Summary

Buying real estate is one of the ways to legally obtain residency or citizenship in another country. All it takes is purchasing an apartment, house, or commercial property that meets the country’s requirements.

In Greece, for example, buying a property for renovation worth at least €250,000 qualifies an investor for residency. In Türkiye, investing at least $400,000 in real estate makes one eligible for citizenship.

Here is where investors buy property, whether they can rent it out, and how to keep residency when selling property.

What should an investor know about investment property for residency or citizenship?

In the migration field, investment property refers to real estate that enables a foreigner to obtain residency or citizenship. It can be an apartment, a house, a plot of land, or commercial premises, as long as the property meets the country’s requirements for price, type, and location.

Countries develop investment programs to attract capital into the economy, particularly into construction, housing renovation, and the development of specific regions. In exchange for their investment, an investor gains the right to long-term residence and, in some cases, a passport.

Residency by real estate purchase is available in Greece, Türkiye, Andorra, and the UAE, as well as in Cyprus and Malta.

Citizenship by real estate purchase is offered by Caribbean countries, such as St Kitts and Nevis, Dominica, Grenada, St Lucia, Antigua and Barbuda, along with Türkiye and Egypt.

Trusted by 5000+ investors

Comparison of citizenship and residency by investment programs

How governments limit the choice of properties

In most countries, legislation allows investment in residential and commercial property. Sometimes purchases are restricted to certain areas to encourage the development of specific regions.

For example, in the UAE, investors buy property in freehold zones, areas where foreigners can acquire full ownership. There are about 100 freehold zones in the country, 60 of which are in Dubai’s residential and resort districts.

Minimum purchase amount is set by law

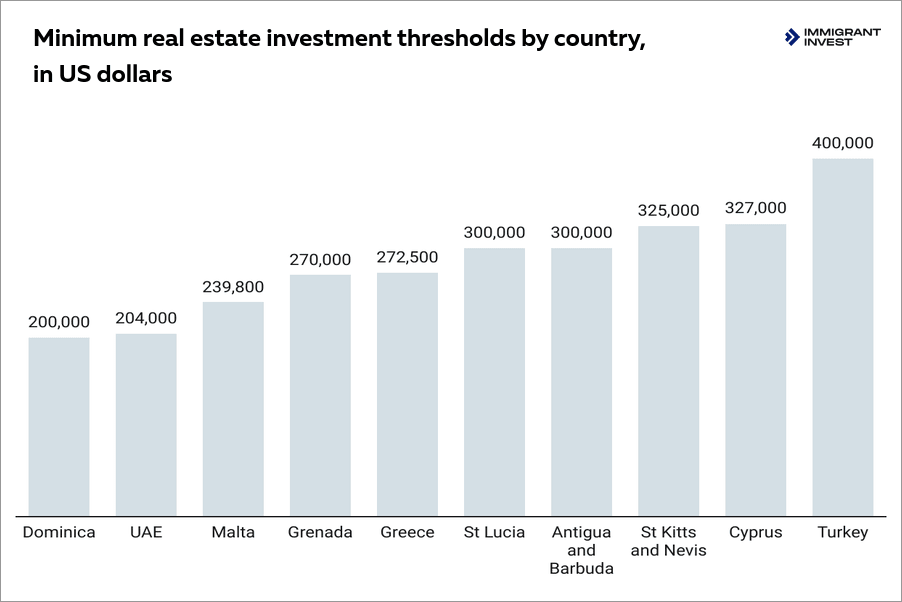

Different countries set their own minimum property value for an investor to qualify for residency or citizenship.

For example, in Greece, it is €250,000; in Cyprus, €300,000; and in Türkiye, $400,000.

State regulates the transaction

The purchase process and the granting of status are handled through government bodies or licensed agents. The entire procedure follows regulations established by law.

For the investor, this means legal protection, clear rules, and minimal risks.

There are restrictions on when the property can be sold

The required ownership period to maintain residency or citizenship depends on the country’s rules. In some cases, it is 3 years; in others, 5 to 7 years.

Selling the property before the required period leads to the loss of status.

Investor can earn rental income

Most countries allow rental of the property, though in some cases only on a long-term basis.

For example, in Greece, property purchased for residency cannot be rented out short term. For such properties, the minimum rental period is 12 months.

Differences between investment property and regular property

5 benefits of buying property to obtain residency or citizenship

About 70% of all investments under EU residency programs are made in real estate. This popularity is driven by several factors.

