Summary

Hungarian real estate attracts investors from all over the world. Citizens of China, Germany, Israel, Russia, and Turkey purchase most properties.

To buy real estate in Hungary, a foreigner has to get permission issued by the Land Registry; this can be done only with the help of a lawyer who accompanies the deal.

Property owners can qualify for a Hungary residence permit if they meet other requirements.

5 advantages and features of the real estate market in Hungary

1. Hungary’s real estate prices are some of the lowest in the EU. Purchasing prices for apartments in Budapest are 20% lower than in Ljubljana and Madrid and 30% lower than in Lisbon.

2. Up to 40% of foreigners buy real estate in Budapest as an investment,as per Statista research.

Foreign buyers are attracted by low prices, a stable market, and the opportunity to decrease property prices by several per cent due to the exchange rate adjustment.

After joining the EU, Hungary did not switch to the euro, and there are fluctuations of the national currency — a Hungarian forint — exchange rate against the euro and dollar.

3. Residency prospects. If a foreigner wants to become a Hungarian resident, they must have a registered address in Hungary. Rented or purchased accommodation can qualify.

This requirement is valid for most residency applicants, including investors pursuing the Golden Visa.

Trusted by 5000+ investors

Will you obtain residence by investment in Hungary?

4. Property rental prices grow. For example, in December 2024, rental prices increased by 9.3% across the country and 9.6% in Budapest compared to the previous year, as reported by the Central Statistical Office. Eurostat compared rental prices in the third quarter of 2010 and the third quarter of 2024 and saw a 108% rise.

Rent in Budapest is HUF 235,000—322,000, which is about 580—795 € per month. The annual rental yield is 3.5 to 8%.

However, some Hungarian communities do not welcome the rise of investment property purchases, leading to rental prices growth. For example, Budapest’s 6th district, Terézváros, banned short-term rentals, including Airbnb, from January 1st, 2026.

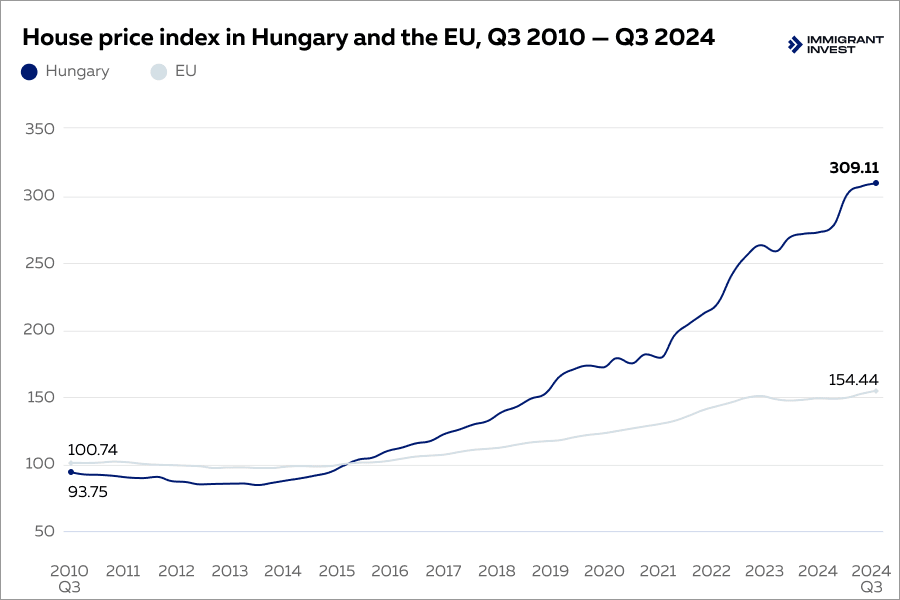

5. The Hungarian real estate market is on the rise. Comparing Q3 of 2010 with Q3 of 2024, real estate prices increased by 230%, according to Eurostat. Thus, Hungary takes first place by the property price increase among EU countries.

The graph shows the growth of the real estate price index in Hungary compared to the average EU real estate price index, as per the Eurostat data

Prices for apartments and houses in Hungary

HUF 1.2 million, or about €2,900 — a sqm of new properties. The Hungarian Central Statistics Office provides such data for Q1—Q3 of 2024.

