Summary

Golden Visas are one the fastest ways for wealthy investors to become residents of a foreign country, and some options are absolute bargains. For example, it is possible to obtain residency in the EU by investing €50,000.

In this article, we name the cheapest options to get a Golden Visa.

What is a Golden Visa?

European Golden Visas

A Golden Visa is a residency by investment program allowing wealthy individuals to obtain residency in another country. Depending on the terms, an applicant can invest in real estate, government bonds or a state-approved project.

Investors choose Golden Visas for many reasons, including freedom of travel, new business opportunities, tax optimisation, and access to education and healthcare systems. In some cases, it’s also a chance to relocate to a country with a better climate.

Caribbean Golden Visas

Caribbean сitizenship by investment programs are also sometimes referred to as Golden Visas. While this designation is incorrect, Caribbean passports are often mentioned in the same conversation as they provide similar benefits and are great value for money. In such cases, the term “golden passport” is more accurate.

Key difference between Golden Visas and Golden Passports

A Golden Visa grants the right to live in a country. Getting a passport after a Golden Visa usually requires years of residence.

A Golden Passport provides full citizenship and a passport within months, often with no residency requirement.

Both options offer greater mobility and personal security. But only a Golden Passport gives full rights, such as voting, access to all public services, and wider visa-free travel.

7 benefits of the cheapest Golden Visas

1. Safe haven

Obtaining a residence permit or citizenship helps one travel to that country even when borders are closed for tourists and stay there indefinitely.

2. Freedom of travel

Becoming a resident in a Schengen country increases global mobility, enabling visa-free travel to the other Schengen Area countries with a permitted stay of 90 days out of 180.

3. Visas for the whole family

All Golden Visa programs allow investors to include their spouses and children in the application.

4. Potential investment return

With a few exceptions, investors can receive their money back in a few years, provided they comply with the terms.

5. Business opportunities

Residents or citizens can open a new business in the country where they have a Golden Visa or move an existing company there.

6. Access to education and healthcare

Investors and their family members can undergo treatment in their country of residence. Their children also have the right to study in schools and universities there.

7. Path to citizenship

Some countries issue a passport immediately after investment. In others, like the European Union states, it’s necessary to maintain residency for a few years before being eligible for citizenship.

13 cheapest Golden Visas in the world

To become a resident of a European country, applicants have to invest at least €50,000. Citizenship in the Caribbean is available for those investing $200,000 and more.

Here are the cheapest Golden Visa countries:

Let’s explore all Golden Visas in detail, starting with the offers in Europe, followed by the Middle Eastern and the Caribbean ones.

Latvia Golden Visa — €50,000

Latvia offers the most affordable residency by investment program in the EU, while granting access to the Schengen Area and offers a path to long-term EU residency.

Investment requirements

The minimum investment is €50,000 in the equity of a Latvian company. The company must have up to 50 employees and an annual turnover under €10 million. If the company has more than 50 employees and a turnover above €10 million, the minimum investment is €100,000.

Other investment options include:

-

€250,000+ — purchase of real estate;

-

€250,000+ — buying non-interest bearing government bonds;

-

€280,000+ — buying subordinated debt instruments.

Family inclusion

Investors can add to the Latvia Golden Visa application:

-

spouse;

-

children under 18;

-

financially dependent adult children and parents.

Additional costs and conditions

Investors pay a one-time state duty of €10,000 after the residence permit is approved.

To maintain the permit, the company must pay at least €40,000 in corporate taxes each year.

Residency requirements

Investors do not need to live in Latvia full-time. They must enter the country once every 12 months to re-register the temporary residence permit.

Path to citizenship

The residence permit is valid for 5 years. After that, the investor can apply for a permanent residence permit.

Latvia citizenship is available after 10 years of continuous residence. The applicant must live as a permanent resident for at least 5 years and pass a language and civics test.

Pros of the Latvia Golden Visa

Some of the most attractive advantages include:

-

one of the lowest costs for Golden Visa in the EU;

-

visa-free travel to the Schengen Area;

-

access to European education and healthcare.

