Digital Nomad Visas

A Digital Nomad Visa opens the door to living and working in an exciting new country, letting you earn remotely while exploring the world legally and without boundaries.

Many countries are offering a Digital Nomad Visa; among them are Portugal, Italy, and Spain.

$815+

Minimum income

1+ month

Acquisition period

1+ year

Permit validity

5 best countries with Digital Nomad Visas

Country and statusInvestmentsTime requiredBenefits

What is a Digital Nomad Visa?

A Digital Nomad Visa is a permit that allows remote workers to legally live in a foreign country while earning income from employers or clients outside that country. It is usually a residency permit or a short-term visa that allows its holder to get a permit once they enter the country.

Digital Nomad Visas gained popularity in recent years as remote work became the norm and professionals sought flexible living options. Countries introduced these visas to attract skilled workers, boost their economies, and revitalise tourism.

According to a travel data agency, Riskline, there are at least 40 million digital nomads worldwide, of whom approximately 18 million are Americans.

Who can obtain a Nomad permit

Remote workers. Individuals employed by a company located outside the host country who work entirely remotely.

Freelancers. Independent professionals, such as writers, designers, developers, or consultants, offer services to clients globally.

Entrepreneurs. Business owners or founders who manage their operations remotely, typically running online or location-independent businesses.

Digital creators. Content creators, bloggers, influencers, and videographers who generate income online through platforms, sponsorships, or advertising.

Independent consultants and specialists. Experts providing specialised remote services, such as legal advisors, financial consultants, or IT professionals.

Contractors. Individuals on fixed-term contracts with foreign companies, working remotely during the duration of the agreement.

Typical requirements. Each country sets specific eligibility criteria, the most common being:

- proof of income, which must be earned outside the host country;

- remote work capabilities, such as a work contract confirming the possibility of working from abroad or an employer’s permission;

- housing in the host country;

- a list of documents to confirm eligibility;

- sometimes, industry or occupation preferences.

Total comparison of Digital Nomad Visa programs

Cost calculation

Family members participation

Investment options

Benefits of each Digital Nomad Visa

5 benefits of a Digital Nomad visa

1

Low-cost relocation

Digital Nomad visas offer a straightforward process for obtaining temporary residency in a foreign country, allowing individuals to legally live and work remotely. However, it requires fewer expenses than through investment.

For example, to move to Portugal, an investor must contribute at least €250,000 for a Golden Visa. The financial requirement for a nomad visa to Portugal is to earn €3,680 monthly. Both ways lead to a residence permit, with the possibility of applying for permanent residency or citizenship after meeting the requirements, including residing in the country for 5 years.

Digital Nomad visas offer a straightforward process for obtaining temporary residency in a foreign country, allowing individuals to legally live and work remotely. However, it requires fewer expenses than through investment.

For example, to move to Portugal, an investor must contribute at least €250,000 for a Golden Visa. The financial requirement for a nomad visa to Portugal is to earn €3,680 monthly. Both ways lead to a residence permit, with the possibility of applying for permanent residency or citizenship after meeting the requirements, including residing in the country for 5 years.

2

Moving with the family

Many Digital Nomad Visas provide options to move abroad with a spouse and children. For example, obtaining such a visa in Malta, Portugal, Italy, or Spain is possible.

Many Digital Nomad Visas provide options to move abroad with a spouse and children. For example, obtaining such a visa in Malta, Portugal, Italy, or Spain is possible.

3

Lower cost of living

Digital nomads enjoy a lower cost of living by relocating to a country where daily expenses, housing, and services are more affordable than the nomad’s home country.

For example, average monthly expenses in American Houston are $6,100, or around €5,900. To maintain the same lifestyle in the Hungarian capital, Budapest, one will need almost twice less, $3,263, or €3,155.

Digital nomads enjoy a lower cost of living by relocating to a country where daily expenses, housing, and services are more affordable than the nomad’s home country.

For example, average monthly expenses in American Houston are $6,100, or around €5,900. To maintain the same lifestyle in the Hungarian capital, Budapest, one will need almost twice less, $3,263, or €3,155.

4

Access to healthcare and education

Digital nomads' children can often attend local schools at no cost, while the entire family may receive medical care at local clinics.

Digital nomads' children can often attend local schools at no cost, while the entire family may receive medical care at local clinics.

5

Tax optimisation

Many countries offer low tax rates or special incentives for digital nomads. Typically, taxes are not applicable during the first six months of stay until nomads become tax residents.

