Summary

The Greece Golden Visa is a state investment programme that grants a renewable 5-year residence permit to investors and their families. Residency can be obtained by investing at least €250,000 in real estate, Greek businesses, public securities, or a bank deposit.

The programme offers flexible conditions — there is no requirement to live in Greece or pass a language test to maintain residency.

What is Greece residency by investment?

Greece grants residency by investment through the government-backed Golden Visa programme. This programme, in force since 2014, sets the conditions under which foreign investors can obtain a residence permit[1].

The Greece Golden Visa grants a renewable 5-year residence permit to first-time investors, which is among the longest initial terms in Europe. By comparison, Portugal and Italy issue 2-year permits at the outset, after which applicants must collect documents again and pay government fees to renew.

To qualify, an applicant must contribute at least €250,000 to the Greek economy. Eligible options include purchasing real estate, placing a deposit in a Greek bank, or investing in securities. Most investors choose property, often renting it out to generate passive income.

Family members can be included in a single application.

The standard processing time is at least 4 months.

How the Greece Golden Visa compares to other residence permits

What are the key benefits of the Greece investment residence permit?

A Greek residence permit unlocks more than a Mediterranean address — it offers a sanctuary for the whole family, visa-free access across Schengen, and entry to public healthcare and education. Add low living costs, strong rental yields, smart tax planning, and rising business opportunities, and it’s easy to see why Greece continues to draw in global investors.

1. Moving to Greece or creating a safe haven in the country

With a Greek residence permit, investors and their families enjoy unrestricted access to the country, even during border closures. This means they can holiday in Greece at any time or use it as a safe haven in emergencies.

Life in Greece is enviable. The Mediterranean climate brings long, sunlit days and a culture built around outdoor living — from lively squares and seaside cafés to mountains, lakes, and the endless sea. The country is also famed for its fresh, seasonal food, which forms one of the world’s healthiest diets.

Combined with its rich history, dramatic coastlines, and unhurried rhythm, Greece is as well suited to everyday life as it is to retreat.

2. Residence permits for family members

Investors can include their family members in the application — a spouse, children under 21, and parents.

Each family member receives a separate residence card with the same validity and renewal conditions as the main applicant. All enjoy lawful residence in Greece, access to education and healthcare, and visa-free travel within the Schengen Area.

3. Visa-free travel within the Schengen Area

With a Greek residence permit, investors can visit other Schengen countries visa-free for up to 90 days in any 180-day period. Travel is straightforward by air, sea, or land.

Frequent direct flights from Athens and Thessaloniki connect to major EU hubs. Most European capitals are a short-haul journey away — roughly 2 to 4 hours. Regular ferry routes link Piraeus and Patras with Greek islands and Italy, ideal for those combining car and sea travel.

4. Investment returns of up to 10% per year

Investors can benefit from steady financial returns on their assets, which may be sold once permanent residency is obtained after 5 years, or citizenship after 7 years.

During the holding period, real estate typically generates a stable rental yield of around 5% per year, reaching up to 10% in some locations[2]. Investment funds offer a similar annual yield of around 4—5%.

5. Tax optimisation

Greece offers attractive tax incentives for foreign investors who become tax residents. Under the non-dom regime, an investor may opt to pay a flat annual tax of €100,000 on their global income, regardless of the actual amount earned. Close relatives can also benefit from this regime, each paying a reduced flat rate of €20,000 per year[3].

For retirees, Greece has introduced a special incentive: foreign pension income is taxed at a flat rate of 7% for up to 15 years[4].

6. Business opportunities in the EU single market

Greece Golden Visa holders cannot take paid employment, but they can own and run businesses — set up a company, act as directors, hire staff, invoice clients, and distribute profits as dividends.

Greece provides access to the EU market and serves as a strategic hub between Europe, the Middle East, and North Africa. It also has strong sectors such as tourism and hospitality, logistics and shipping, agri-food, energy, and technology services.

7. Low cost of living

Greece offers a relatively affordable standard of living, especially compared with Western European countries or major cities in the United States. Living costs are roughly 30—40% lower, and rent is 70—80% cheaper than in the United Kingdom and the United States.

A single person spends about €840 a month on everyday expenses, while a family of four needs around €2,900, excluding rent. Renting a one-bedroom flat outside the city centre in Athens averages €600, while a 3-bedroom flat in the centre costs roughly €1,200[5].