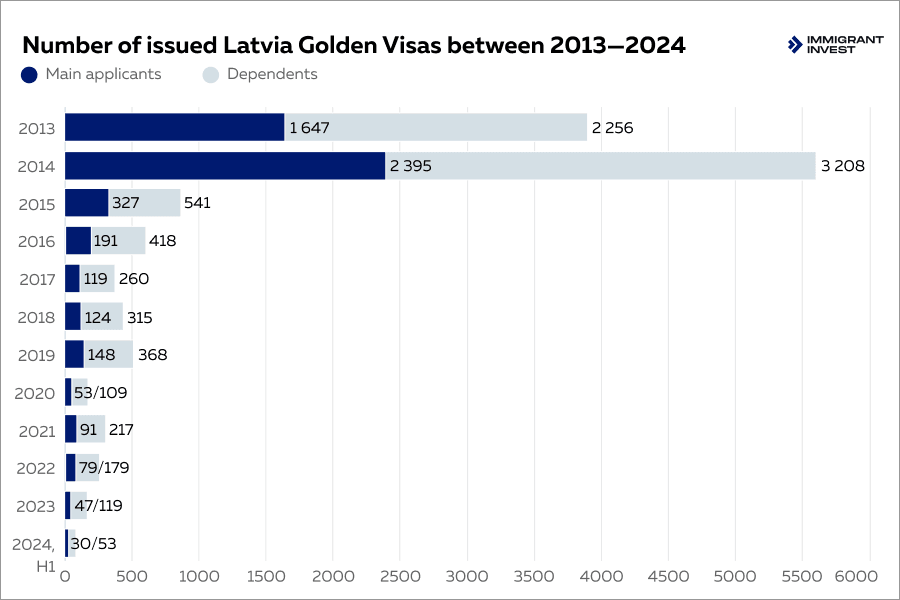

Number of issued Latvia Golden Visas between 2013—2024

Portugal Golden Visa — €250,000

Investment requirements

Portugal offers five investment options to obtain a residence permit. The minimum investment threshold is €250,000 for supporting arts and restoring cultural heritage.

The most popular option is purchasing investment fund units for a minimum of €500,000.

The holding period is at least 5 years, but in practice, the money is usually returned in 6—10 years. The other investment option is a €250,000+ donation to national cultural projects.

Family inclusion

Investors can add to the Portugal Golden Visa application:

-

spouse;

-

unmarried financially dependent children under 26;

-

financially dependent parents.

Residency requirements

Golden Visa holders must only spend 7 days a year in Portugal to maintain their residency.

Path to citizenship

The residence permit cards must be renewed every 2 years. After 5 years of residence, investors can apply for Portugal citizenship.

Pros of the Portugal Golden Visa

One of the key reasons investors consider Portugal residence by investment is the range of long-term benefits they offer. Some of the most attractive advantages include:

-

visa-free travel to the Schengen Area countries;

-

short stay requirement;

-

path to EU citizenship in 5 years.

Hungary Golden Visa — €250,000

Hungary formally relaunched the Golden Visa in July 2024, allowing non-EU and non-EEA citizens obtain a 10-year residence permit in the country.

Investment requirements

The cheapest option to apply for a residence permit is purchasing fund units for €250,000.

The investment fund should allocate at least 40% of its assets to residential real estate in Hungary for it to be eligible for the program. The share certificate must have a 5-year maturity period.

The other investment option is a €1,000,000+ donation to an institution of higher learning.

Family inclusion

Investors can add to the Hungary Golden Visa application:

-

spouse;

-

unmarried financially dependent children under 25;

-

financially dependent parents.

Residency requirements

Investors do not have to live in Hungary. The residence permit can be renewed for another 10-year period if the investment is maintained.

Path to citizenship

After 3 years of living in the country with a residence permit, the investor becomes eligible for permanent residency.

To apply for citizenship, they must live in Hungary for 8 years as a permanent resident.

Pros of the Hungary Golden Visa

Some of the most attractive advantages include:

-

visa-free travel across the Schengen Area;

-

opportunity to live at the heart of Europe;

-

low cost of living by European standards.

Greece Golden Visa — €250,000

Investment requirements

There are multiple options to obtain a 5-year Greece residence permit by investment for a minimum amount of €250,000.

