Grenada citizenship for visa-free business trips to China and a holiday home by the sea

My wife and I have lived together for 16 years, travelled half the world and dreamt of moving to somewhere warm by the sea. Five years ago, our son Stephan was born. We thought about obtaining second citizenship.

However, two years ago, my wife Emma passed away; we were left alone with our son. Emma’s mother, Irene, took care of Stephan. The question of second citizenship receded into the background.

In 2022, I realised that it was time to consider getting second passports again. On a friend’s advice, I turned to Immigrant Invest. The company’s specialists helped me and my family to obtain Grenada citizenship.

Mikhail, 46 years old

Deputy director of the metallurgical plant

Clients’ names and photos have been changed

This case was provided by our expert

Investment programs expert

Grenada citizenship for visa-free business trips to China and a holiday home by the sea

Share:

Why Michael decided to obtain a second citizenship

Michael is a deputy director of a chemical factory in Canada. He is a widower with a son Stephan, who is 5 years old and looked after by Michael’s mother-in-law Irene.

Michael travelled a lot when his wife Emma was alive. They visited most of the European countries, went on a safari in Africa, and cruised in the Caribbean. The couple thought about second citizenship to move to or make a holiday home in a warm country by sea.

When their son was born, the couple travelled less and put off the issue of second citizenship. After Emma’s death in 2020, Michael thought he did not need a second passport anymore.

In April 2022, Michael’s factory, producing household chemicals, signed a partnership agreement with a Chinese production company. Michael had to visit China for meetings frequently and share best practices with the new business partner to develop and expand his production. Each trip required obtaining a visa, as Canada didn’t have a visa-waiver agreement with China.

Michael contacted Immigrant Invest on June 6th, 2022. Investment program experts advised him to consider Caribbean citizenship: with a Grenada or Dominica passport, he would be able to travel to China visa-free. In addition, those Caribbean islands were popular travel destinations familiar to Michael’s family.

Upon consideration, Michael chose Grenada as a well-developed country known not only for its resorts but for universities, too. The investor thought it could be an option for his son in the future.

With Grenada passports, the investor and his family can come to the country of citizenship anytime to have a vacation to live for as long as they wish. They also get the following new opportunities:

Travel without visas to China for 30 days.

Optimise taxes: Grenada has no taxes on inheritance, capital gains and global income.

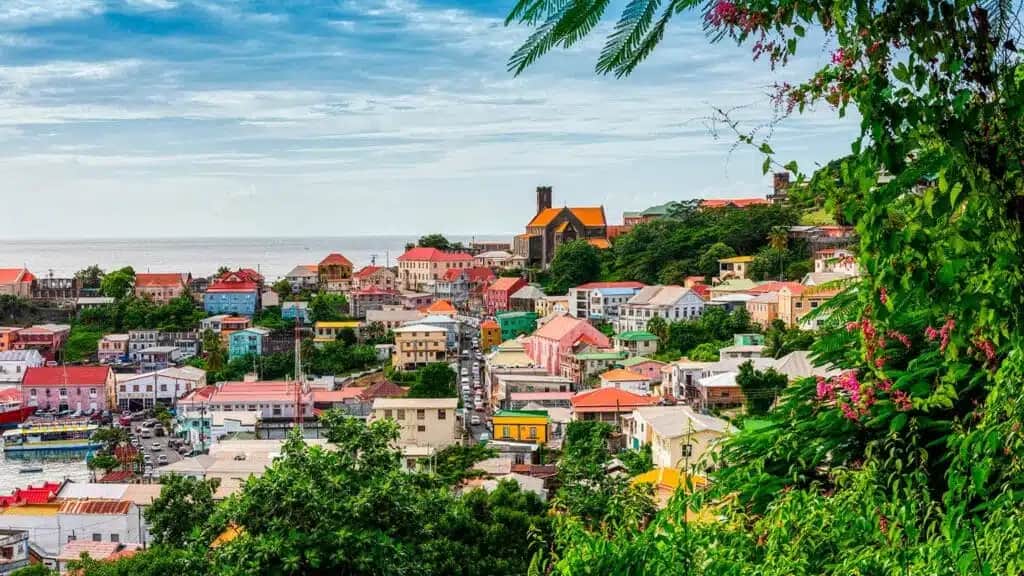

Grenada is a small island nation washed by the Caribbean Sea on one side and the Atlantic Ocean on the other

Preliminary Due Diligence

The investor passes a preliminary Due Diligence check against international databases of legal and business information before signing a services agreement with Immigrant Invest. A certified Anti Money Laundering Officer carries out the check.