The most expensive developments are in Budapest: on average, a square metre of the capital’s housing costs HUF 1.5 million, or about €3,695. In prestigious and tourist parts of the city — including districts I, II, V, and XII — prices for apartments may reach €5,500 per m².

In major Hungarian cities, the average price per square metre varies significantly. In Nyíregyháza, the average price is below HUF 700,000, which is about €1,725. In Siófok, a square metre is worth about HUF 1.4 million, or €3,450.

Average prices for new real estate in Hungary

In Hungary, there is a growing demand for apartments up to 60 m² in modern residential complexes, as prices for such properties grow faster than others. Additionally, property maintenance in new buildings is cheaper than in historical ones due to the higher energy efficiency class of new properties.

HUF 519,000, or about €1,280 — a sqm of resale properties. In Budapest, the price is twice higher: HUF 955,000, which is about €2,355 per square metre.

In Budapest, the prices of prefabricated homes saw the largest increase, rising by 10% compared to 2023. Meanwhile, the prices in non-prefab multi-dwelling buildings increased by 7%. Detached houses saw a price rise of 4.1%.

HUF 760,000, or about €1,870 — a sqm near Lake Balaton. These areas are as popular with foreign real estate purchasers as Budapest.

Examples of properties for purchase in Hungary

Taxes and fees for property purchase in Hungary

Property buyers in Hungary pay stamp duty for the title transfer, administrative fees, and charges for the services of experts who accompany the deal.

The stamp duty for the title transfer is paid when the deal is completed. The rate is 4% of the purchasing price for properties under 1 billion forints, or €2.5 million. The buyer pays 2% for the exceeding amount for more expensive properties.

The stamp duty is paid within 90 days after the purchase.

VAT. The primary real estate buyers pay the VAT of 5%. The tax is usually included in the property price.

Administrative fees are the following:

-

€170—200 — for obtaining permission for property purchase;

-

€60 — for putting a veto on activities with the property;

-

€30 — for an extract of the land registry;

-

€22 — for property ownership certificate.

Legal, realtor, and notary services are also paid for by the buyer. The expenses usually do not exceed 5% of the property price.

Expenses when purchasing real estate are about 10% of the property price. When purchasing apartments for €175,000, the buyer will spend about €192,500 on the deal, all taxes and fees included.

Property tax exemptions in Hungary

After purchasing real estate in Hungary, a buyer pays a transfer tax, or a stamp duty, at a general rate of 4%. However, in some cases, a new property owner can be allowed to pay a reduced tax:

-

If buying a new property within 3 years after selling the previous one, a person pays the tax only if the purchase price of a new house is higher, and the tax is imposed only on the difference in selling and purchasing prices.

-

Buyers under 35 purchasing their first property pay property tax at a 2% rate. The main condition is to buy property for less than HUF 15 million, or €36,960.

-

Newly built properties can be taxed at a reduced rate: the amount under HUF 15 million, or €36,960, is not taxed. The buyer only pays the tax to the amount over this value. Properties cheaper than HUF 15 million are not levied.

Best places to invest in real estate in Hungary

Budapest is the capital and the largest city of Hungary. It is known for its historical buildings, great Danube views, cultural sights, and high life standards. At the same time, the cost of living in Budapest is lower than in many other large EU cities.

Buying property in Budapest allows one to experience the charm of living in a historical house with elegant architecture, high ceilings, and unique decorations.

Budapest is the most popular city among real estate investors: in 2022, more than half of properties purchased by foreigners were located in Budapest. As a result, property prices are the highest compared to the rest of Hungary.

Debrecen is the second-largest city in Hungary. The city has a convenient location and an airport, making it easy to travel to any part of Europe. There are several universities and research centres in the city, so it can be a choice for those who seek a place with good educational opportunities.

Unlike Budapest with its vibrant lifestyle, Debrecen offers a tranquil environment to its inhabitants. This is combined with a rich culture, a high quality of life, and lower property prices.

Towns around Lake Balaton, such as Siofok or Veszprém, are also in high demand among real estate buyers. In 2023, nearly 10% of properties purchased by foreigners were located in this area.

There are more than 70 development projects on Lake Balaton shore, and investors can purchase primary apartments with beautiful scenery.