The most popular option is investing in real estate, but the investment threshold depends on the location and type of property:

-

€800,000 — for properties in high-demand areas, including Attica, Thessaloniki, Mykonos, Santorini, and other islands with over 3,100 residents;

-

€400,000 — for properties in all other regions of Greece;

-

€250,000 — for properties that require renovation and will be converted into residential use.

Other investment options include:

-

€350,000+ — buying investment fund units;

-

€500,000+ — deposit in a Greek bank.

Family inclusion

Investors can add to the Greece Golden Visa application:

-

spouse;

-

unmarried children under 21;

-

parents.

Path to citizenship

Obtaining a residence permit in Greece allows investors to spend up to 90 days out of 180 in any Schengen Area country without a visa. If they maintain residence in Greece for 7 years, they can apply for citizenship.

Pros of the Greece Golden Visa

Some of the most attractive advantages include:

-

visa-free travel to Schengen countries;

-

returnable investment;

-

5-year validity;

-

path to EU citizenship in 7 years.

Italy Golden Visa — €250,000

Investment requirements

For Italy Golden Visa applicants, real estate investment is off the table.

The cheapest option is contributing at least €250,000 to an innovative startup. Other options include:

-

€500,000+ — investing in shares of an Italian company;

-

€1,000,000+ — donation to a philanthropic organisation;

-

€2,000,000+ — purchase of government bonds.

Family inclusion

Investors can add to the Italy Golden Visa application:

-

spouse;

-

unmarried financially dependent children;

-

financially dependent parents.

Path to citizenship

The residence permit cards are issued for an initial 2-year period and can be extended for 3 years. After 10 years of residing in Italy, investors can apply for citizenship.

Pros of the Italy Golden Visa

Some of the most attractive advantages include:

-

visa-free travel to Schengen countries;

-

path to citizenship in 10 years.

Cyprus permanent residency — €300,000

Cyprus offers permanent residency to investors, unlike many other EU countries where it is only possible to obtain temporary residence permits first.

Investment requirements

Four investment options are available, each of them worth €300,000:

-

purchase of residential property;

-

purchase of commercial property;

-

purchase of shares of a local company;

-

purchase of units of Cypriot investment funds.

Family inclusion

Investors can add to the Cyprus Golden Visa application:

-

spouse;

-

unmarried financially dependent children under 25;

-

disabled children of any age.

Path to citizenship

Permanent residency is granted to the investor and their family members for life. They may be eligible for Cyprus citizenship if they live in the country for a total of 5 full years over an 8-year period.

Those who become Cypriot citizens can return their investment.

Pros of the Cyprus permanent residency

Some of the most attractive advantages include:

-

lifelong residency in a EU country;

-

path to EU citizenship in 8 years.

Malta Permanent Residence Programme as an alternative to EU Golden Visas

The Malta Permanent Residence Programme is available to non-EU, non-EEA, and non-Swiss citizens. This is not a Golden Visa, as it provides immediate permanent residency rather than a renewable temporary residence permit.

Investment requirements

One option for investors to obtain permanent residency in Malta is to rent a property with the following expenses:

-

renting real estate for five years — €70,000+;

-

administrative fee — €60,000, with an extra €7,500 paid for every relative over 18, excluding spouse;

-

contribution fee — €37,000;

-

charitable donation — €2,000.

The other option is purchasing real estate worth at least €375,000, with the other expenses unchanged.

The total cost for the two Investment options with added fees:

-

€169,000+ — renting real estate;

-

€474,000+ — buying real estate.

Additional conditions

The investor must also confirm having total assets of at least €500,000, of which €150,000 must be in liquid financial assets. The alternative option is to confirm a minimum of €650,000 in total assets, including €75,000 in liquid financial assets.

Family inclusion

Investors can add to the Malta Permanent Residence application:

-

spouse;

-

unmarried principally dependent children under 29;

-

principally dependent parents and grandparents.

Obtaining period

The application is processed for at least 6 months.

Permanent residence is granted for life, allowing the investor and family members to visit the Schengen Area for 90 days in 180. The permanent residence card must be renewed every 5 years, though.

Pros of the Malta Permanent Residence Programme

Some of the most attractive advantages include:

-

residency for life;

-

visa-free travel to Schengen countries;

-

living, working, and doing business in Malta.