8. Using the services of Greek banks

Opening a bank account in Greece is possible for both residents and non-residents. Customers without residency generally need to visit a branch in person and provide additional documentation.

Having a residence permit makes the process easier, as it comes with a Greek tax number, AFM, and TAXISnet access — the state’s secure online portal for tax and administrative services. With these credentials, many banks now offer fully digital onboarding.

Banks typically ask for:

- passport or ID;

- AFM and tax details;

- proof of address;

- phone number;

- proof of income or occupation.

For online account openings, TAXISnet credentials are also required.

9. Access to high-quality healthcare

Holders of a Greek residence permit have access to the country’s public healthcare system. According to the CEOWORLD Healthcare Index 2025, Greece ranks 28th out of 110 countries for the efficiency, affordability, and accessibility of its medical services[6].

Investors must purchase private health insurance under Golden Visa regulations. This grants access to both public and private healthcare providers, ensuring broader medical coverage. The cost of such insurance starts at approximately €300 per year.

10. Access to education

Children of Greece Golden Visa holders have access to free public education, with instruction in Greek and language support available. International schools operate mainly in Athens and Thessaloniki, offering English or bilingual curricula, with annual tuition fees ranging from €9,000 to €16,000.

At university level, EU and EEA citizens can study free of charge at public universities for undergraduate degrees. Non-EU students, including Golden Visa families, pay €1,500—3,000 per year for bachelor’s programmes. Tuition for master’s degrees ranges from €3,000 to €7,000, with some English-taught programmes costing up to €12,000 per year.

11. Getting EU citizenship

The investor can apply for Greek citizenship after 7 years of living in the country. To qualify, applicants must demonstrate proficiency in the Greek language and pass an examination covering Greece’s history, culture, and system of government.

Greece allows dual and multiple citizenships. Investors are not required to renounce their original citizenship unless their home country’s laws demand it.

Greek citizenship grants full rights of European Union membership. Citizens can live and work in any EU country without restrictions, study free of charge at public universities, vote in national and European elections, and travel visa-free to 171 countries worldwide.

Who qualifies for the Greece Golden Visa?

Any person over 18 years old with no criminal record who passes the state Due Diligence check is eligible to apply for a Greece Golden Visa.

Family members who can be included in the application are:

- spouse or de facto partner with a signed Cohabitation Agreement registered in Greece;

- unmarried children under 21;

- parents of either spouse, of any age.

Unmarried children who are students can remain in the programme until the age of 24, provided they were included in the original application and obtained their residence permit before turning 21. If the child continues to study and remains financially dependent, their permit is automatically renewed until 24. After that, it can still be renewed, but only under the general Immigration Code, not as a dependent.

Julia Loko,

Investment programs expert

For de facto partners, the application process takes place in two stages. First, the main applicant completes the property purchase and submits the Golden Visa application. Once a temporary residence certificate is issued, the couple can sign and register a Cohabitation Agreement. The partner’s application is then added to the main applicant’s open case, allowing both to receive their residence cards simultaneously.

What are the current rules for getting a Greece Golden Visa by buying property?

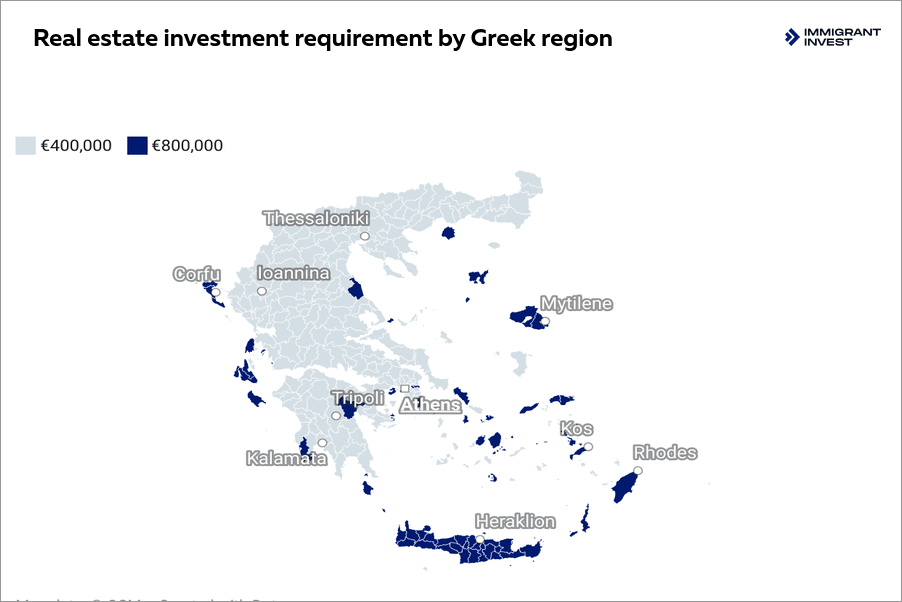

Real estate investors can qualify for Greece’s Golden Visa through one of three property investment routes. The rules have changed several times in recent years, and under the latest update, the required minimum depends on the property’s type, location, and intended use.

