Summary

The Greece Golden Visa offers several investment options to obtain a residence permit, including the purchase of real estate. However, not all investors are interested in managing property or dealing with maintenance costs and taxes.

For those seeking a simpler and more flexible solution, investing at least €350,000 in regulated mutual funds provides a practical alternative — with no need to own or maintain physical assets.

This article explores how fund-based investments work, who they suit best, and why they are gaining traction in today’s market.

Market trends for fund-based residence permits in Greece

Golden Visa general statistics overview

The Greece Golden Visa is one of the most popular residency by investment programs in the EU. It offers third-country nationals and their families the right to live in Greece in exchange for a qualifying investment.

While the path initially attracted attention mostly from property buyers, the number of total applications has multiplied since 2022. Greece’s Golden Visa generated around €4.3 billion between 2021 and 2023, according to recent data published by the European Parliament.

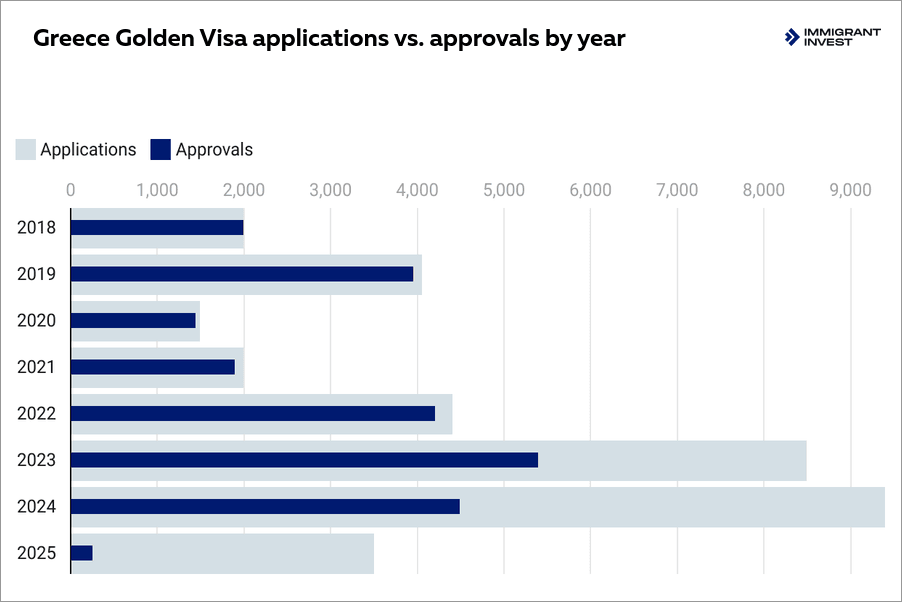

As shown in the chart below, Golden Visa applications jumped significantly in 2023 and 2024, surpassing 8,000 annually. Although approvals tend to lag behind due to administrative backlogs, demand remains strong.

The number of Greece Golden Visa applications more than doubled between 2022 and 2024, reaching nearly 9,000 in 2024

Real estate still leads, but at a cost

Nearly 40% of Greece’s real estate investments were made by Golden Visa applicants, according to a 2021 study by the London School of Economics and Harvard University.

While this influx of capital supported the country’s post-crisis housing sector, it also contributed to surging property prices. It made housing increasingly unaffordable for local residents. Besides, it has also contributed to a steep rise in rental prices, especially in urban centres and tourist-heavy islands.

By late 2024, growing social discontent led to mass protests in Athens, where thousands of workers voiced concerns about the rising cost of living, including housing unaffordability. In response, the Greek government increased the minimum property investment threshold to €400,000—800,000, depending on location.

Fund-based investment gaining appeal

The Greece Golden Visa has long been dominated by real estate investments. However, a combination of public pressure, economic recalibration and regulatory changes has started to shift the landscape — gradually paving the way for alternative routes such as investment in mutual funds.

As real estate becomes less accessible and more politically sensitive, mutual fund investments under the Golden Visa program are gaining interest. Though still a minority route, fund-based residence applications are increasing gradually, especially among financially literate investors from the US, Canada, and Asia.