UAE Residence Visa — $204,000

Foreigners can obtain residency in the United Arab Emirates by purchasing real estate in freehold zones.

Investment requirements

To get a 2-year residency visa, the minimum worth of the residential property must be at least AED 750,000, or $204,000. If a loan is taken, a down payment is worth at least 50% of the property value.

It’s also possible to apply for a 10-year visa, but in this case, the investor must purchase residential property for at least AED 2,000,000, or $545,000.

Family inclusion

Investors can add to the UAE residency visa application:

-

spouse;

-

unmarried sons under 25;

-

unmarried daughters of any age.

Obtaining period

The process can take 2 months, during which the applicant must be in the UAE.

Path to citizenship

Foreigners may apply for UAE citizenship by naturalisation after 30 years of legal residence in the country.

Pros of UAE Residence Visa

Some of the most attractive advantages include:

-

fast processing time;

-

large expat communities;

-

business opportunities in an expanding economy;

-

issuance of the Emirates ID and an Esaad Privilege Card, Dubai’s discount program.

Vanuatu citizenship by investment — $130,000

Investment requirements

The cheapest option to become a Vanuatu citizen is to contribute at least $130,000 to the state development fund. The investment is non-refundable. The applicant must also prove they have at least $250,000 in the bank account.

The second option is investing in the local coconut oil industry. The minimum investment for a single applicant or a family of up to 4 people is $157,000. An extra $26,500 is paid for each additional applicant, regardless of age.

Family inclusion

Investors can add to the Vanuatu citizenship application:

-

spouse;

-

financially dependent children under 25;

-

financially dependent parents over 50.

Obtaining period

Apart from a relatively low cost, the main advantage of the program is fast processing time. A passport can be issued as fast as 2 months after applying.

Pros of Vanuatu citizenship by investment

Some of the most attractive advantages include:

-

fastest processing time;

-

no personal income tax;

-

5-year B‑1/B‑2 visa to the USA;

-

no minimum stay requirement.

Dominica citizenship by investment — $200,000

Investment requirements

Dominica offers two options to obtain citizenship by investment.

The cheaper option is a non-refundable contribution to the Economic Diversification Fund. The minimum amount is $200,000 for a single investor and $250,000 for a family of up to 4 people.

The other option is purchasing at least $200,000 worth of shares in state-approved real estate projects, like spa resorts and hotels. The investment can be returned in 5 years if the property is resold to another program participant or in 3 years in other cases.

Family inclusion

Investors can add to the Dominica citizenship application:

-

spouse;

-

financially dependent children under 30;

-

financially dependent parents and grandparents over 65.

Obtaining period

The Dominica passport can be issued after at least 6 months.

Pros of Dominica citizenship by investment

Some of the most attractive advantages include:

-

relatively small investment;

-

opportunity to return real estate investment;

-

10-year B‑1/B‑2 visa to the USA;

Dominica is a Caribbean country that offers one of the cheapest citizenship-by-investment programs

Antigua and Barbuda citizenship by investment — $230,000

Investment requirements

Antigua and Barbuda allows investors to make a non-refundable contribution to the National Development Fund as the cheapest way to obtain citizenship. Starting from August 2024, the minimum investment threshold for this option is $230,000.

Investors who want to receive their money back can purchase shares in state-approved real estate projects for at least $300,000 with the option to resell the property in 5 years.

For families of six or more, there is a possibility of investing $260,000 in a higher education institution. The contribution is non-refundable.

Family inclusion

Investors can add to the Antigua and Barbuda citizenship application:

-

spouse;

-

children under 30;

-

financially dependent parents and grandparents over 55;

-

unmarried siblings.

Obtaining period

The processing time for Antigua and Barbuda citizenship by investment application is at least 6 months.

Pros of Antigua and Barbuda citizenship by investment

Some of the most attractive advantages include:

-

10-year B‑1/B‑2 visa to the USA;

-

relatively small investment;

-

special offer for big families;

-

no personal income tax.

Grenada citizenship by investment — $235,000

Investment requirements

To apply for Grenada citizenship, a single investor has to make a non-refundable contribution of $235,000 to the National Transformation Fund.

