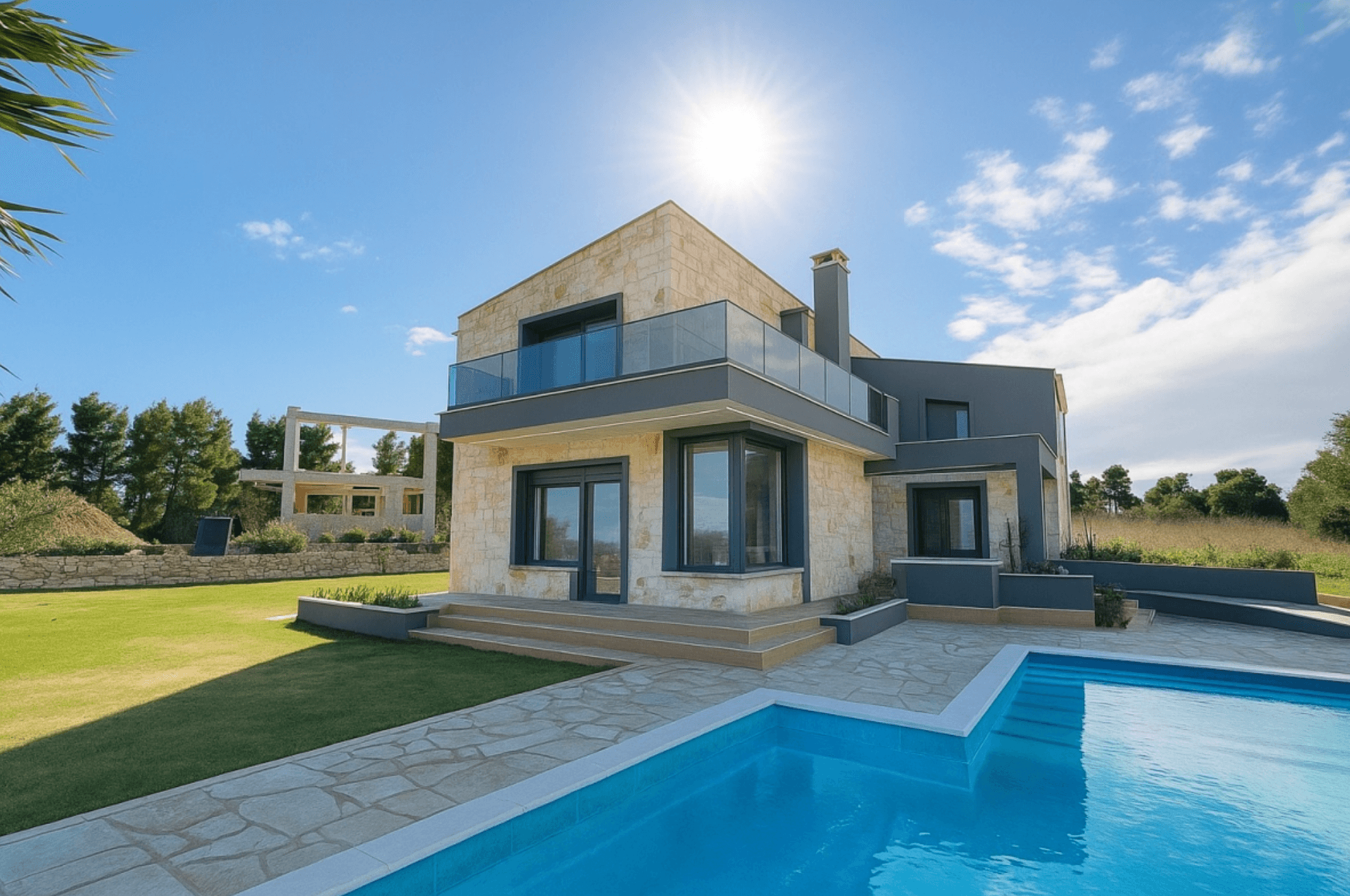

8. Living in a beautiful place. Whether you want a vacation escape or a new home, Greece’s beaches, mountains, and history make every visit unforgettable.

9. Pleasant climate. Greece has a warm but not stifling climate. Spring and fall are more pleasant periods to visit the famous places of Greece. Winter time is also mild, with an average temperature of +15°C.