Immigrant Invest has its own Compliance Department. Such a check helps to identify potential risks, including sanctions.

The check took one day. Michael’s financial history was clean: he had no criminal records, paid taxes annually, and was not included in the sanctions lists. He entered into a services agreement with Immigrant Invest immediately after the check.

Preparing documents for the investor and his family

Immigrant Invest lawyers have compiled a list of required documents based on the preliminary Due Diligence check and the conditions of Grenada’s citizenship program.

Michael’s case was slightly different from the standard one. The investor had been a widower for two years, but he decided to add his mother-in-law Irene to the citizenship application.

Adding a deceased wife’s parent was only possible if the investor had not remarried. Michael also had to confirm his relationship with his mother-in-law: provide his wife’s birth and death certificates and prove that he supported his mother-in-law financially all that time.

Bank statements from the investor and mother-in-law confirmed regular transfers and the absence of other comparable sources of income. They showed that Irene’s pension was much less than her expenses. Michael also paid for his mother-in-law’s trips with his grandson on vacation more than once.

As soon as Michael had collected all the documents, Immigrant Invest lawyers translated them, certified copies, drafted affidavits, and filled out government forms. Then the package of documents was sent to the Grenada CBI Unit.

The main documents that Michael provided when applying for citizenship were the following:

the investor’s questionnaire;

copies of the passports;

son’s birth certificate;

a marriage certificate;

wife’s birth and death certificates;

bank statements from Mikhail and his mother-in-law’s accounts;

a statement of the mother-in-law’s income from the pension fund;

health insurance;

certificates of no criminal record;

photos;

a form stating all investor’s assets and sources of income for the new banking Due Diligence.

Due Diligence and fulfilment of the investment condition

When the Grenada CBI Unit received the documents, Due Diligence began. Four months later, Immigrant Invest received a notification that Michael’s application was approved. No additional questions arose during the audit.

Michael chose to make a non-refundable contribution to a state fund to participate in the Grenada CBI program. To transfer money to the Grenada state fund, he was given 30 days.

The investor transferred the money within three days after his application was approved. The investment for a family of three was $200,000. Additional costs for Due Diligence and payment of state fees were $20,250.

The payment confirmation was received in two weeks, and passports were ready four weeks later. On December 27th, 2022, Michael and his family received their naturalisation certificates and Grenada passports. Participation in the citizenship program took them about seven months.

$220,250 and 7 months were spent by Michael for obtaining Grenada citizenship

Michael contacted Immigrant Invest

Preliminary Due Diligence

Signing a services agreement with Immigrant Invest

Preparation of documents

Applying for Grenada citizenship and payment of fees

$8,000

Due Diligence by the Grenada CBI Unit

$10,000

Immigrant Invest received a notice of approval for Michael's application

Michael transferred investments to the Grenada state fund

$200,000

Preparation of passports for the investor and his family

Michael and his family received naturalisation certificates and Grenada passports

$2,250

Michael and his family’s plans for Grenada citizenship

The investor has scheduled business trips to China in January and February 2023. If the epidemical situation in China allows, Michael will take his son and mother-in-law on one of the trips as the boy has been dreaming of seeing ancient palaces and the Great Wall of China.

In the meantime, Irene took Stephan to Grenada, where they rented a small villa on the coast. They plan to spend all the winter months and March in the warmth, sunbathing and swimming in the Caribbean Sea. Michael plans to visit them as often as his work will allow him to.

Investor’s opportunities before and after obtaining Grenada citizenship

If Irene or Michael spend more than 183 days a year in Grenada, they will become the country’s tax residents. It’s an opportunity to reduce tax payments: in Grenada, tax residents are charged only on income earned in the country; foreign income isn’t taxed. In Canada, non-residents pay a flat income tax of 25% instead of a progressive scale of 15 to 33%.

Grenada citizens are eligible for scholarships and deductions for studying at local universities. Despite Stephan’s young age, Michael already thinks about his son’s future and considers all the opportunities to save on tuition fees.

Immigrant Invest is a licensed agent for government programs in the European Union and the Caribbean.

Schedule a meeting

Let's discuss the details

Schedule a meeting at one of the offices or online. A lawyer will analyze the situation, calculate the cost and help you find a solution based on your goals.

Prefer messengers?