The second option is investing in state-approved real estate: a minimum of $270,000 for a share and $350,000 for full ownership. The funds can be returned in 5 years.

Family inclusion

Investors can add to the Grenada citizenship application:

-

spouse;

-

financially dependent children under 30;

-

financially dependent parents and grandparents;

-

unmarried siblings over 18.

Obtaining period

Obtaining a Grenada passport takes at least 8 months.

Pros of Grenada citizenship by investment

Some of the most attractive advantages include:

-

10-year B‑1/B‑2 visa to the USA;

-

fewer major hurricanes compared to other Caribbean countries.

St Lucia citizenship by investment — $240,000

Investment requirements

There are four ways to apply for St Lucia citizenship by investment. Like in other Caribbean states, the cheapest option is a $240,000 non-refundable contribution to the National Economic Fund.

In addition, the new “Infrastructure Option” also lets applicants invest in projects that will improve the country’s infrastructure: ports, bridges, roads, and so on. The prices start at $250,000.

Investors can also buy non-interest-bearing government bonds for $300,000. They can be fully redeemed in 5 years as well.

Family inclusion

Investors can add to the St Lucia citizenship application:

-

spouse;

-

financially dependent children under 30;

-

financially dependent parents over 55;

-

siblings under 18.

Obtaining period

Obtaining St Lucia citizenship by investment may take at least 6 months.

Pros of St Lucia citizenship by investment

Some of the most attractive advantages include:

-

relatively small investment;

-

10-year B‑1/B‑2 visa to the USA;

-

no residency requirement.

Some of the key benefits of living in St Lucia are the country’s natural beauty and the opportunity for vacation and leisure

St Kitts and Nevis citizenship by investment — $250,000

Investment requirements

The minimum investment to obtain citizenship in St Kitts and Nevis amounts to $250,000. Investors contribute to the Federal Consolidated Fund or the Approved Public Benefit Projects.

For real estate investors, there are three options. They can purchase shares in a government-approved real estate project or a condominium unit for at least $325,000 or a single-family private dwelling for $600,000.

The real estate investment can only be returned in 7 years. However, the investor can earn an income of 2 to 5% per year from leasing the property.

Family inclusion

Investors can add to the St Kitts and Nevis citizenship application:

-

spouse;

-

financially dependent children under 25;

-

dependent parents over 55.

Obtaining period

Obtaining St Kitts and Nevis citizenship by investment may take at least 6 months.

Pros of St Kitts and Nevis citizenship by investment

Some of the most attractive advantages include:

-

10-year B‑1/B‑2 visa to the USA;

-

free healthcare for children under 18 and adults over 62.

Comparing the cheapest Golden Visa options

The two most frequent investment options to obtain a Golden Visa are a non-refundable contribution and a real estate purchase.

The Golden Visas are valid for life or renewable if all the required conditions are still met.

Other countries offering Golden Visas

There are more European countries where it is possible to obtain residency permits by investment, such as Belgium, the Netherlands, Luxembourg, and Ireland.

In the USA, an investment of at least $800,000 can make a foreigner eligible for a Green Card via the EB‑5 Immigrant Investor Program.

General requirements for Golden Visa applicants

Main applicant

Specific requirements can vary between programs. However, in most cases, the investor must:

-

be over 18 years old;

-

have sufficient funds and prove the legality of their income;

-

have no criminal record;

-

have medical insurance and no serious illnesses.

Applicants must also submit a full set of documents, including:

-

personal identification;

-

financial records such as tax returns and bank statements;

-

police clearance certificates;

-

proof of relationship to accompanying family members, such as birth and marriage certificates.

These documents often require certified translation, legalisation, or an apostille.

Authorities conduct strict Due Diligence checks to confirm that the applicant poses no financial, reputational, or security risk.

Family members

Family members included in the application must meet similar health and background standards.

Investment options to obtain a Golden Visa

The exact terms of obtaining a Golden Visa vary between countries. Below are the most frequent options for investors.

1. Real estate

The most popular option for investors looking for a second home is purchasing or renting residential property. Some countries, like Cyprus, also allow applicants to invest in commercial real estate.

