Summary

Real estate in Malta may be a good choice for investment: the objects are considered liquid assets, and the prices usually grow by 3 to 6% a year. Renting a property out may help you earn 3 to 5% of its cost annually.

In addition, buying a property in Malta helps to get temporary or permanent residency or even citizenship in this country. Let’s take a closer look at Malta’s real estate and the benefits it may provide to investors.

Ways of obtaining Malta residency for real estate investors

Maltese legislation allows foreign investors to obtain an official status in the country. There are three opportunities for non-EU citizens:

-

Get a residence permit under the Malta Global Residence Programme.

-

Obtain permanent residency under the Malta Permanent Residence Programme.

-

Apply for Malta citizenship for exceptional services by direct investment.

Each path requires purchasing or renting residential real estate. Rent is more popular because it is cheaper and faster, but the purchase may be more profitable over time.

The minimum housing price depends on the status you apply for and the property’s region.

Property price for obtaining a long-term status in Malta

This article focuses on getting permanent residency in Malta by purchasing a property. The Malta Permanent Residence Programme allows an investor to get a PR permit in several months, including 4—6 months to process the application.

Malta permanent residence by investment in real estate may suit an applicant, who wants to get a life-long status in Malta, allowing them to live there, and travel to the Schengen Area visa-free. There is no obligation for the PR permit holders to spend time in Malta or restrict its amount in other countries.

Best locations for purchasing real estate in Malta

Foreigners may buy properties in any region of Malta. Usually, they may purchase residential real estate for themselves and need a special permit, but some areas are exempt from restrictions. Also, some nuances of choosing an object depend on the location and an investor’s goals.

Special Designated Areas (SDA) are complexes where non-Maltese citizens may buy a property without any restrictions. They are allowed to purchase several objects and rent them out. Also, there’s no need to get permission for the purchase.

SDA complexes are situated in attractive locations and offer different types of properties. Popular resorts like St. Julian’s and Sliema have their own SDAs. Investors may choose properties on the islands of Malta or Gozo, depending on the minimum investment requirements and locations’ benefits.

Regions to buy a property. The northern parts of Malta are the most developed and, as a result, expensive. There are developed transport infrastructure and high building density. Small towns flow over one another; they all have schools, hospitals, shops and restaurants. Investors prefer such coastal locations: Mellieha, St Julian's, Sliema, and Pembroke. St Julian’s, Sliema and Msida are also popular with people moving to Malta for business or work.

The South of Malta and the island of Gozo are not so developed, and their investment attractiveness is lower than in other areas of the country. However, the minimum investment in property for getting a Malta permanent residence permit is also lower there.

Sliema is a popular resort in Malta, and the minimal cost of real estate per square metre is about €2,517 there