Conditions for obtaining a Greece Golden Visa by purchasing a property

Residency by investment in Greece can be obtained by the purchase of real estate. Investors get a residence permit within 4 months after submitting documents. There is no need to pass a Greek language proficiency test or live in the country permanently.

Requirements for the main applicant and family members. You can apply to participate in the program alone or with family members. A single investor or a married couple can own the property.

Here’s what you’ll need to qualify:

-

over 18 years old;

-

clean police record;

-

medical insurance that is valid in Greece and covers at least €30,000;

-

Greek bank account.

A spouse, children under the age of 21, and parents of both spouses can also apply for Greek residence permits with the main applicant. You can all apply together or separately, whatever works best for you.

Cost of real estate. To participate in the Golden Visa Program, you must purchase real estate valued at least €400,000 or €800,000, with an exception available at €250,000.

An investment of at least €800,000 is required for new properties in popular regions, including Athens, Thessaloniki, Mykonos, Santorini, and other islands with populations over 3,100 residents.

A minimum investment of €400,000 applies to new properties located outside these high-demand areas.

The reduced investment threshold of €250,000 applies exclusively to properties purchased for renovation or for converting industrial buildings into residential units.

Types of qualifying real estate. You can buy residential or commercial real estate, one or multiple properties, as an individual or through a legal entity.

The property area for purchases amounting to €400,000 or €800,000 must be at least 120 square metres.

Not ready to buy? You can also lease a hotel for 10 years and still qualify. Even inherited property can unlock a Golden Visa for you.

How to buy real estate in Greece and obtain a residence permit

The process of obtaining a Greek residence permit takes around 4 months. At least 2 months of this period is needed to buy property in Greece and prepare all the documents.

1 week

Select a property

First, you choose a property that meets the investment amount criteria.

We help investors at any stage of obtaining a Greece Golden Visa, including the selection of real estate. Can’t travel to Greece right now? No problem — we’ll arrange virtual property tours so you can explore options from anywhere.

First, you choose a property that meets the investment amount criteria.

We help investors at any stage of obtaining a Greece Golden Visa, including the selection of real estate. Can’t travel to Greece right now? No problem — we’ll arrange virtual property tours so you can explore options from anywhere.

1 day

Reserve the selected property

Once you’ve picked your property, you’ll reserve it by placing about 10% of the price into a special bank account. A state-appointed lawyer oversees the process to make sure everything’s 100% legal and transparent.

You’ll have a full seven days to change your mind and get your deposit back. After that, if no cancellation is made, the funds go directly to the seller.

Once you’ve picked your property, you’ll reserve it by placing about 10% of the price into a special bank account. A state-appointed lawyer oversees the process to make sure everything’s 100% legal and transparent.

You’ll have a full seven days to change your mind and get your deposit back. After that, if no cancellation is made, the funds go directly to the seller.

Up to 1 week

Get a tax number

To finalise your reservation, you’ll need a Greek tax ID. It’s easy to get online through the General Commercial Register’s system.

To finalise your reservation, you’ll need a Greek tax ID. It’s easy to get online through the General Commercial Register’s system.

1 day

Pay the real estate transfer tax

A legal check of the property is carried out. After receiving positive results, you will pay a real estate transfer tax.

A legal check of the property is carried out. After receiving positive results, you will pay a real estate transfer tax.

1 day

Sign the main purchase and sale contract

At this point, you can start using the property, even before it’s officially yours. To complete the purchase, you’ll just need to pay the remaining balance.

You’ll get the sales contract in your own language and a Greek version for official use. Once your full payment hits the special bank account, the keys are yours. A notary and your lawyer will join you to sign the final agreement.

According to our experience, expenses for the purchase of real estate include the services of a lawyer, a notary, the cost of registration, and the real estate transfer tax. This covers everything — your lawyer, notary, registration costs, and real estate transfer tax.

At this point, you can start using the property, even before it’s officially yours. To complete the purchase, you’ll just need to pay the remaining balance.

You’ll get the sales contract in your own language and a Greek version for official use. Once your full payment hits the special bank account, the keys are yours. A notary and your lawyer will join you to sign the final agreement.