Investment thresholds

Greece sets an investment threshold of €800,000 for real estate located in the regions of Attica and Thessaloniki, as well as on the islands of Mykonos, Santorini, and other islands with more than 3,100 residents.

The minimum investment is €400,000 for properties in less renowned regions.

Athens has emerged as the leading destination for property investors. Almost 40% of transactions now involve foreign buyers, many of whom are participating in the Golden Visa programme.

An exceptional minimum of €250,000 applies to two categories of properties:

- architectural monuments intended for restoration, with the work required to be completed within 5 years;

- conversions of non-residential properties into residential ones, with the construction work completed before submitting the Golden Visa application.

For these types of properties, the investment threshold remains €250,000 regardless of the region, and they are not subject to the minimum area requirement.

Purchasing rules

An investor may purchase only one new property, and its area must be at least 120 m². Consequently, foreigners cannot obtain a residence permit by purchasing studio apartments or small houses.

An investor may buy real estate in any part of Greece, either as an individual or through a legal entity. When purchasing through a company, the following conditions apply:

- the company’s head office must be located within the EU;

- the investor must own 100% of the company’s shares.

Spouses may purchase property in joint ownership. In this case, they invest in a single property, and its total value must meet the minimum threshold. For example, to buy an apartment in central Athens, a couple only needs to acquire one property worth at least €800,000.

Leasing rules

Short-term rentals are not permitted under the Golden Visa regulations, including those arranged through platforms such as Airbnb. If the investor fails to comply with this rule, the residence permit will be revoked and a fine of €50,000 imposed.

However, passive income is still possible. Investors may lease their properties through long-term rental agreements, earning an average annual yield of around 4.6%, with returns reaching up to 10% in certain areas.

Alternatives to purchasing property as an investment

Hotel or tourist complex rental. Instead of buying real estate, an investor can choose to rent accommodation in a hotel or a furnished apartment within a tourist complex. The rental or timeshare agreement must be concluded for 10 years. The minimum investment is €400,000 or €800,000, depending on the region.

Inheritance and gifts. A Greece Golden Visa can also be obtained by a person who has inherited real estate worth more than €400,000 or €800,000, or has received it as a gift. They must pass the Due Diligence check and submit the documents required for a residence permit application.

Examples of investment real estate in Greece

Can funds, bonds, and listed shares be used to obtain the Greece Golden Visa?

The Greece Golden Visa program offers investors the opportunity to qualify through securities investments. The required investment amount depends on the type of asset chosen and the number of family members included in the application.

The following options are available:

- Purchase of shares in mutual or alternative investment funds — €350,000.

- Purchase of government bonds — €500,000.

- Capital investments in Greek companies — €500,000.

For an investment of €800,000, investors can independently build a portfolio of shares or corporate and government bonds traded on Greek stock exchanges. In this case, there are no restrictions on bond maturity.

Greece Golden Visa funds focus on commercial real estate sectors such as logistics, data centres, hospitality, and office space. Strong demand from the tourism industry helps sustain interest in these segments.

With a lower minimum investment of €350,000, fund units provide a more accessible alternative for investors wishing to avoid the responsibilities associated with property maintenance or renovation — a clear contrast to the higher entry costs of real estate ownership.

How can opening a deposit account in a Greek bank lead to residency?

Depositing a significant amount into a Greek bank account is another route to obtain residency under the Greece Golden Visa programme. The investor must place at least €500,000 in a fixed-term deposit account with automatic renewal. The initial term of the deposit is one year.

Only three EU countries currently offer Golden Visas in exchange for a bank deposit: Greece, Latvia, and Andorra.

What documents are required for the Greece Golden Visa application?

To participate successfully in the Greece Golden Visa programme, applicants must provide a set of documents for both the investor and their family members.

Basic list of documents includes:

- valid international passport;

- ID-card;

- residence permit, if applicable;

- completed Golden Visa application form;

- proof of health insurance;

- confirmation of the source of funds, such as bank statements and an employment contract.