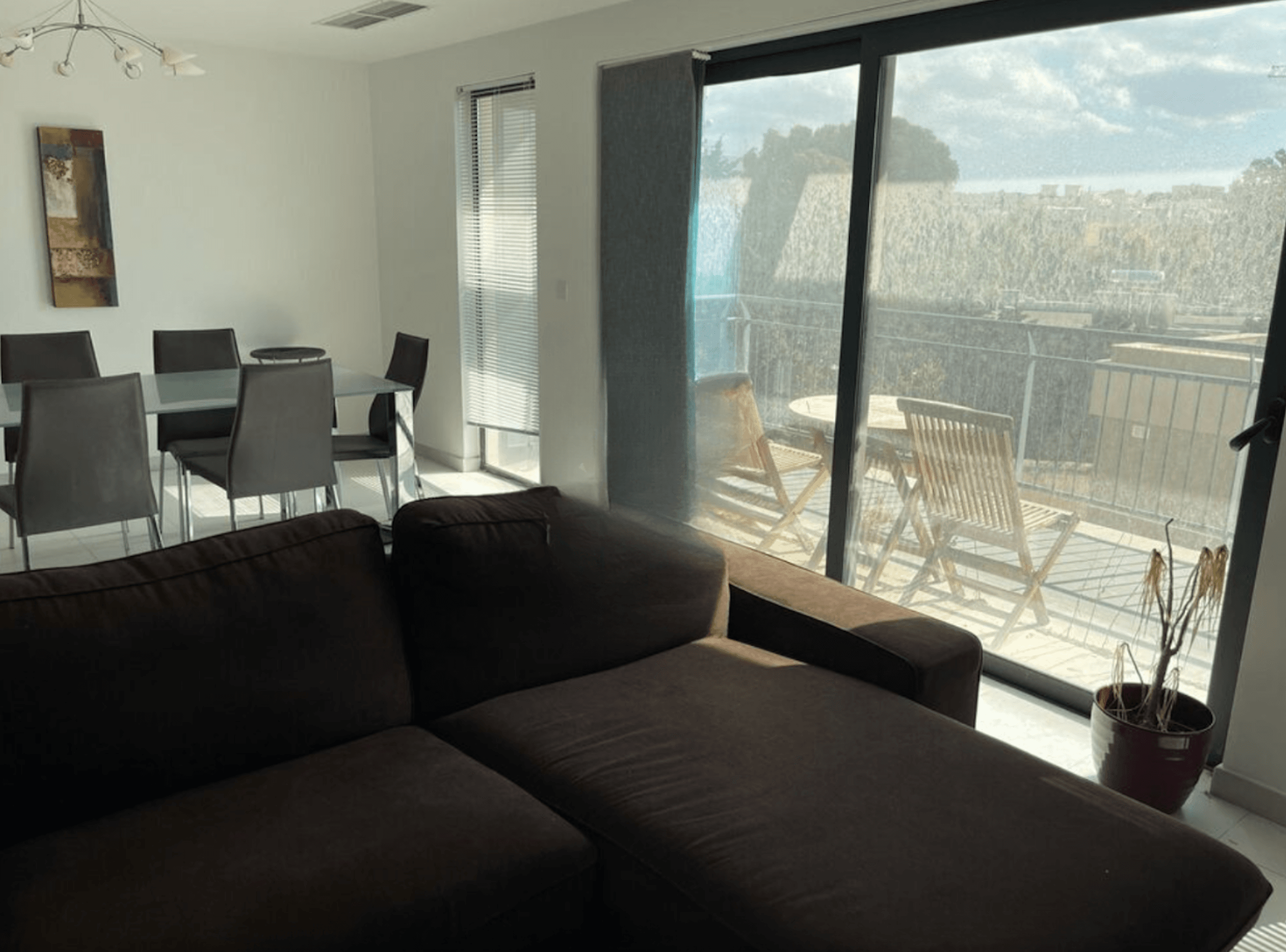

Examples of real estate in Malta suitable for residency

Applicants for a residence permit may choose any Malta property for sale: an apartment, a house or another home they prefer. The main requirement is to fit within the price stated by the program.

An average price of an apartment per square metre in Malta is around €2,600 if an object is outside a city centre. The highest prices are in the places that are centres of tourism and business, for example, Valletta or St. Julian’s. The lowest prices are on the island of Gozo; they may be twice lower than average.

Examples of properties in Malta

Malta real estate taxes

Malta has no annual property tax, so you pay it once when you buy a home. There is a stamp duty of 2 to 7% from the estate cost and a property tax — of 5% from the cost of the object.

There are additional expenses for the execution of the transaction:

-

1–2,5% notary fee and 18% VAT from its amount;

-

1–2% agency fee and 18% VAT from its amount;

-

€350 AIP (Acquisition of Immovable Property) permit, not needed for SDA‑property.

If the land under a house is in rental, investors pay the land tax of €40 to €250 per year. And the tax on rental income is up to 35%.

When you sell real estate in Malta, you pay a property transfer tax of 5 to 12%, depending on the term of ownership.

The procedure of buying a real estate

The process of buying a property in Malta can be divided into four stages:

Benefits of buying real estate in Malta

As we’ve already said, there are two ways of participation in MPRP: renting and buying real estate. The first way may seem more attractive, but it is not quite so cut and dried. There are several benefits of buying real estate to consider.

Buying a liquid asset. Real estate in Malta rose in price faster than in other EU countries. It grew 25% in five years, from 2015 to 2020. In 2020 despite the pandemic, prices went up by 5—9%. Housing prices index in Malta increased to 149 points in the first quarter of 2023. It means that on average, prices grow by 5% a year.

Getting passive income . Real estate leasing can give you a gain of about 3‑5% per year, and the profit may be higher if you buy a property in a location popular among tourists. In comparison, interest rates in EU banks do not rise higher than 1,5%.

The target audience for rent is foreigners or young families without their property. Villas and houses are not as popular for renting as apartments. The maximum demand is for flats from 75 to 120 m², accommodating families of three or four. Contract with deposit is standard practice.

Investors can rent their Malta real estate out if they participate in MPRP or get citizenship for exceptional services. They cannot lease their properties if they obtain a Malta temporary residence permit under the GRP.

What are the expenses of getting a Malta permanent residence by investment?

Malta Permanent Residence Program allows getting permanent residence by foreigners without:

-

criminal records or violations of migration law,

-

socially dangerous sicknesses, such as HIV.

There is no opportunity to participate for citizens of EU, EEA, Swiss and sanctioned countries.

The program allows adding family to the application:

-

a spouse,

-

children under and over 18,

-

parents,

-

grandparents.

Children and parents should be principally dependent on the investor. The family composition has an impact on the investment amount and additional fees.

Investors have two options for participating in the MPRP: renting or purchasing real estate. The minimum period of rent or ownership is five years after obtaining a residence permit.

The minimum sum of rent and purchase of real estate to get a Malta permanent residence permit

In both cases, there are mandatory administrative and state fees, donations to Maltese organisations and buying medical insurance:

-

€40,000 — an administrative fee;

-

€58,000 — the government contribution if you rent real estate;

-

€28,000 — the government contribution if you buy real estate;

-

€2,000 — a charitable donation.

So, the fixed part starts from €70,000. The contribution fee for parents and grandparents is an additional €7,500 per person.

There are also related expenses on health insurance, document translation, apostille and notary.