According to our experience, expenses for the purchase of real estate include the services of a lawyer, a notary, the cost of registration, and the real estate transfer tax. This covers everything — your lawyer, notary, registration costs, and real estate transfer tax.

Up to 10 days

Register real estate in the Land Register

After the documents have been notarised, it is necessary to register the sale in the Land Register. After that, the property is officially yours and you’re ready to submit your residence permit application right away.

After the documents have been notarised, it is necessary to register the sale in the Land Register. After that, the property is officially yours and you’re ready to submit your residence permit application right away.

1 week

Prepare a package of documents for the Greek Golden Visa

You provide a package of documents. It includes:

-

two copies of the application;

-

four recent coloured photos;

-

certified copy of a valid passport;

-

medical insurance.

If applying with family, you’ll just need to provide a recent certificate confirming your relationship with each relative.

Don’t worry about paperwork. We will give you a personalised list of documents based on your situation and current legal requirements. Preparing everything usually takes around 2 months.

You provide a package of documents. It includes:

-

two copies of the application;

-

four recent coloured photos;

-

certified copy of a valid passport;

-

medical insurance.

If applying with family, you’ll just need to provide a recent certificate confirming your relationship with each relative.

Don’t worry about paperwork. We will give you a personalised list of documents based on your situation and current legal requirements. Preparing everything usually takes around 2 months.

1 day

Provide fingerprints

As part of the final step, you and your family members will need to provide fingerprints for the biometric data requirement. It’s a quick and standard part of getting your Greek residence permit.

As part of the final step, you and your family members will need to provide fingerprints for the biometric data requirement. It’s a quick and standard part of getting your Greek residence permit.

1—2 months

Wait for a documentation check

After submitting all the documents and biometric data, the authorities will send a confirmation that the application has been submitted. This confirmation is valid for 1 year. During this period, you can legally reside in the country.

After submitting all the documents and biometric data, the authorities will send a confirmation that the application has been submitted. This confirmation is valid for 1 year. During this period, you can legally reside in the country.

1 day

Obtain a residence permit

You will get the residence permit when the Secretary-General of the Decentralised Administration reviews the application and makes a favourable decision.

You will get the residence permit when the Secretary-General of the Decentralised Administration reviews the application and makes a favourable decision.

Real estate purchase prices in Greece

Property prices in Greece steadily grew in 2018—2025. Despite this, Greek properties are still cheaper than in most popular Mediterranean countries, especially France and Italy.

Greek property average prices per square metre depend on the regional unit:

-

Central Athens — €2,340;

-

North Athens — €3,250;

-

South Athens — €3,940;

-

West Athens — €2,275;

-

Piraeus — €3,000;

-

Thessaloniki — €3,100;

-

Corfu — €3,000;

-

Corinthia — €1,800.

Athens, the capital of Greece, is attractive to investors because it is not subject to seasonality: tourists come to the city all year round.

The average price of real estate in Athens differs and depends on the region. Housing prices in the southern areas are the most expensive because the apartments and houses are closer to the coast.

The cost of properties away from the sea is cheaper, and they are usually low in demand. If investors want a good return on investment, they might consider apartments or houses attractive to tourists. Renting out real estate in Greece usually brings a yield of 5.22% annually.

Greek villas vary in price, but the average cost is still lower than in other European countries. For example, the average price per square metre in the city centre in Greece is €2,886, while in Spain it is €3,674, and in Italy — €3,800.

Examples of properties for obtaining an investment visa in Greece

Additional costs when investing in real estate in Greece

Associated costswhen buying real estate and obtaining a residence permit in Greece include taxes and administrative fees.

When buying a property, investors pay a one-time tax of 3.09% of its value.

The property registration fee is 0.5% of the property value. Notary fees are 1.5—2%.

The application fee for a Golden Visa is €2,000 for the main applicant and €150 per adult family member.

Health insurance is also required for Golden Visa applicants. Its cost starts at €300 per person.

Terms of selling real estate. If investors wish to remain a Greek resident, they must keep the investment until obtaining citizenship. One can apply for it after 7 years of living in the country.

After becoming a citizen of renouncing the Golden Visa, the investor can sell real estate. The profit from this deal will be subject to a 15% capital gains tax.