To include family members in the application, the investor must provide a marriage or partnership certificate registered in Greece. Birth certificates are required for children and parents.

Additional documents depend on the chosen investment option. For example, when purchasing real estate, the applicant must provide a sale and purchase agreement, registration with the Land Registry, and a certificate confirming that there were no legal impediments to the transaction.

How long does it take to obtain a Greece Golden Visa?

The time needed to obtain a Greece Golden Visa varies by investment type. Fund and term deposit options take at least 4 months. The real estate route requires more time, with the process lasting a minimum of 6 months.

Below is a step-by-step guide for the property investment route as the example.

1 day

Preliminary Due Diligence

At this stage, an investor undergoes a preliminary check against international legal and business information databases, as well as a review for any harmful or compromising materials found online.

Preliminary Due Diligence, conducted by Immigrant Invest’s Compliance Department, helps reduce the risk of application rejection to just 1%.

At this stage, an investor undergoes a preliminary check against international legal and business information databases, as well as a review for any harmful or compromising materials found online.

Preliminary Due Diligence, conducted by Immigrant Invest’s Compliance Department, helps reduce the risk of application rejection to just 1%.

1+ week

Choose property for purchase

The real estate selection stage typically takes over a week. Immigrant Invest’s experts assist investors in picking a property that aligns with their goals and budget. They work directly with reliable Greek developers and provide access to a catalogue of more than 200 investment-ready projects.

The real estate selection stage typically takes over a week. Immigrant Invest’s experts assist investors in picking a property that aligns with their goals and budget. They work directly with reliable Greek developers and provide access to a catalogue of more than 200 investment-ready projects.

1+ week

Collect the necessary documents

A form with personal data is filled out for each family member. When filling out the forms, all documents, according to the list, must be available for reliable paper completion and further submission.

A form with personal data is filled out for each family member. When filling out the forms, all documents, according to the list, must be available for reliable paper completion and further submission.

Up to 1 week

Get a tax number in Greece

In Greece, obtaining a tax number is crucial for major transactions, including purchasing property.

A lawyer will file the necessary application and documents to register for a tax number. Generally, the number is issued within 3 to 7 working days.

In Greece, obtaining a tax number is crucial for major transactions, including purchasing property.

A lawyer will file the necessary application and documents to register for a tax number. Generally, the number is issued within 3 to 7 working days.

1+ months

Purchase property

Purchasing property in Greece as a foreigner usually takes over a month. The process begins with the investor signing a preliminary purchase agreement and paying a 10% deposit. Legal experts then draft the final sale contract, which is signed before a notary.

The purchase agreement may be signed either by the investor or their legal representative via power of attorney. Once signed, the lawyer submits the contract for registration with the Land Registry and the Cadastre and obtains the property registration certificate.

The buyer receives the complete set of property documents, translated and certified.

Purchasing property in Greece as a foreigner usually takes over a month. The process begins with the investor signing a preliminary purchase agreement and paying a 10% deposit. Legal experts then draft the final sale contract, which is signed before a notary.

The purchase agreement may be signed either by the investor or their legal representative via power of attorney. Once signed, the lawyer submits the contract for registration with the Land Registry and the Cadastre and obtains the property registration certificate.

The buyer receives the complete set of property documents, translated and certified.

1 day

Apply for a residence permit

Applications for Golden Visas are accepted online. Upon submission, the investor receives a 1-year certificate allowing them to stay in Greece until a residence permit is issued.

The fee for applying for a residence permit is €2,000 for the main applicant and €150 for each adult family member included in the application. There is no fee for children under 18.

Applications for Golden Visas are accepted online. Upon submission, the investor receives a 1-year certificate allowing them to stay in Greece until a residence permit is issued.

The fee for applying for a residence permit is €2,000 for the main applicant and €150 for each adult family member included in the application. There is no fee for children under 18.

Within 6 months, but usually within 1 month after application

Submit biometric data

Applicants must submit their biometric data — including photographs and fingerprints — for their residence permit cards to be issued.

Biometric appointments can typically be scheduled 1—2 weeks after submitting the residence application. To enter Greece for this step, a visa may be required, depending on the investment route:

- tourist visa is used if the investor purchased property;

- national D visa applies if the investment was made via another route.

Applicants must submit their biometric data — including photographs and fingerprints — for their residence permit cards to be issued.