Many countries offer low tax rates or special incentives for digital nomads. Typically, taxes are not applicable during the first six months of stay until nomads become tax residents.

How to get a Digital Nomad Visa

The process of gaining a visa and a residence permit usually depends on the country. For example, a digital nomad will get a visa to Malta within at least 2 months, while in Portugal, the obtainment period is a minimum of 6 months.

1 day

Preliminary Due Diligence

Immigrant Invest conducts a preliminary check of a digital nomad before concluding a Services Agreement.

A certified Anti-Money Laundering Officer checks information on the applicant in international legal and business databases. The check helps discover possible issues that may affect obtaining a Malta residence permit and reduce the risk of refusal.

The check is fully confidential.

3 weeks

Collect and submit documents

Typically, nomads apply for a visa at the consulate in their country of residence. Some countries, like Malta, allow applicants to submit an application online.

In some cases, nomads need to get additional documents. For instance, before applying for a visa, Spain requires foreigners to request an ID number called Número de Identificación de Extranjero, or NIE.

Up to 3 months

Obtain the Digital Nomad Visa

The consulate reviews the submitted documents. Once the application is approved, a nomad schedules an appointment to receive the document. The visa looks like a sticker on a passport page.

2 days

Enter the country with the Digital Nomad Visa

After obtaining a visa and arranging housing in the country, the next step is to move and apply for a residence permit. On the border, you must show a passport with a visa affixed to it.

1 day

Apply for the residence permit, if necessary

If you enter with a short-term visa, you must get a residence permit once in the country. The local immigration office issues residence permits. Schedule an appointment and prepare documents.

3 weeks

Get a residence permit card

The process typically takes about 2–3 weeks. Once completed, the immigration office will send the residence permit card to your local address.

Every 1—3 years

Extend a residence permit

Most countries allow digital nomads to extend their stay. If so, you must revisit the immigration office to renew your permit.

A Digital Nomad Visa can lead to permanent residency or citizenship in some countries. The lawyers at Immigrant Invest provide expert advice on this matter and assist in acquiring a new status.

Costs of a Nomad permit

Digital Nomad’s expenses typically consist of several aspects.

1

Minimum required income

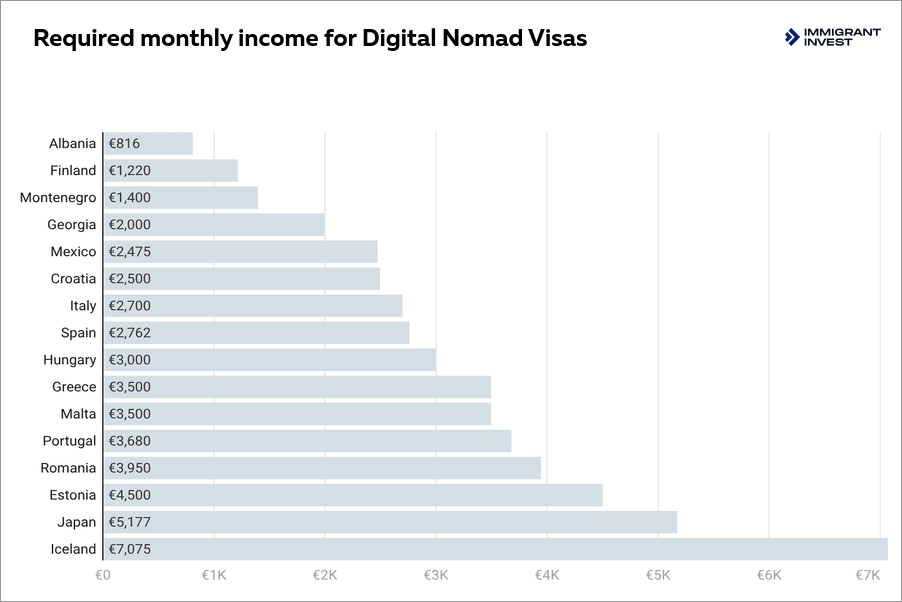

Applicants must demonstrate a steady income that meets the host country’s threshold, which typically falls between €1,000 and €5,000 per month, depending on the destination.

Applicants must demonstrate a steady income that meets the host country’s threshold, which typically falls between €1,000 and €5,000 per month, depending on the destination.

2

Housing expenses

Accommodation costs vary by location, with monthly rents ranging from affordable options in Southeast Asia of €300—800 to higher-end choices in European cities of €1,000+.

Accommodation costs vary by location, with monthly rents ranging from affordable options in Southeast Asia of €300—800 to higher-end choices in European cities of €1,000+.