This route is especially appealing, because it:

- avoids the burden of managing physical assets abroad;

- is less exposed to local housing market volatility;

- offers a clearer regulatory framework for institutional-style investors.

Elena Ruda,

Chief Development Officer at Immigrant Invest

Based on market observations and expert assessments, fund-based Golden Visa applications are estimated to have accounted for 5—7% of total applications in 2023—2024.

While no official breakdown has been published, this share is expected to grow following the March 2024 property threshold increase and the wider promotion of fund-based routes.

Golden Visa requirements for investments and funds

To qualify, the applicant must invest at least €350,000 in a mutual fund.

The fund must meet the following conditions regarding its operation:

- the fund must invest exclusively in shares, corporate bonds or Greek government bonds that are listed on regulated markets or multilateral trading facilities operating in Greece;

- the fund must be established in Greece or another country and have total assets of at least €10 million.

How Greece Golden Visa funds are regulated by the Hellenic Capital Market Commission, HCMC

To obtain a Greek residence permit by fund investment, applicants may choose a regulated mutual fund option instead of purchasing real estate. This route is governed by strict financial and legal criteria, ensuring transparency and oversight.

Licensing and supervision

The mutual fund and its manager must be licensed by the relevant capital market authority in the fund’s home country. If the fund is based outside the EU, the authority must:

- Be a member of the International Organization of Securities Commissions.

- Have a bilateral information-sharing agreement with the Hellenic Capital Market Commission.

How the investment is managed

Fund-based investments under the Greece Golden Visa are subject to detailed financial procedures that ensure transparency, regulatory oversight and active capital use:

- all investments must be executed through a licensed investment company or a credit institution with a registered office or branch in Greece;

- investor participation is recorded in the Intangible Securities System, SAT, operated by the Hellenic Central Securities Depository;

- dedicated and exclusive account is opened in a Greek credit institution to manage the fund’s operations, including portfolio transactions, dividend distributions and investment execution.

To prevent passive holding of capital, the fund manager must ensure that no more than 20% of the fund’s value remains uninvested on average annually. This rule guarantees that the majority of the funds are actively placed in eligible securities, as defined by the program.

Proof and certification

The investor’s participation in the fund must be verified annually through the fund’s annual report; or certificates from the fund manager, investment company, or credit institution confirming the holding and execution of the investment.

Who can invest in a Greece fund and get a Golden Visa

The Greece Golden Visa program is open to third-country nationals — that is, citizens of countries outside the European Union and the European Economic Area — who meet the investment and legal requirements.

Main applicant criteria

To qualify as a main applicant, an investor must:

- be at least 18 years old;

- hold a clean criminal record;

- legally enter Greece, typically on a visa or within a visa-free period;

- provide proof of health insurance covering their stay in Greece;

- make a qualifying investment, such as purchasing shares in a regulated mutual fund worth at least €350,000.

Eligible family members

The following relatives of the main investor may be included in the same application:

- Spouse or registered partner officially recognised under Greek law.

- Children under 21 years old, regardless of whether they are biological or adopted.

- Parents of the main applicant and parents of the spouse, without age restrictions and without a requirement to prove financial dependency.

Each family member is granted an individual residence permit valid for 5 years, which is renewable as long as the investment is maintained.

Children turning 21 can apply to switch to an independent permit, provided they meet the relevant criteria.

No residency requirement for applicants

Golden Visa holders are not required to live in Greece permanently. They may retain the residence permit as long as the qualifying investment is maintained, making this program especially attractive for international investors seeking flexibility and long-term EU access.

How to obtain Greece residence permit via fund investment: a step-by-step procedure

Applying for a Greece Golden Visa by the purchase of mutual fund shares is a structured and transparent process. With legal assistance, most steps can be completed remotely via power of attorney. The process typically takes 4+ months and includes the following stages.

1 day

Preliminary Due Diligence

An initial Due Diligence check is conducted by a certified Anti-Money Laundering Officer to assess any legal or reputational risks. This step significantly reduces the chance of rejection, often to under 1%.

If issues are identified, they may be addressed through clarifying documents or by adjusting the investment strategy.

An initial Due Diligence check is conducted by a certified Anti-Money Laundering Officer to assess any legal or reputational risks. This step significantly reduces the chance of rejection, often to under 1%.