1. Fast way to obtain residency

The process of granting residency or citizenship for real estate purchase is set out in law, so an investor knows the application processing time in advance.

Residency by real estate purchase is usually granted within 2—9 months, while citizenship takes 6—10 months. Timeframes may be longer depending on the country, political situation, and level of bureaucracy.

2. Passive rental income

Short-term rentals bring an average return of 6—12% per annum, while long-term rentals yield 5—10%.

Property management can be delegated to a management company. It allows the investor to earn income remotely.

3. Property value growth

In economically stable countries, price growth can be predicted over a 5—10-year horizon. Real estate prices in EU countries rose by 57.9% from 2010 to the first quarter of 2025.

4. Access to preferential tax regimes

To benefit from tax incentives, an investor must become a tax resident and spend most of the year in the country: usually at least 183 days.

In Greece, foreigners with residency can pay a flat €100,000 tax on foreign-sourced income. In Andorra, the tax rate on dividends and capital gains for them is 10%.

5. Residency for the whole family

An investor can include a spouse, children, and sometimes parents in the application for residency or citizenship by real estate purchase.

Even without plans to relocate, a second passport or residency enables family members to open accounts in foreign banks and access healthcare abroad. Residency in a Schengen Area country allows visa-free travel to 29 states.

European residency obtained by investment is often called a Golden Visa. It can be granted to the whole family, enabling free travel within the Schengen Area given that obtained in a Schengen Country.

Andorra residents can only travel visa-free to Spain and France, while Cypriot residency holders need a Schengen visa for such trips.

Types of property and their liquidity when selling

If the goal is residency or citizenship, investors usually choose high-liquidity real estate. Such properties are easier to rent out or sell in the future.

Liquidity depends on the property type, location, and market conditions.

Residential property: apartments, houses, villas

Investors most often choose completed or off-plan apartments and houses in tourist areas. New builds are particularly attractive during the construction stage since after completion, these properties can be sold at a higher price.

Areas with high demand among foreigners in different countries:

Commercial property: offices, retail spaces, warehouses

The most sought-after are small retail units on popular tourist streets and offices in business districts.

In Istanbul, offices in Levent and Maslak are in demand; in Dubai — in Business Bay and DIFC. In Cyprus, commercial property in central Limassol is liquid.

Land plots for construction

Liquidity depends on the location and building permits. The most in-demand are plots in active development zones, near resorts or city centres.

In Türkiye, foreigners buy land in the suburbs of Antalya and Bodrum. In Cyprus, land near Limassol and Ayia Napa is popular. In Greece, plots on Crete and Corfu with potential for villa construction attract buyers.

Properties for renovation: old houses, historic buildings

After restoration, such properties can sell for several times their purchase price. Historic buildings in tourist centres and popular islands are particularly liquid.

In Greece, restored houses in the old quarters of Athens are in high demand; in Malta, historic buildings in Valletta and Gozo are. In Cyprus, buyers look for renovated houses in central Larnaca and Paphos.

Apartments and hotels in tourist areas

Liquidity depends on tourist traffic and rental yield.

In the Caribbean, hotel shares and apartments in resort complexes are in demand. In the UAE, studios and apartments in Dubai Marina and Palm Jumeirah are popular. In Egypt, investors buy apartments in apart-hotels in Hurghada and Sharm El Sheikh.

Top 6 countries for buying investment property

In 2024, Greece, Malta, Türkiye, Andorra, and the UAE became the most popular destinations for buying investment property.

Greece received more than 9,000 Golden Visa applications in a year. In Türkiye, foreigners purchased almost 24,000 properties. In Dubai, over 100,000 property transactions were registered — 42% of them involving foreign buyers.

Investors choose Greece and Cyprus for their affordable entry thresholds, the UAE for tax advantages and flexible residency, and Türkiye for its fast route to citizenship.

Malta and Andorra appeal as destinations with a high standard of living and stable rules for long-term residence.

Buying property is not only a migration tool but also a stable source of additional income. For example, the average rental yield is about 4.60% in Greece, 4.77% in Cyprus, 6.4% in Dubai, and up to 7.4% in Türkiye.

Conditions for obtaining and maintaining residency by investment in real estate

How to buy and sell investment property in Greece

How to buy and sell investment property in Greece

Buying property

An investor can choose one of several purchase options depending on their goals and budget. In all cases, the property must meet the country’s requirements.

