In Estonia, I started to feel bored. My company brought a stable income that was enough to live and save. But I saw no prospects for the development or optimising taxes.

In Dubai, it’s different. I can pay virtually no taxes here. At first, it sounded like nonsense to me, but it was a reality. And here are many opportunities to find a collaboration that will result in something brand-new, something huge — I’m excited about it.

Dylan

Entrepreneur, IT company owner

Clients’ names and photos have been changed

Why Dylan decided to move to the UAE

Dylan is a UK citizen living in Estonia. He has an IT services business. When Dylan noticed his company’s development stagnated, he realised he needed a change.

After looking for solutions, the entrepreneur decided to relocate, especially since nothing bound him to Estonia any more. He had divorced his Estonian wife and had fewer rights and freedoms in the country after Brexit.

The businessman did not want to get back to Britain. First, he would have to pay income tax at a higher rate there. Next, the UK was experiencing an energy crisis and was not the best destination for transferring an IT company, in Dylan’s opinion.

Dylan wanted to get a residence permit in a country with a fast-growing economy, vast opportunities for business expansion and tax incentives. And his choice fell on the United Arab Emirates.

The UAE is recognised as the most supportive environment for entrepreneurship: the country is ranked 1st in the Global Entrepreneurship Monitor Index. The Emirates has multiple free economic zones with special tax regimes for companies, where VAT and taxes on profit, export and import are not levied. Moreover, there is no personal income tax in the country or taxes on capital gains, property ownership, gifts and inheritance.

The entrepreneur counted that the relocation to Dubai, a thriving cosmopolitan business hub, would lead to the following:

-

he would significantly reduce his tax burden, both personal and corporate;

-

find more customers and partners;

-

and take the business to a new level: if everything was as planned, his company might go public.

Dylan did not plan to renew his Estonian residence permit valid until March 2023. He made up his mind to move at the end of November 2022, so he needed to obtain UAE residency within 3 months. With this goal in mind, Dylan contacted Immigrant Invest.

Dubai Media City (DMC) is a tax-free zone aimed at boosting UAE’s media foothold. It is a hub for media organisations like news agencies, publishing, online media, advertising, production, and broadcast facilities

Choosing real estate in the Emirates — for living and investing

As Dylan was short in time, we offered him the most straightforward and least time-consuming way of getting a UAE residence permit — real estate investment. By purchasing a property, investors can obtain residency for 2 or 10 years, depending on the real estate value.

Dylan wished to apply for a 10-year permit. For that, he needed to buy a residential property in one of the free economic zones in the Emirates for AED 2,000,000 ($545,000). The investment real estate may be completed or under construction.

As the entrepreneur planned to move, he decided to invest in such a property he could live in. The property under construction or in the design stage was unsuitable in Dylan’s situation. Considering this, our real estate experts selected several options for the investor.