If issues are identified, they may be addressed through clarifying documents or by adjusting the investment strategy.

1+ weeks

Select and reserve a qualifying mutual fund

The applicant, with assistance from legal and financial experts, selects a licensed mutual fund that complies with Golden Visa requirements, i.e. minimum capital of €10 million, regulated under EU or IOSCO standards, and focused exclusively on listed Greek securities.

The investment manager confirms fund availability and prepares the required participation agreements.

The applicant, with assistance from legal and financial experts, selects a licensed mutual fund that complies with Golden Visa requirements, i.e. minimum capital of €10 million, regulated under EU or IOSCO standards, and focused exclusively on listed Greek securities.

The investment manager confirms fund availability and prepares the required participation agreements.

1+ weeks

Collect and legalise supporting documents

The investor gathers and prepares necessary documents:

- Valid passport.

- Birth and marriage certificates.

- Criminal record certificate.

- Proof of income or assets.

- Health insurance valid in Greece.

All documents must be translated into Greek and apostilled or legalised depending on the country of issuance.

The investor gathers and prepares necessary documents:

- Valid passport.

- Birth and marriage certificates.

- Criminal record certificate.

- Proof of income or assets.

- Health insurance valid in Greece.

All documents must be translated into Greek and apostilled or legalised depending on the country of issuance.

Up to 1 week

Get a Greek tax identification number

A Greek Tax Identification Number, AFM is required to proceed with the investment. It can be issued remotely by a tax representative in Greece via power of attorney.

A Greek Tax Identification Number, AFM is required to proceed with the investment. It can be issued remotely by a tax representative in Greece via power of attorney.

4+ weeks

Transfer funds and complete the investment

The investor transfers at least €350,000 to the dedicated fund account held at a Greek bank. The fund manager declares shareholder details and executes the investment in line with program rules like capital must be placed in listed shares or bonds, and not remain idle.

Proof of investment is provided by the fund manager, investment company, and bank involved.

The investor transfers at least €350,000 to the dedicated fund account held at a Greek bank. The fund manager declares shareholder details and executes the investment in line with program rules like capital must be placed in listed shares or bonds, and not remain idle.

Proof of investment is provided by the fund manager, investment company, and bank involved.

1—2 days

Submit the application for the residence permit

An application for a residence permit is submitted through the official Greek migration portal. Within a week, the applicant receives a certificate of submission that allows legal stay in Greece for up to one year while the application is processed.

An application for a residence permit is submitted through the official Greek migration portal. Within a week, the applicant receives a certificate of submission that allows legal stay in Greece for up to one year while the application is processed.

Mandatory within 24 weeks

Submit biometric data

All applicants, including family members, must submit biometric data — fingerprints and digital photos.

For the fund investment route, applicants typically enter Greece on a national D visa to attend their appointment. The biometric process must be completed no later than 6 months after the application date.

All applicants, including family members, must submit biometric data — fingerprints and digital photos.

For the fund investment route, applicants typically enter Greece on a national D visa to attend their appointment. The biometric process must be completed no later than 6 months after the application date.

12+ weeks

Receive a decision and residence cards

Upon approval, the residence permit cards are issued for 5 years and can be collected in person or via a legal representative. The permit is renewable as long as the investment in the fund is maintained.

Upon approval, the residence permit cards are issued for 5 years and can be collected in person or via a legal representative. The permit is renewable as long as the investment in the fund is maintained.

Other investment options in Greece

Greece offers a variety of investment routes under its Golden Visa program, making it one of the few EU countries where investors can gain residency by property ownership or financial assets. This flexibility allows applicants to align their investment with personal, financial or strategic goals.

Real estate options

The real estate pathway remains the most popular choice among investors, offering three main tiers:

- €800,000 — for ready-to-use property in high-demand areas such as central Athens, Thessaloniki, Mykonos or Santorini;

- €400,000 — for ready-to-use property in less densely populated areas;

- €250,000 — for property requiring full renovation or conversion from non-residential use, available in any location.

In addition to purchasing property, Golden Visa eligibility may also be granted through a 10-year lease or timeshare agreement on tourist accommodation; or inheritance or donation of real estate that meets the minimum value threshold.