To obtain residency in Greece, an investor may purchase:

- Property for restoration or conversion into residential premises worth at least €250,000.

- Ready-to-move-in residential property in the provinces worth at least €400,000.

- New real estate in Athens, Thessaloniki, and on Mykonos, Santorini, and other islands with a population of at least 3,100 people worth at least €800,000.

Elena Kozyreva,

Managing Director for Real Estate projects

In Greece, the purchase of real estate can be paid from any bank account not subject to sanctions. Close relatives, such as parents or a spouse, may also make the payment, even if they are not included in the residency application.

Renting out property

Investors may rent out property only on a long-term basis. The yield can reach 10% per annum.

Short-term rentals are prohibited for properties purchased after August 31st, 2024. Breaching this rule leads to the annulment of residency and a €50,000 fine.

Selling property

It is possible to sell the property and keep residency only if the conditions set by the country are met. A property can be sold if:

- The investor does not renew residency, it is renewed every 5 years. For investments starting at €250,000, restoring the property is a mandatory condition for renewal.

- The investor has obtained permanent residency and has lived in the country for at least 5 years.

- The investor has obtained citizenship, which requires living in the country for at least 183 days a year and at least 4 years out of 7.

Investment property in Greece

Taxes when selling property

Real estate taxes in Greece are paid by both tax residents and non-residents. It affects the tax structure but does not exempt one from paying.

Capital gains from the sale of property are taxed at a rate of 15%. However, since 2013, a suspension has been in place until December 31st, 2026. Properties owned for more than 5 years are also exempt from capital gains tax.

By the time of sale, the investor must pay the Unified Property Ownership Tax — Ενιαίος Φόρος Ιδιοκτησίας Ακινήτων, ENFIA. The basic part is calculated based on the property’s area and ranges from €2 to 13 per m². An additional rate of 0.15—1.15% of the cadastral value applies if the property is worth more than €250,000.

How to buy and sell investment property in Malta

How to buy and sell investment property in Malta

Buying property

Investors buy property in Malta to place funds in a liquid asset, rent it out, live in it themselves, or use it as a holiday home.

To obtain residency in Malta, an investor must purchase property worth at least €220,000 in the south of Malta or on the island of Gozo, or property worth at least €275,000 in central and northern regions.

To obtain permanent residency, an investor must buy property worth at least €375,000, regardless of location in Malta.

Renting out property

With residency, renting out or subletting the property is prohibited. Breaching this condition may result in the loss of status.

If permanent residency is granted, renting is allowed. Property owners can earn 5—10% per annum from rentals, and in premium coastal areas such as St Julian’s, Sliema, and Swieqi, yields can reach up to 15% per annum.

Investment property in Malta

Selling property

If a residency holder in Malta sells the property, they lose their status.

Investors with permanent residency may sell the property after 5 years while keeping their status.

Taxes when selling property

The seller pays capital gains tax at a rate of 8%. The rate can be reduced to 2—5% in exceptional cases, such as when the investor bought property in Valletta before December 31st, 2018, and restored it, when selling the only residence owned for less than 5 years, or in other qualifying circumstances.

In some cases, capital gains tax is not charged. For example, when the property is transferred officially as a gift to a spouse or children, by inheritance, to a charitable foundation, or when selling one’s company.

How to buy and sell investment property in Cyprus

How to buy and sell investment property in Cyprus

Buying property

Investors in Cyprus typically choose residential units in new developments or commercial property, such as a shop or office.

To obtain permanent residency, it is necessary to purchase one or two properties with a total value of at least €300,000.

Renting out property

In Cyprus, investors with permanent residency may rent out their property on a short-term or long-term basis.

Rental yields can reach 8—9% per annum.

Selling property

Investors may sell the property if they do not intend to keep permanent residency. The status is granted indefinitely, but the residency card must be renewed every 5 years. To maintain the status, residents only need to keep the property in ownership and visit Cyprus once every 2 years.

After 5 years of living in the country, an investor may obtain permanent residency on general grounds, sell the property, and recover the investment, provided they have lived in Cyprus for at least 183 days per year and have not been absent for more than 90 consecutive days.

After 8 years of living in Cyprus, an investor can obtain citizenship, sell the property, and recover the investment.

Taxes when selling property

The seller pays capital gains tax at a rate of 20%. Acquisition and maintenance costs, such as purchase taxes, fees, and renovation expenses, are deducted from the profit.