Property taxes in Greece

Transfer tax . The first tax a foreigner needs to pay on the property is a transfer tax.It is 3.09% of the taxable value of the real estate.

The property tax is paid in Greece once a year. It consists of a main and an additional part. The amount of tax varies for cities and districts. For coastal areas, the average tax is €10—12 per square metre per year. An additional 0.5—1% tax applies to real estate exceeding €300,000.

Municipal taxes usually amount to 0.025—0.035% of the cadastral cost of the property. These taxes do not need to be paid separately, as they are included in the electricity bills.

Tax on rental income. If the property is rented out, tax will be due on the rental income. There are progressive tax rates for individuals:

-

15% on annual rental income of €12,000 or less;

-

35% on €12,000 to €35,000;

-

45% on more than €35,000.

How to renew a Greece residence permit

For property owners in Greece, a residence permit will need to be renewed every five years. To get a new residence card, investors must fully own the property, and the relevant contracts and leases must be ongoing.

The resale of real estate during the validity period of a residence permit grants another person the right to obtain a residence permit. But in this case, the seller’s residence permit will be cancelled.

To extend a residence permit, applicant must provide the following list of documents:

-

filled-in application;

-

four recent colour photos;

-

true copy of a valid passport;

-

certified copy of the previous residence permit;

-

insurance contracts.

Family members should also submit a package of documents, including certification by an insurance agency for the cost of medical care. The main applicant has to provide the sponsor’s statement that family circumstances have not changed. If a child was born during the validity period of the residence permit in Greece, provide a copy of the birth certificate.

The investor and their family submits documents for the renewal of residence permits at least 2 months prior to their expiration. Otherwise, a fine of €50 will have to be paid.

Greece Golden Visa compared to Cyprus Golden Visa and Malta permanent residence

Greece isn’t your only choice when it comes to real estate-based residency. Malta and Cyprus also welcome high-net-worth individuals with Golden Visa on similar but not the same terms.

Malta offers individuals and families the opportunity to obtain permanent residency by making a qualifying investment under the Malta Permanent Residence Programm, MPRP.

To apply for the MPRP, applicants meet several key requirements:

-

Rent real estate for at least €14,000 per annum or buy a property for at least €375,000.

-

Pay an administrative fee of €15,000 as an initial payment and €35,000 at the final stage, regardless of whether they choose to buy or rent property.

-

Make a one-time, non-refundable contribution of €30,000 if purchasing property or €60,000 if renting.

-

Donate €2,000 to a local NGO. This donation contributes to social projects in Malta.

-

Demonstrate assets worth at least €500,000 with €150,000 in liquid financial assets or show a portfolio of €650,000 with at least €75,000 in financial assets.

In Cyprus, the minimum investment is €300,000, but there are no restrictions on the type or location of the property. It can be any commercial or residential real estate.

You and your family can secure permanent residency with citizenship prospects.

Greece Golden Visa vs. Malta and Cyprus Golden Visas

What is the 7-year law in Greece?

You can’t acquire Greece citizenship by purchasing real estate or securities. But with a Golden Visa, you’re on the right path. From there, it’s all about meeting the naturalisation requirements.

Live in Greece for 7 straight years with your Golden Visa, and you can apply for full citizenship.

To qualify, you’ll need to show you know the basics—Greek language, geography, and history by passing the “Panhellenic” exam with a score above 80%.

Greece allows its citizens to have multiple citizenships at once. So unless your home country says otherwise, there’s no need to give up your original passport.

Key moments about the Greece residence permit by investment

-

Thinking about joining the Greece Golden Visa Program? You can get started with a property investment as low as €250,000.

-

The minimum investment threshold is €400,000—800,000 in regions experiencing high demand for property.

-

With the Greece Golden Visa, you and your family get a residence permit, the freedom to travel visa-free across the Schengen Area, and the chance to own a villa by the sea.

-

When buying a property, an investor pays a one-time tax of 3.09% of its value.

-

Stay in Greece for 7 years, and your Golden Visa can lead to full citizenship and an EU passport.

Immigrant Invest is a licensed agent for citizenship and residence by investment programs in the EU, the Caribbean, Asia, and the Middle East. Take advantage of our global 15-year expertise — schedule a meeting with our investment programs experts.