2. Government bonds

Golden Visa applicants purchase government bonds as a low-risk investment option.

3. Business investment

Italy and Portugal allow investors to establish new companies or invest in existing entities and create new jobs. Another variety of this option is a startup investment.

4. Bank deposits

In Greece, it is possible to open an account in a local bank and transfer a certain sum to become a resident.

5. Investment funds

Portugal offers investors the opportunity to purchase units of state-approved investment funds to obtain residency permits.

6. Contribution to national development funds

In the Caribbean countries, you can make a non-refundable contribution to the national funds to obtain citizenship. The minimum investment tends to be lower than for other options.

7. Arts and culture

In Portugal, the cheapest option to get a Golden Visa is to support national arts and cultural heritage.

Common step-by-step process of obtaining a Golden Visa

Golden Visa and citizenship by investment programs usually follow a standard process. The timeline may vary by country, but the main steps remain the same — from initial assessment to receiving a residence permit or passport.

1 day

Initial consultation with an expert

The process begins with a consultation. Immigrant Invest specialists assess the investor’s goals, family situation, and preferred countries. After reviewing available options, the investor chooses a suitable program. Our legal team then evaluates eligibility and potential risks.

The process begins with a consultation. Immigrant Invest specialists assess the investor’s goals, family situation, and preferred countries. After reviewing available options, the investor chooses a suitable program. Our legal team then evaluates eligibility and potential risks.

1 day

Preliminary Due Diligence

A certified Compliance Anti-Money Laundering Officer checks the investor against international databases. This internal check reduces the refusal risk to 1%.

We do not sign a contract without this step. If risks are identified, we suggest solutions such as submitting extra documents or selecting a different program.

A certified Compliance Anti-Money Laundering Officer checks the investor against international databases. This internal check reduces the refusal risk to 1%.

We do not sign a contract without this step. If risks are identified, we suggest solutions such as submitting extra documents or selecting a different program.

2 weeks

Document preparation and collection

Our lawyers provide a personalised list of required documents. The investor collects the documents, including:

- valid passport;

- proof of income and source of funds;

- police clearance certificate;

- medical insurance;

- birth and marriage certificates, if applying with family.

Documents must be translated and legalised as required. Our team handles this to avoid errors.

Our lawyers provide a personalised list of required documents. The investor collects the documents, including:

- valid passport;

- proof of income and source of funds;

- police clearance certificate;

- medical insurance;

- birth and marriage certificates, if applying with family.

Documents must be translated and legalised as required. Our team handles this to avoid errors.

Up to 3 months

Making the investment

The investor transfers funds to complete the qualifying investment. This may include buying real estate, subscribing to a fund, or donating to a government fund. Proof of investment is needed to proceed with the application.

The investor transfers funds to complete the qualifying investment. This may include buying real estate, subscribing to a fund, or donating to a government fund. Proof of investment is needed to proceed with the application.

1 day

Application submission

After the investment is confirmed and documents are finalised, the complete application is submitted to the relevant government agency. Depending on the country, this can be done remotely or may require physical presence.

After the investment is confirmed and documents are finalised, the complete application is submitted to the relevant government agency. Depending on the country, this can be done remotely or may require physical presence.

2—6 months

Due diligence and government processing

The government conducts its own Due Diligence checks. This may involve checks through international security databases or, in some countries, in-person interviews.

The government conducts its own Due Diligence checks. This may involve checks through international security databases or, in some countries, in-person interviews.

1—2 weeks

Biometrics and issuance of residence card or passport

In most residency programs, the applicant must visit the country to submit biometric data, such as fingerprints and photographs. Shortly after, Golden Visa applicants receive a residency certificate and residence card, while Golden Passport applicants receive a naturalisation certificate and passport.

In most residency programs, the applicant must visit the country to submit biometric data, such as fingerprints and photographs. Shortly after, Golden Visa applicants receive a residency certificate and residence card, while Golden Passport applicants receive a naturalisation certificate and passport.

After 1—10 years

Ongoing compliance and renewal

To maintain the Golden Visa status, the investor may need to:

- spend a minimum number of days in the country;

- renew the residence card every few years;

- maintain the investment for a set period, typically 5 years.