3

Permit fees

Application fees for a Digital Nomad Permit vary, starting at €50 to 1,000 or more, depending on the program and processing time.

Application fees for a Digital Nomad Permit vary, starting at €50 to 1,000 or more, depending on the program and processing time.

4

Monthly expenses

In addition to housing, digital nomads should budget for food, transportation, healthcare, and entertainment, ranging from €500 to €2,000 per month.

In addition to housing, digital nomads should budget for food, transportation, healthcare, and entertainment, ranging from €500 to €2,000 per month.

Cheapest countries for digital nomads

Several countries that offer Digital Nomad Visas do not specify the minimum income. Among them are Germany, the Bahamas, Uruguay, and Seychelles. This means that applicants will only need to cover their expenses in the new living place.

Few countries require a monthly income of $2,000 or less. These countries are:

- Colombia — $750;

- Albania — $815;

- Ecuador — $1,350;

- Montenegro — $1,440;

- Brazil — $1,500;

- Czechia — $1,670.

As for the European Union, three countries demand a nomad to earn less than €3,000:

Taxes that digital nomads must pay

Taxes for digital nomads vary depending on the host country, the duration of stay, and the nomad’s tax residency status. While many digital nomad visas provide attractive benefits, understanding tax obligations is essential to avoid unexpected liabilities.

Tax residency and double taxation

Digital nomads typically remain tax residents of their home country, unless they spend more than 183 days in the host country, which often triggers tax residency there. This could result in double taxation unless a tax treaty between the home and host countries prevents it.

Tax benefits

Some countries offering digital nomad visas provide significant tax advantages:

- Tax exemptions. For instance, Croatia exempts digital nomads from local income taxes during their stay.

- Flat tax rates. Countries like Estonia offer simplified tax structures for remote workers.

- No tax residency. Specific destinations like the Bahamas do not require digital nomads to pay any income tax.

Key considerations

Check whether your home country has a double taxation treaty with the host country to prevent being taxed twice on the same income. Also, find out your legal obligations. Even with exemptions, digital nomads may still need to contribute to social security or pay indirect taxes like VAT.

Adding family members

Many Digital Nomad Visa programs allow nomads to bring their families along, offering remote workers a convenient way to relocate with their loved ones.

Who can join:

- spouse or registered domestic partner;

- minor children;

- in some cases, older children who are financially dependent on the nomad;

- rarely, elderly parents or other dependents if their financial dependency is proven.

Case studies

Why Digital Nomad Visa applications get rejected

Digital Nomad Visa applications may be rejected for several reasons, often related to documentation, financial requirements, or visa terms compliance.

Insufficient proof of remote work. Applicants must demonstrate that they work remotely for a foreign employer, run an online business, or freelance for international clients.

Not meeting income requirements. Digital Nomad Visas require applicants to earn a minimum monthly income to ensure financial stability during their stay. Applications may be denied if income documentation, like bank statements or salary slips, does not meet the threshold or is incomplete.

Incomplete or incorrect documentation. It is essential to provide all documents on the list to get approval. Errors in application forms or failure to translate documents when required can also cause issues.

Non-compliance with visa terms. Some applicants fail to meet criteria such as no local employment in the host country or restrictions on business operations. Any indication of plans to violate these terms may result in a rejected application. Renewing or extending a visa will also be impossible if the rules are broken.

To avoid rejection, it is advisable to seek professional assistance to prepare a flawless application. For example, Immigrant Invest lawyers conduct a preliminary check to help indicate potential risks at an early stage and find a solution.

Schedule a meeting

Let's discuss the details

Schedule a meeting at one of the offices or online. A lawyer will analyze the situation, calculate the cost and help you find a solution based on your goals.

Prefer messengers?

List of all Digital Nomad Visas in 2026

Europe

The Caribbean

Americas

Asia and Oceania

Middle East and Africa

Drawbacks of a Digital Nomad Visa

Tax and financial challenges. Some countries impose income thresholds and potential tax obligations, which can increase the financial burden, especially if local taxation overlaps with taxes in the home country.

Limited duration and pathway. Digital Nomad Visas are temporary, usually lasting 6 months to 2 years, and do not necessarily lead to permanent residency or citizenship.

Restrictions on local employment. These visas typically prohibit working for companies within the host country, limit income opportunities, and require reliance on remote or foreign income sources.

Total comparison of Digital Nomad Visa programs

Cost calculation

Family members participation

Investment options

Benefits of each Digital Nomad Visa