Financial and corporate investment routes

Greece also provides non-real estate investment options for those seeking a more diversified or low-maintenance approach:

- €500,000 — fixed-term deposit in a Greek bank;

- €500,000 — equity investment in a Greek company;

- €500,000 — purchase of shares in a Greek real estate investment company;

- €500,000 — investment in a business holdings capital company;

- €500,000 — Greek government bonds;

- €800,000 — listed corporate or government bonds.

These options are especially attractive for investors who prefer financial instruments over physical assets, or who want to avoid the management burden of owning real estate abroad.

5 benefits of obtaining the Greece Golden Visa through funds

1. No need to manage property

Unlike real estate, mutual funds do not require finding tenants, paying for maintenance or dealing with property taxes. The investment is handled by a licensed fund manager, which means no day-to-day involvement is needed from the investor.

2. Fast and remote process

Most steps — including fund selection, investment, tax registration and document submission — can be completed remotely via power of attorney. This is especially useful for applicants who cannot travel frequently to Greece or wish to complete the procedure from their home country.

3. Regulated and transparent structure

Only funds that are licensed in the EU or by a supervisory authority that is a member of IOSCO qualify for the Golden Visa. This means the fund’s performance, asset allocation and transactions are subject to strict international oversight, adding a layer of transparency and security.

4. Potential for capital growth and dividends

Investing in a mutual fund opens the door to potential financial returns through dividends or capital appreciation. While the fund must comply with program restrictions, many are professionally managed and structured for medium-to-long-term performance.

5. Flexibility for long-term planning

Fund investments do not tie the investor to a specific location or property. This gives greater freedom to relocate, resell or rebalance assets without the constraints of physical ownership — ideal for global investors planning their mobility, tax strategy or retirement.

Immigrant Invest support with fund-based investments

Choosing the fund route under the Greece Golden Visa program requires careful navigation of financial regulations, fund eligibility criteria, and legal documentation. Immigrant Invest provides full-cycle support, making the process clear, compliant and efficient for each client.

Pre-screening and Due Diligence

Before proceeding, clients undergo a confidential Preliminary Due Diligence check by a certified Anti-Money Laundering Officer. This reduces the risk of rejection to below 1%.

Selection of eligible funds

Experts help investors choose from pre-vetted mutual funds that meet the Golden Visa criteria: a minimum fund size of €10 million, EU or IOSCO-compliant licences, and investment strategy focused on Greek-listed securities.

Remote document preparation

Clients receive step-by-step guidance for preparing, translating and legalising all necessary documents — from passport copies to financial records. The team also assists with obtaining a Greek tax number remotely.

Coordination with fund managers and banks

Immigrant Invest facilitates communication with licensed investment companies and Greek banks. The firm ensures that the capital transfer, account opening, shareholder declaration, and fund participation are completed in accordance with Greek law.

Visa and biometric assistance

The legal team handles the online submission of the Golden Visa application, schedules biometric appointments in Greece and arranges necessary travel documents (such as the national D visa required for fund-based investors).

Post-approval support

After the residence permit is issued, Immigrant Invest provides ongoing support with renewals, tax matters, and compliance with fund holding requirements — ensuring your permit remains valid over time.

Final thoughts on funds in Greece for obtaining a residence permit

- The Greece Golden Visa allows non-EU investors to obtain a 5-year renewable residence permit by making a qualifying investment in the country. The minimum investment for the mutual fund option is €350,000.

- Many applicants are turning to mutual funds as a strategic alternative to real estate. This shift reflects a growing demand for more transparent, manageable and flexible investment options within the program.

- The fund route offers key advantages: it avoids the complexity of managing property abroad, meets high regulatory standards, and allows for remote application and ownership.

- Fund-based investments still represent a small share of total applications. However, this share is growing steadily, especially among financially literate individuals from countries such as the United States, Canada and China.

- With professional guidance from firms like Immigrant Invest, applicants can safely navigate the legal requirements, select compliant funds and secure residency with confidence.

Immigrant Invest is a licensed agent for citizenship and residence by investment programs in the EU, the Caribbean, Asia, and the Middle East. Take advantage of our global 15-year expertise — schedule a meeting with our investment programs experts.