I thought I had a perfect plan. I bought an apartment, very good for investment in capital growth, and planned to get a Dubai Golden Visa based on that. The Visa would open an opportunity to transfer business to Dubai and significantly cut taxes. The apartment would jump in price when the developer hands it over.

But I was chasing two rabbits at once. It didn’t work. It actually never works. It turned out my apartment wasn’t suitable for applying for a Golden Visa. I’m grateful that at Immigrant Invest, I was told it immediately and offered a solution.

Lance

Entrepreneur and property investor from the US

Clients’ names and photos have been changed

Investor’s goals

Lance is an entrepreneur and a real estate investor from the US. He has an online business, which is not tied to infrastructure in the States. So, when Lance thought of optimising taxes, he decided to relocate his company. Having considered different tax residences, Lance opted for the UAE.

In the Emirates, companies pay a 9% tax on the profit. And businesses registered in free zones are exempt from income tax at all. In comparison, Lance’s company is subject to a 21% tax in the US.

The UAE offers multiple routes towards residency. Lance could get a residence permit as an entrepreneur running a business in the country, but he chose another way. The investor wanted to get a UAE Golden Visa by purchasing a property.

Golden Visas are issued immediately for 10 years. To compare, an entrepreneur’s permit can be granted for 1 to 5 years. Lance did not wish to care about frequent permit renewals, so he opted for Golden Residence.

Dubai is home to Burj Khalifa, the tallest office building. It is more than twice the height of the Empire State Building, and almost three times the size of the Eiffel Tower

Solving an issue with the investment property

Lance had experience with property investments, so he decided to buy real estate independently. The investor knew he needed to spend a minimum of AED 2 million on the property, around $545,000. Lance purchased an apartment for $600,000 and turned to Immigrant Invest for us to help him through the Golden Visa obtaining procedure. We were ready to assist, but an issue arose.

Lance bought the apartment in the project at the early stage of construction. As a real estate investor, he wanted to earn more money on capital growth. Lance knew real estate prices may rise by up to 40% by the time it is completed.

Elena Kozyreva,

Managing Director for Real Estate projects

To participate in the UAE Golden Visa Program, you can invest only in properties completed for at least 50%. Lance’s property did not meet the condition. With that apartment, the investor could apply for a Golden Visa only in 2025, when the construction is half over.

We offered Lance a solution: first, get a UAE Residence Visa for 2 years and then switch to a Golden Visa.

To obtain a 2-year residence permit, you need to buy real estate for over AED 750,000, around $204,000. And in this case, only fully completed properties are suitable.

Lance agreed with the plan: he was ready to purchase another property. So, Immigrant Invest real estate experts offered the investor several suitable options.

The investor opted for a property in Dubai near the sea. He bought a studio for $210,000.