The seller must also pay 0.4% of the transaction amount to the fund supporting displaced persons from Northern Cyprus. This levy was introduced in February 2021.

How to buy and sell investment property in Türkiye

How to buy and sell investment property in Türkiye

Buying property

An investor may purchase any type of property, secondary or new build, residential or commercial, or a plot of land.

To obtain residency in Türkiye, it is necessary to buy a property worth at least $200,000. It must be registered with the Land Registry and located in a zone open for residency permits.

Buying property worth at least $400,000 allows an investor to obtain Turkish citizenship without the need to become a tax resident.

Renting out property

An investor may rent out the property short term or long term.

The highest yields are in Istanbul, Antalya, Alanya, and Bodrum. The average annual yield is 8—12%.

Selling property

An investor with Turkish residency cannot sell the property if they wish to keep their status.

Residency in Türkiye is granted for 1 year and then renewed for 2 years, provided the investor continues to own the property and resides in the country for at least 183 days per year.

After 5 years of living in Türkiye with residency, the investor may apply for citizenship by naturalisation. Once citizenship is obtained, the property can be sold, and the investment returned.

If a foreigner has obtained Turkish citizenship by a real estate investment of at least $400,000, the property can be sold sooner and the investment may be returned after 3 years.

Taxes when selling property

Property taxes in Türkiye paid by the seller include capital gains tax, levied if the property has been owned for less than 5 years. The rate ranges from 15 to 35% on the increase in cadastral value.

By the time of sale, the seller must also pay annual property tax: 0.1—0.6% of the cadastral value. Owners of high-value luxury properties pay an additional annual luxury tax — 0.3—1% on the portion of the cadastral value exceeding $280,000. Stamp duty of 4% is typically split between the buyer and the seller.

Investment property in Türkiye

How to buy and sell investment property in Andorra

Buying property

Foreigners in Andorra can buy apartments, houses, commercial premises, and land plots only with government approval. There are no restrictions on the number of properties they may own.

To obtain residency in Andorra, an investor must purchase property worth at least €600,000.

Renting out property

In Andorra, investors are prohibited from renting out property. It must be used solely by the owner and their family. Breaching this rule results in the annulment of residency.

Selling property

An investor may sell the property only after their residency expires, provided they do not plan to renew it.

The property can also be sold after obtaining Andorran citizenship — an application for which may be submitted after 20 years of living in the country.

Taxes when selling property

An investor pays capital gains tax in Andorra at a rate of 15% if the property is sold in the first year of ownership, 13% if sold in the second year, and 10% in the third year. The rate then decreases by 1% each subsequent year.

How to buy and sell investment property in UAE

How to buy and sell investment property in UAE

Buying property

Foreigners can own property outright only in designated freehold zones. These areas are located in the two largest emirates: 9 in Abu Dhabi and 60 in Dubai.

An investor can obtain a UAE residency visa valid for 2 years by purchasing property worth at least AED 750,000, or $204,000.

A 10-year Golden Visa is granted for real estate investments of AED 2,000,000, or $545,000. Mortgages are available from UAE banks, with a minimum down payment of 20%.

Renting out property

In the UAE, investors may rent out property short term or long term. Yields range from 6 to 12% annually, depending on the season and location.

The most popular districts are Dubai Marina, Palm Jumeirah, and Downtown Dubai.

Selling property

An investor may sell the property if they do not intend to renew their status.

If they wish to keep their residency visa after selling, they must purchase another property that meets the minimum investment threshold.

Taxes when selling property

When selling property in the UAE, a property transfer fee applies: 4% in Dubai and 2% in Abu Dhabi.

By law, both parties share the cost, but in practice, the seller often includes the amount in the sale price.

Investment property in UAE

Documents for obtaining residency by purchasing real estate

To obtain residency, an investor must provide two sets of documents. The first is an individual list of personal and financial documents, and the second confirms the purchase of the property.

Standard set of documents for a residency application

This package is required to confirm the investor’s reliability, financial solvency, and compliance with immigration requirements.

Immigration authority websites usually publish standard lists. Immigrant Invest lawyers prepare an individual list for each investor, depending on the specific programs, type of property, and family composition.