Many programs allow investors to apply for permanent residency or citizenship after 5—10 years, subject to conditions such as physical presence or language knowledge.

To maintain the Golden Visa status, the investor may need to:

- spend a minimum number of days in the country;

- renew the residence card every few years;

- maintain the investment for a set period, typically 5 years.

Many programs allow investors to apply for permanent residency or citizenship after 5—10 years, subject to conditions such as physical presence or language knowledge.

Risks and considerations: what every investor must know

Program changes

Golden Visa programs can change or close without notice. Governments may raise investment thresholds, change eligibility rules, or remove options. In 2023, Portugal removed the real estate option from its Golden Visa, and Spain closed its program entirely in 2025.

These changes show why it is important to act while conditions are favourable. Investors who obtain a residence permit or citizenship before changes take effect usually keep all acquired rights. In most cases, existing permits remain valid and renewable under the original terms.

Political and economic instability

Some Golden Visa countries may face regulatory pressure or geopolitical shifts that affect the program’s stability or travel benefits.

For instance, Vanuatu lost visa-free access to the Schengen Area due to Due Diligence concerns. Similar scrutiny has been directed at several Caribbean citizenship programs.

Common mistakes and reasons for visa refusal

Investors can be denied if basic requirements are not met. Frequent mistakes include:

-

incomplete or incorrectly prepared documents;

-

criminal record or issues in international databases;

-

unclear source of funds;

-

past visa denials or legal issues;

-

investing in a company or property that doesn’t meet program conditions.

Albert Ioffe,

Legal and Compliance Officer, certified CAMS specialist

Immigrant Invest is a licensed agent for leading programs. Our Compliance Department conducts internal Due Diligence before an application is submitted, allowing us to identify potential issues early and improve the chances of approval.

We check all documents and ensure compliance with current laws. Our legal team works to prevent delays, refusals, or complications.

4 latest updates about Golden Visa programs in 2025

1. Spain Golden Visa officially ends

On April 3rd, 2025, Spain officially closed its Golden Visa program. The decision was linked to housing market concerns in major cities. Existing permit holders retain their rights, but no new applications are accepted.

2. Malta updates fees for Permanent Residence Programme

Though not a Golden Visa, the Malta Permanent Residence Programme remains a popular route to EU residency. In 2025, the Maltese government revised its fee structure:

-

administrative fee increased to €60,000 for the main applicant and to €7,500 for family members over 18, except the spouse;

-

contribution fee was reduced to €37,000;

-

no contribution fee is required for family members;

-

minimum total investment now starts at €169,000 for renting and €474,000 for buying property.

3. Caribbean citizenship programs under review

Governments of Antigua and Barbuda, Dominica, Grenada, St Kitts and Nevis, and St Lucia have aligned their minimum investment thresholds at $200,000+ following the Memorandum of Agreement in 2024.

Further changes are under discussion. Authorities may introduce mandatory residency requirements. If adopted, investors could be required to spend time in the country before or after obtaining citizenship — a significant shift for the Caribbean programs.

4. Vanuatu begins biometric passport requirement

In 2025, Vanuatu introduced a rule requiring citizenship by investment applicants to travel to the country to submit biometric data before receiving their passports. This change replaces the previous remote process and aims to improve transparency and meet international security standards.

Key things to know about the cheapest Golden Visas

-

A Golden Visa allows foreigners to obtain residency by investment in a country’s economy. It can also serve as an umbrella term for investment programs, including permanent residency and citizenship by investment.

-

Latvia offers the most affordable Golden Visa in the European Union, with the option to invest just €50,000 in a local company.

-

Hungary, Greece, Italy, and Portugal also remain among the cheapest EU residency programmes, with minimum investments starting at €250,000.

-

Vanuatu offers the least expensive path towards obtaining citizenship by investment: a passport of this country can be obtained for $130,000.

-

Malta Permanent Residence Programme is not a Golden Visa, but a separate option that grants lifelong permanent residency. The minimum investment starts at €169,000 with a 5-year property rental.

Immigrant Invest is a licensed agent for citizenship and residence by investment programs in the EU, the Caribbean, Asia, and the Middle East. Take advantage of our global 15-year expertise — schedule a meeting with our investment programs experts.