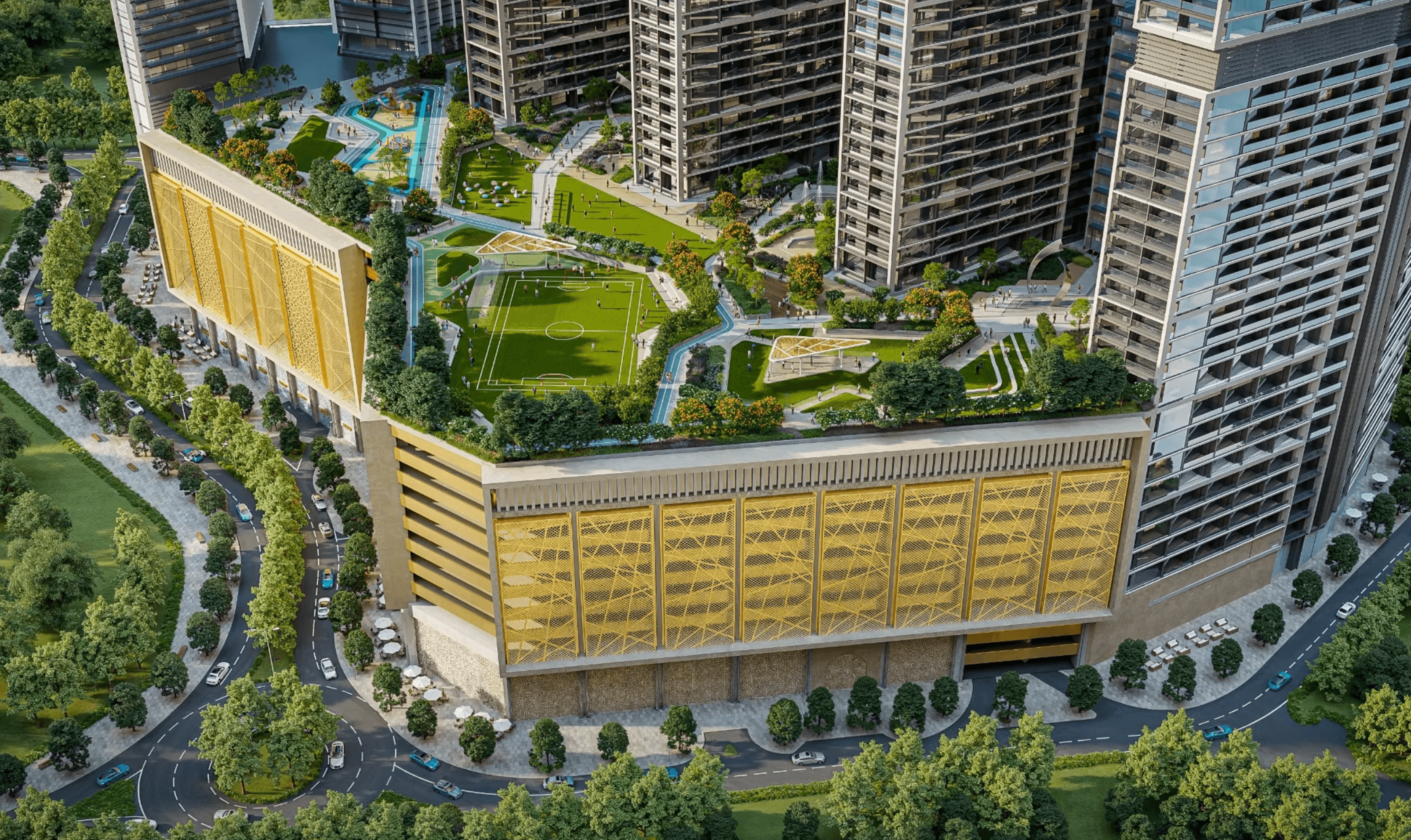

Lance’s apartment is in the Al Furjan area, close to Dubai Marina. The residential complex has round-the-clock security, swimming pools, recreation areas, fully equipped gyms and retail outlets.

Investment properties suitable for both UAE Residence and Golden Visa

How Lance acquired a Residence Visa to the Emirates by spending $220,400

One day, April 10th 2023

Preliminary Due Diligence

To verify Lance’s eligibility for UAE Residence, we performed an internal assessment of Lance’s biography and his business. The vetting showed no red flags.

To verify Lance’s eligibility for UAE Residence, we performed an internal assessment of Lance’s biography and his business. The vetting showed no red flags.

+ 4 weeks

Preparation of documents

With the lawyers’ assistance, Lance got his documents collected and notarised. The investor also secured an insurance policy and fulfilled the state fee obligations.

With the lawyers’ assistance, Lance got his documents collected and notarised. The investor also secured an insurance policy and fulfilled the state fee obligations.

+ 3 weeks

Property purchase and medical checkup

Lance came to the UAE. Accompanied by our real estate experts, Lance inspected investment properties and made a choice. The lawyers helped to prepare a sales and purchase agreement and register ownership.

Besides the studio price of $210,000, Lance paid a property transfer tax at 4% of the price — $8,400.

Then the investor underwent a health checkup. He got a certificate confirming the absence of any hazardous infectious diseases.

Lance came to the UAE. Accompanied by our real estate experts, Lance inspected investment properties and made a choice. The lawyers helped to prepare a sales and purchase agreement and register ownership.

Besides the studio price of $210,000, Lance paid a property transfer tax at 4% of the price — $8,400.

Then the investor underwent a health checkup. He got a certificate confirming the absence of any hazardous infectious diseases.

+ 7 days

Main Due Diligence

Lance visited the Dubai Land Department and applied for a 2-year Residence Visa. The investor also supplied his biometric data. The Immigrant Invest lawyer accompanied him through the procedure.

Following a week of evaluation, the authority approved the application.

Lance visited the Dubai Land Department and applied for a 2-year Residence Visa. The investor also supplied his biometric data. The Immigrant Invest lawyer accompanied him through the procedure.

Following a week of evaluation, the authority approved the application.

June 7th, 2023

Receiving the Residence Visa

Lance received his UAE Residence Visa two months after the preparation started. Besides the investment made, the investor bore additional expenses of around $2,000 on visa fees, insurance, medical checkup and documents notarization.

Lance received his UAE Residence Visa two months after the preparation started. Besides the investment made, the investor bore additional expenses of around $2,000 on visa fees, insurance, medical checkup and documents notarization.

Lance’s prospects

Lance is going to register a company in one of Dubai’s free zones, open a corporate bank account and start enjoying tax relief. His company will be subject to 0% income tax or 9% if it earns income in the mainland UAE. It will be a considerable cut after a 21% US tax.

The investor will rent out the studio he bought for getting a Residence Visa — it’s allowed. In the UAE, Lance will not be charged any tax from the rental income, as the Emirates has 0% personal income tax.

In 2025, we will help Lance obtain a Golden Visa for 10 years. After that, the investor will be able to sell the studio if he wants.

Immigrant Invest is a licensed agent for government programs in the European Union and the Caribbean.