The cost of living in this area is lower than in Budapest, Debrecen, and other big Hungarian cities. Being the main Hungarian resort area, Lake Balaton offers various recreational activities such as sailing, windsurfing, kayaking, hiking, cycling, and horse riding.

Lake Balaton scenery in Siofok. Visitors and inhabitants of the city can enjoy a vibrant nightlife, beautiful beaches, and the promenade with picturesque views of Lake Balaton

Who can buy property in Hungary, and what are their rights and obligations

Hungarian legislation allows foreigners to purchase any properties in the country, except for farming lands and heritage assets.

Foreigners must obtain permission for real estate purchase at the Land Registry of the district where the property is located. The permission is obtained by the lawyer who accompanies the deal. The procedure takes up to 4 weeks.

The following categories do not need permission for purchase:

-

citizens of Hungary;

-

citizens of EU countries, as well as Norway, Lichtenstein, Iceland, and Switzerland;

-

citizens of any country if inheriting property.

Foreigners must fully compensate for property purchase, ownership, and maintenance expenses. Buyers pay the title transfer stamp duty, owners pay utility charges and the annual real estate tax, and sellers have to pay the capital gains tax.

Procedure of real estate purchase for obtaining a residence permit in Hungary

A foreigner must have a registered address in Hungary to get a residence permit. Therefore, they can buy accommodation without price limits.

A buyer turns to lawyers to purchase real estate in Hungary. Only a lawyer has the right to register a purchase and sale contract, get permission for purchase, and receive a property ownership certificate.

Applicants for a Hungary residence permit are accompanied by legal companies that assist in obtaining resident status. Apart from lawyers, the Immigrant Invest team includes real estate experts.

Selecting several properties to choose from

The investor specifies their property requirements regarding price, area, location, and infrastructure. For example, an international school for children or a park should be nearby.

Immigrant Invest real estate experts select several residential properties that meet the specified parameters and the requirements to qualify for a residence permit.

The investor specifies their property requirements regarding price, area, location, and infrastructure. For example, an international school for children or a park should be nearby.

Immigrant Invest real estate experts select several residential properties that meet the specified parameters and the requirements to qualify for a residence permit.

Choosing the appropriate property

Experts make real estate viewing appointments in person if the investor is in Hungary or is ready to come to the country or remotely with a detailed photo and video report.

Experts make real estate viewing appointments in person if the investor is in Hungary or is ready to come to the country or remotely with a detailed photo and video report.

Signing a preliminary agreement and making a downpayment

Lawyers do Due Diligence on the title of the chosen property, the owner, or the developer. Afterwards, they compile a preliminary agreement indicating the technical characteristics of the property, the address, the deal amount, the responsibilities of the parties, and the procedure of the title transfer.

The buyer makes a downpayment of 10% of the property price. The downpayment is not refunded if the buyer renounces the deal.

Lawyers do Due Diligence on the title of the chosen property, the owner, or the developer. Afterwards, they compile a preliminary agreement indicating the technical characteristics of the property, the address, the deal amount, the responsibilities of the parties, and the procedure of the title transfer.

The buyer makes a downpayment of 10% of the property price. The downpayment is not refunded if the buyer renounces the deal.

Obtaining permission to purchase

Based on the preliminary agreement, lawyers obtain permission for property purchase. Documents are processed for 2—4 weeks. For this period, the Land Registry of Hungary vetoes any activities with the chosen property for the owner.

Based on the preliminary agreement, lawyers obtain permission for property purchase. Documents are processed for 2—4 weeks. For this period, the Land Registry of Hungary vetoes any activities with the chosen property for the owner.

Paying for the property

The main purchase and sale agreement is made when permission for purchase is obtained. The buyer transfers the remaining amount to the seller.

The main purchase and sale agreement is made when permission for purchase is obtained. The buyer transfers the remaining amount to the seller.

Receiving a property ownership certificate

To finalise the deal, one should obtain a property ownership certificate. The lawyer picks documents at the Land Registry. The property ownership certificate gives the right to obtain a residence permit in Hungary.

To finalise the deal, one should obtain a property ownership certificate. The lawyer picks documents at the Land Registry. The property ownership certificate gives the right to obtain a residence permit in Hungary.