In addition, applicants should have regular and stable financial resources. The amount should be sufficient to maintain themselves and their dependents. And have capital assets of not less than €500,000, out of which a minimum of €150,000 must be financial assets.

Procedure for getting Malta permanent residence by investment

The fastest way of getting a residence permit in Malta is to participate in the investors' program, and you can get permanent residency immediately after completing the procedures. There are eight stages:

Preliminary check

It is a provisional Due Diligence procedure when an Anti Money Laundering Officer of an agency explores information about investors and evaluates the risk of rejection. The check ImmigrantInvest takes a day; it is confidential.

It is a provisional Due Diligence procedure when an Anti Money Laundering Officer of an agency explores information about investors and evaluates the risk of rejection. The check ImmigrantInvest takes a day; it is confidential.

Conclusion of the contract with an agent

You can’t apply to the Malta Permanent Residence Programme directly, only with an agent. This is prescribed in The Malta Permanent Residence Programme Regulations, L.N. 121 of 2021. The Government of Malta should accredit the agent, and the agent assists you at every stage.

Immigrant Invest is an MPRP licensed agent. The licence is №AKM-IMIN‑23.

You can’t apply to the Malta Permanent Residence Programme directly, only with an agent. This is prescribed in The Malta Permanent Residence Programme Regulations, L.N. 121 of 2021. The Government of Malta should accredit the agent, and the agent assists you at every stage.

Immigrant Invest is an MPRP licensed agent. The licence is №AKM-IMIN‑23.

Collecting documents and application submission

A lawyer gives you a complete list of documents and helps prepare them. The papers should be translated into English and notary certified. Along with application submission, you pay an administration fee of €10,000, which is non-refundable. This stage takes from 4 to 6 weeks.

A lawyer gives you a complete list of documents and helps prepare them. The papers should be translated into English and notary certified. Along with application submission, you pay an administration fee of €10,000, which is non-refundable. This stage takes from 4 to 6 weeks.

Due Diligence

The Residency Malta Agency provides this check. They can request additional information about the investor, and the agent helps prepare it. This stage takes from 4 to 6 months.

The Residency Malta Agency provides this check. They can request additional information about the investor, and the agent helps prepare it. This stage takes from 4 to 6 months.

Fulfilment of program conditions

After getting approval, you should make the required payments, get medical insurance and rent or buy a property in Malta, and pay all necessary contributions. After satisfying all requirements, the agent submits your documents to the Residency Malta Agency. This stage may take up to 8 months.

After getting approval, you should make the required payments, get medical insurance and rent or buy a property in Malta, and pay all necessary contributions. After satisfying all requirements, the agent submits your documents to the Residency Malta Agency. This stage may take up to 8 months.

Getting final approval

The Residency Malta Agency gives the final approval and allows receiving permanent residence cards. It takes one month.

The Residency Malta Agency gives the final approval and allows receiving permanent residence cards. It takes one month.

Providing fingerprints

The investor and their family, announced in the application, should travel to Malta for the submission of fingerprints. The biometrics submission takes a day.

The investor and their family, announced in the application, should travel to Malta for the submission of fingerprints. The biometrics submission takes a day.

Getting permanent residence cards

Investors get the Certificate of Residence and cards by courier, and there is no need to visit Malta to collect them. This stage takes about two weeks.

Investors get the Certificate of Residence and cards by courier, and there is no need to visit Malta to collect them. This stage takes about two weeks.

After getting the permanent residence cards, you should pass the five-year annual review. The sense of review is the confidence that investors follow the program’s conditions and proceed to rent or own property in Malta.

Benefits of Maltese permanent residence

A right to live in Malta. Investors and their family members may live in Malta with a permanent residence permit as long as they wish. However, they are not obliged to: they will maintain their status even if they don’t visit the country.

Another benefit of Maltese residency is that we could call it a “second choice”. Investors don’t have to live permanently on islands, but they should own or rent real estate. So, in an emergency, investors can relocate promptly to Malta.

Visa-free travel to the Schengen Area . A Maltese residence permit allows you to visit the Schengen Area countries without a visa and stay there for 90 days out of 180.

Access to high-quality medicine and education . The investor and their family have access to Maltese health and education systems. Moreover, many British and American universities have their branches in Malta.

An opportunity to get Malta tax residency. Malta attracts investors and entrepreneurs through its taxation system.

Permanent residence doesn’t give you tax benefits, but if you move to Malta or stay in the country at least 183 days during the year, you become a tax resident and pay taxes in accordance with Maltese legislation. In some cases, it may help to reduce the tax burden.

If you transfer your business to Malta, you may enjoy some of the system’s advantages: for example, shareholders of Maltese companies can return up to 100% of the corporate tax paid by the company.

Malta has Double Tax Avoidance Agreements with more than 80 countries. India, France, Canada and China are on this list.

Immigrant Invest is a licensed agent for citizenship and residence by investment programs in the EU, the Caribbean, Asia, and the Middle East. Take advantage of our global 15-year expertise — schedule a meeting with our investment programs experts.