The main package of documents includes:

- valid foreign passport;

- police clearance certificate from the country of permanent residence;

- birth certificates of children and a marriage certificate — if the applicant includes family members in the application;

- proof of legal income — a bank statement showing regular inflows, a certificate from the place of work, or financial statements of the applicant’s business;

- health insurance valid in the host country;

- recent photographs in the format required by the host country’s legislation;

- completed visa or immigration forms;

- receipts for fee payments.

Proof of income is not required in all countries. For example, for residency by investment in Greece, it is sufficient to confirm payment for the property. Exact requirements should be checked for each country separately.

Documents confirming the purchase of property

The applicant must prove that the purchased property meets the country’s requirements. A sale and purchase agreement alone is usually not enough — notarised copies, registration documents, and other papers may also be needed, especially if the property is under construction or located in a special zone.

To confirm the purchase of property, it is necessary to provide:

- sale and purchase agreement;

- notarised confirmation of the transaction;

- certificate of ownership or its equivalent;

- extract from the land registry or property register;

- certificates from the developer — if the property is under construction;

- in some countries, a permit from the municipality or ministry;

- act of acceptance and transfer or an equivalent document upon completion of the transaction.

How to buy investment property and obtain residency: step-by-step plan for Greece

According to Immigrant Invest’s lawyers, the process of purchasing a property and obtaining residency in Greece takes at least 4 months. An investor can choose and buy property remotely by power of attorney. The document must be drafted in Greek and legalised with an apostille.

If an authorised lawyer submits the residency application without the investor’s personal presence, the authorities send a notice asking the applicant to choose a convenient date for submitting biometric data.

1 day

Preliminary check

An Anti‑Money Laundering Officer conducts an initial Due Diligence screening. It helps identify potential risks and reduce the probability of a residency refusal to as low as 1%.

Immigrant Invest signs a service agreement with a client only after this check. If a risk of refusal is detected, the specialist proposes a solution — for example, prepares an explanation in the form of an affidavit or offers an alternative.

An Anti‑Money Laundering Officer conducts an initial Due Diligence screening. It helps identify potential risks and reduce the probability of a residency refusal to as low as 1%.

Immigrant Invest signs a service agreement with a client only after this check. If a risk of refusal is detected, the specialist proposes a solution — for example, prepares an explanation in the form of an affidavit or offers an alternative.

1+ week

Search and selection of property

Immigrant Invest real estate specialists help choose a property that matches the investor’s goals, budget, and requirements.

We work directly with developers in Greece and offer only projects that have passed internal checks. All properties are included in our own database and meet the conditions of the country’s investment programs.

Immigrant Invest real estate specialists help choose a property that matches the investor’s goals, budget, and requirements.

We work directly with developers in Greece and offer only projects that have passed internal checks. All properties are included in our own database and meet the conditions of the country’s investment programs.

1+ week

Document preparation

The investor collects financial and personal documents and then signs a power of attorney in the lawyer’s name. The lawyers translate and certify the documents and complete the government forms.

The investor collects financial and personal documents and then signs a power of attorney in the lawyer’s name. The lawyers translate and certify the documents and complete the government forms.

Up to 1 week

Obtaining a tax number in Greece

A tax number is issued by the Greek tax authority and serves as an identifier for any financial operations — from purchasing property to filing returns.

A lawyer submits the application and document package on behalf of the investor. The procedure usually takes 3—7 business days. Once the number is obtained, the transaction can proceed.

A tax number is issued by the Greek tax authority and serves as an identifier for any financial operations — from purchasing property to filing returns.

A lawyer submits the application and document package on behalf of the investor. The procedure usually takes 3—7 business days. Once the number is obtained, the transaction can proceed.

1+ months

Purchasing the property

The parties first sign a preliminary sale and purchase agreement. At this stage, the investor pays a deposit — usually 10% of the property price. The lawyers then prepare the final agreement with the notary and verify the property’s clean title and all documents.

The agreement is signed either by the investor in Greece or by the lawyer under power of attorney. The lawyer then files it for registration with the Land Registry and obtains a registration certificate.

The complete set of documents with an official translation is sent to the investor.

The parties first sign a preliminary sale and purchase agreement. At this stage, the investor pays a deposit — usually 10% of the property price. The lawyers then prepare the final agreement with the notary and verify the property’s clean title and all documents.

The agreement is signed either by the investor in Greece or by the lawyer under power of attorney. The lawyer then files it for registration with the Land Registry and obtains a registration certificate.

The complete set of documents with an official translation is sent to the investor.