Paying taxes

Real estate purchasers must pay a stamp duty of 4% of the property price within 90 days after purchasing a property.

Real estate purchasers must pay a stamp duty of 4% of the property price within 90 days after purchasing a property.

Pitfalls of buying property in Hungary

When investing in Hungarian real estate, foreigners should be aware of some pitfalls they might encounter.

Complex procedure of property purchase. When buying a property in Hungary, a foreigner cannot turn to public agencies in person. The purchase and sale deal must be accompanied by a lawyer who submits and receives all the documents on behalf of the buyer.

Most foreigners must also get special permission to purchase a house, which adds to the time and expenses.

Transfer of ownership specifics. In Hungary, property becomes the buyer's possession not when a purchase agreement is signed but after a corresponding record is made in the land registry. This can take several weeks to several months, and until the process is complete, the buyer is not legally an owner of the property.

To the investor, this means that they might not make some significant decisions regarding the property, such as renovation, renting out, or moving, until the land registry record is made.

Protection of historical heritage buildings. The country protects its historical heritage, including houses. For some buildings, there are restrictions relating to property ownership and renovation. Thus, if a buyer wants to renovate their house, they might be obliged to get a special permit and comply with preservation guidelines.

Property energy performance certificates. The owner must have an up-to-date energy performance certificate in Hungary when selling real estate. The certificate includes information about the energy efficiency class of the building that can influence the value of the property and the expenses of a new owner.

If the seller provides an outdated certificate or does not provide it at all, the deal can be legally challenged or invalidated.

Expenses for property ownership and maintenance

The annual property tax rate depends on the municipality where the property is located. The maximum rate is about 3% of the property's cadastral value, or about €1 per m² a year.

Monthly utility costs depend on the property area, the energy efficiency class of the building, and the water and electricity consumption. On average, owners of 85 m² apartments pay €85—210.

Property insurance in Hungary is optional. Only properties purchased with a mortgage are subject to obligatory insurance.

Taxes for selling real estate in Hungary

When selling real estate in Hungary, the owner has to pay a capital gains tax. The tax rate is 15% of the difference between the selling price and the property purchase expenses.

The longer the owner holds the property, the lower the tax rate upon selling. The capital gains is taxed, depending on the property possession time:

-

less than two years of ownership — 100% of capital gains are taxed;

-

two to three years — 90%;

-

three to four years — 60%;

-

four to five years — 30%;

-

over five years — 0%.

Obtaining a Hungary residence permit by investment

In 2024, Hungary launched the Golden Visa program, allowing foreigners to obtain a residence permit in return for investments in the country’s economy.

Available investment options include:

-

investing in local real estate funds — €250,000+;

-

donating to an institution of higher learning — €1,000,000+.

Additionally, the investor must have a registered address in Hungary, meaning they rent or purchase residential real estate in the country but they are not limited in price.

The investor first gets a Guest Investor Visa for 6 months, allowing them to enter Hungary. Within 93 days of entering Hungary with this visa, they must fulfil the investment condition — purchase real estate fund units or donate. After that, the investor applies for a residence permit.

A spouse, children under 25, and parents can be included in the application with the investor.

Investors holding residence permits get the right to move to Hungary, travel visa-free to the Schengen Area countries, and do business in the EU.

Summary on real estate purchase in Hungary

-

Up to 40% of buyers of Budapest’s real estate consider it an investment asset. The real estate market is growing, while Hungary’s property prices remain some of the lowest in the EU.

-

Lawyers must accompany a property purchase and sale deal. Only they have the right to make a purchase and sale agreement, obtain permission for purchase, and get the property ownership certificate.

-

Taxes and fees for property purchases make up to 10% of the property price.

-

The most attractive real estate in terms of investment are apartments of up to 60 m² in modern residential complexes.

-

Foreign real estate investors can obtain a residence permit in Hungary. A foreigner must rent or buy a property to have a registered address and fulfill the required investment conditions.

Immigrant Invest is a licensed agent for citizenship and residence by investment programs in the EU, the Caribbean, Asia, and the Middle East. Take advantage of our global 15-year expertise — schedule a meeting with our investment programs experts.