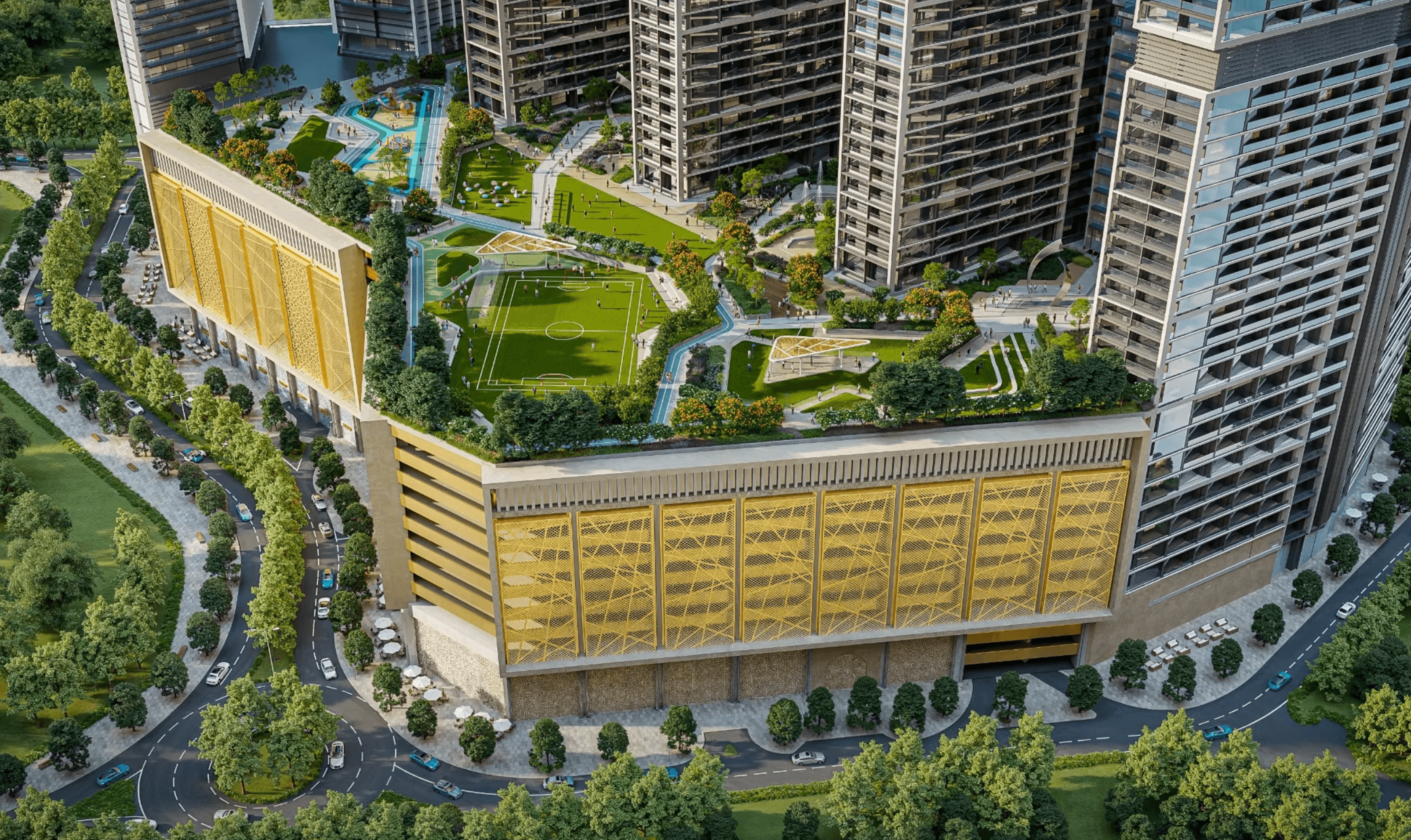

Dylan opted for a two-bedroom apartment for $600,000 in a residential complex in the Jebel Ali Free Zone. He thought this zone would best suit for transferring his company to and intended to rent an office nearby the apartment.

Upon the purchase, Dylan paid another $24,000 as a 4% fee to register ownership.

Examples of properties in UAE

How the investor obtained a UAE Golden Visa by spending $626,600 and 2 months

December 10th, 2022

Preliminary Due Diligence

We conducted an internal check on Dylan and his business to ensure he was eligible for the UAE Golden Visa.

We conducted an internal check on Dylan and his business to ensure he was eligible for the UAE Golden Visa.

+ 6 weeks

Preparation of documents and purchase of the real estate

Dylan provided the required documents for the lawyers to translate and notarise them. In parallel with document preparation, Dylan selected real estate and purchased it. The investor also took out an insurance policy and paid the state fees. Then he obtained a 6-month entry permit to the UAE so he could come to the country to apply for a Golden Visa.

Dylan provided the required documents for the lawyers to translate and notarise them. In parallel with document preparation, Dylan selected real estate and purchased it. The investor also took out an insurance policy and paid the state fees. Then he obtained a 6-month entry permit to the UAE so he could come to the country to apply for a Golden Visa.

+ 7 days

Medical checkup

Dylan came to the Emirates to undergo a medical checkup and pass fluorography. He got a certificate of health status showing he had no dangerous infectious diseases.

Dylan came to the Emirates to undergo a medical checkup and pass fluorography. He got a certificate of health status showing he had no dangerous infectious diseases.

+ 7 days

Main Due Diligence

Accompanied by the Immigrant Invest lawyer, the investor went to the General Directory of Residency and Foreign Affairs and submitted a visa application in person. Dylan also provided his biometrics.

The authority considered the application for a week and issued the approval.

Accompanied by the Immigrant Invest lawyer, the investor went to the General Directory of Residency and Foreign Affairs and submitted a visa application in person. Dylan also provided his biometrics.

The authority considered the application for a week and issued the approval.

February 15th, 2023

Receiving the visa

Dylan received his UAE Golden Visa and the right to live in the country on time — two weeks before his Estonian residence permit expired.

Dylan received his UAE Golden Visa and the right to live in the country on time — two weeks before his Estonian residence permit expired.

How Dylan’s life has changed after relocation to Dubai

Dylan has moved from Estonia to the UAE with his cat. He is now collecting documents for registering his company in Dubai. The investor has tremendous plans on how to develop his business in the Emirates and internationally.

Half a year after relocation, Dylan will become a UAE tax resident. He will obtain a Taxation Residence Certificate to send to Estonia and stop paying income tax.

How Dylan’s tax burden will reduce:

-

20% income tax in Estonia → 0% income tax in the UAE.

-

20% VAT in Estonia → Exempt from VAT in the UAE free economic zone.

-

20% corporate tax on the profit distribution → Exempt from tax on the company’s profit.

In 10 years, Dylan’s UAE Golden Visa will expire, but he is allowed to renew it as long as he owns the investment property.

Immigrant Invest is a licensed agent for government programs in the European Union and the Caribbean.