1 day

Submitting the residency application

After the transaction is completed and the property is registered, the investor submits an application for the Golden Visa.

Documents can be filed online via the official portal of Greece’s migration service. Within a week of submission, the investor receives a certificate granting the right to stay legally in the country for up to 1 year.

After the transaction is completed and the property is registered, the investor submits an application for the Golden Visa.

Documents can be filed online via the official portal of Greece’s migration service. Within a week of submission, the investor receives a certificate granting the right to stay legally in the country for up to 1 year.

1—2 weeks after submitting the application

Biometrics

Booking for biometrics opens 1—2 weeks after the residency application is filed. The migration service emails the applicant or their authorised representative with further instructions.

All applicants must provide fingerprints and photographs in person. Biometrics must be submitted within 6 months of filing for residency.

Booking for biometrics opens 1—2 weeks after the residency application is filed. The migration service emails the applicant or their authorised representative with further instructions.

All applicants must provide fingerprints and photographs in person. Biometrics must be submitted within 6 months of filing for residency.

3+ months

Receiving residency cards

The investor and family members receive residency cards in person or through a representative under power of attorney. The certificate issued upon application must be returned.

The residency card is valid for 5 years.

The investor and family members receive residency cards in person or through a representative under power of attorney. The certificate issued upon application must be returned.

The residency card is valid for 5 years.

Every 5 years

Renewing residency

Residency in Greece is granted for 5 years and can then be renewed an unlimited number of times. The key condition is to keep the property in ownership.

The renewal application and documents are submitted 2 months before the current card expires. If the investor sells the property earlier, they lose the right to residency, but may reapply after purchasing a new property for the same amount.

Residency in Greece is granted for 5 years and can then be renewed an unlimited number of times. The key condition is to keep the property in ownership.

The renewal application and documents are submitted 2 months before the current card expires. If the investor sells the property earlier, they lose the right to residency, but may reapply after purchasing a new property for the same amount.

Countries granting citizenship by purchasing real estate

In 2024, the leaders were Caribbean states, St Kitts and Nevis, Dominica, Grenada, St Lucia, and Antigua and Barbuda, according to the annual CBI Index citizenship programs ranking.

![]() St Kitts and Nevis grants citizenship for purchasing property worth at least $325,000. Investors can choose from modern apartments in resort areas to spacious residences. The property can be sold after 7 years while retaining citizenship.

St Kitts and Nevis grants citizenship for purchasing property worth at least $325,000. Investors can choose from modern apartments in resort areas to spacious residences. The property can be sold after 7 years while retaining citizenship.

![]() Dominica grants citizenship for purchasing property worth at least $200,000. These are usually shares in tourism infrastructure: hotels, apartment complexes, and villas from a government-approved list. The property may be sold 3 years after purchase.

Dominica grants citizenship for purchasing property worth at least $200,000. These are usually shares in tourism infrastructure: hotels, apartment complexes, and villas from a government-approved list. The property may be sold 3 years after purchase.

![]() Grenada grants citizenship to investors who purchase property worth at least $270,000. Foreigners choose properties in coastal tourist areas or near national parks. The property can be sold after 5 years.

Grenada grants citizenship to investors who purchase property worth at least $270,000. Foreigners choose properties in coastal tourist areas or near national parks. The property can be sold after 5 years.

![]() Antigua and Barbuda grants citizenship for purchasing property worth at least $300,000. Investors often choose resort complexes and hotel projects, some of which are under construction. The property may be sold after 5 years.

Antigua and Barbuda grants citizenship for purchasing property worth at least $300,000. Investors often choose resort complexes and hotel projects, some of which are under construction. The property may be sold after 5 years.

![]() St Lucia grants citizenship for purchasing property worth at least $300,000. Investments must be in government-approved projects. These may be hotel complexes or apartments for short-term rentals. The property can be sold after 5 years.

St Lucia grants citizenship for purchasing property worth at least $300,000. Investments must be in government-approved projects. These may be hotel complexes or apartments for short-term rentals. The property can be sold after 5 years.

![]() Türkiye grants citizenship for an investment of at least $400,000 in residential or commercial property. The property must be registered with the Turkish Land Registry. It can be sold after 3 years.

Türkiye grants citizenship for an investment of at least $400,000 in residential or commercial property. The property must be registered with the Turkish Land Registry. It can be sold after 3 years.

![]() Egypt grants citizenship for purchasing property worth at least $300,000. Investors can choose residential and commercial properties, as well as land plots in Cairo, Giza, Hurghada, and Sharm El Sheikh. The property can be sold after 5 years.

Egypt grants citizenship for purchasing property worth at least $300,000. Investors can choose residential and commercial properties, as well as land plots in Cairo, Giza, Hurghada, and Sharm El Sheikh. The property can be sold after 5 years.

Conditions for obtaining and keeping citizenship by purchasing real estate

Risks when selling investment property and how to mitigate them

Investing in property is not only a way to obtain residency or citizenship but also an asset for a profitable sale in the future. To minimise potential risks when selling, it is important to consider key factors before making a purchase.

Risk of falling prices

Prices most often decline in areas with poorly developed infrastructure or unstable demand.

To protect their investment, investors choose properties in popular locations — tourist, business, or student hubs — where demand is consistently high.

Slow sale of the property

Sometimes a property cannot be sold immediately, especially during market downturns. In such cases, investors rent out the property to generate income and cover maintenance costs, allowing them to wait for a better offer.

In Cyprus and the UAE, annual rental yields can reach 10—12%; in Türkiye, 8—10% in tourist areas of Antalya and Alanya; and in Malta, after obtaining permanent residency, coastal properties can yield up to 15% annually.

Changes in legislation

Countries periodically raise the minimum investment threshold and change property requirements. To avoid losing status, it is essential to monitor legislative updates and consult with lawyers.

For example, on July 1st, 2025, a draft agreement between Caribbean countries was published to introduce unified rules for citizenship by investment.

Key proposed changes include:

- mandatory residence in the country for at least 30 days within the first 5 years;

- completion of a mandatory integration programs;

- introduction of annual quotas for citizenship grants;

- first passport is valid for 5 years, renewable for 10 years if all conditions are met.

Document-related issues when selling

Properties with unregistered ownership rights, tax debts, or other encumbrances are difficult to sell. To prevent such issues, Immigrant Invest lawyers conduct a full legal check of documents and a due diligence review of the property before purchase.

For example, in Malta, when buying historic properties, it is important to ensure the building is listed in the registry and eligible for restoration — meeting all requirements can reduce the sales tax from 8 to 2%. In Türkiye, properties must be registered with the Land Registry; otherwise, it is impossible to apply for citizenship.

When to sell investment property

The right timing for selling depends on a mix of market conditions, investment performance, and personal circumstances. Consider the following factors before making a decision.

Strong market phase. Real estate prices tend to move in cycles. Selling during a peak period, when demand is high and supply is limited, can significantly increase your profit.

Declining performance. If rental income has fallen, vacancy periods are getting longer, or maintenance costs are rising faster than returns, the property may no longer serve its investment purpose. A timely sale can free up capital for more profitable ventures.

Better opportunities. Sometimes holding an underperforming asset means missing out on higher-yield investments. If other markets, sectors, or financial products offer stronger returns with lower risk or management effort, selling to reallocate capital can be a smart move.

Life events. Major changes such as moving to another country, retirement planning, or changes in family size can shift financial priorities. Selling a property can provide liquidity and simplify asset management during transitions.

Residency or tax planning. For properties purchased under residency or citizenship by investment programs, selling before the minimum ownership period can result in loss of status.

Seasonal timing. In many countries, the housing market is more active in spring and early summer, when buyer interest peaks. In tourist destinations, listing the property before or during the high season can attract more buyers and secure a higher price.

Key points for investors selling property

- Residency by investment is offered in Greece, Malta, Cyprus, the UAE, and Andorra. To qualify, investors purchase property that meets the minimum threshold at $204,000 in the UAE to €800,000 in prime areas of Greece.

- Most countries allow investors to obtain residency or citizenship together with their family. The main applicant can include a spouse, children, and, in some cases, parents in the application.

- Property can be rented out, but rules vary. In the UAE and Cyprus, both short- and long-term rentals are allowed. In Greece, investors have been prohibited from renting out property short term since 2024.

- To maintain status, the property must remain in ownership for 3—7 years.

- Taxes on sale depend on the ownership period. In Türkiye, capital gains tax can reach 40%, but if the property has been owned for more than five years, it is exempt.

Immigrant Invest is a licensed agent for citizenship and residence by investment programs in the EU, the Caribbean, Asia, and the Middle East. Take advantage of our global 15-year expertise — schedule a meeting with our investment programs experts.