Biometric appointments can typically be scheduled 1—2 weeks after submitting the residence application. To enter Greece for this step, a visa may be required, depending on the investment route:

- tourist visa is used if the investor purchased property;

- national D visa applies if the investment was made via another route.

3+ months

Receive a residence permit card

Investors may collect their permit cards personally or through a lawyer. The investor presents their international passport and retrieves the residence permit application certificate upon collection.

Investors may collect their permit cards personally or through a lawyer. The investor presents their international passport and retrieves the residence permit application certificate upon collection.

Every 5 years

Renew a residence permit

Residence permits, valid for 5 years, can be renewed by submitting applications and necessary documents within 2 months of the current permit’s expiry. Continued ownership of the property or investment assets is required.

Residence permits, valid for 5 years, can be renewed by submitting applications and necessary documents within 2 months of the current permit’s expiry. Continued ownership of the property or investment assets is required.

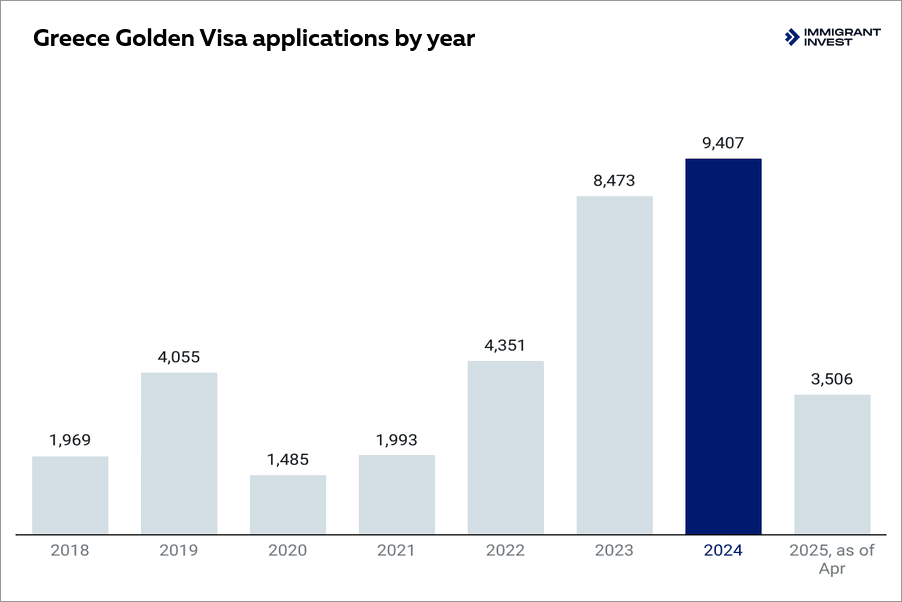

How popular is the Greece Golden Visa in 2025?

Since its launch in 2014, Greece has issued nearly 50,000 Golden Visas to investors and their family members.

In the 12-month period from April 2024 to April 2025, the programme remained highly active, with 14,631 new applications submitted. During this time, the Greek authorities granted a total of 8,093 residence permits, including 6,011 initial approvals and 2,082 renewals[7].

Among renewal applicants, the dominant nationalities remain largely unchanged:

- China — 59%;

- Turkey — 9%;

- Russia — 8%;

- Iran — 4%;

- Egypt and Lebanon — around 3% each.

As of February 2025, interest has also grown among applicants from the UK and the US[8].

Do Golden Visa investors become tax residents in Greece?

Investors become Greek tax residents when they spend at least 183 days a year in the country. To obtain an official status of a tax resident, they must apply to the Greece tax authorities.

Greece property taxes

Greek property buyers should budget for several taxes and fees in addition to the purchase price.

Transfer tax of 3.09% applies to resale properties. 24% VAT applies to newly built properties purchased directly from a developer.

However, most developers currently opt for the temporary VAT suspension, meaning buyers pay the reduced 3.09% transfer tax instead. This lower rate is valid for new builds purchased before December 31st, 2025[9].

Other standard costs include:

- 1.5% in legal fees;

- 0.5% for cadastral fees;

- 0.3% for the engineer’s review.

Estimated total. These extra charges amount to roughly 5.5% of the property value. For example, a €400,000 property would incur about €22,000 in added costs.

Greece taxes for fund owners

Dividends. Greek tax residents pay a 5% withholding tax on dividends received from both domestic and foreign companies. This applies to most fund distributions as well.

Interest income. The standard withholding tax is 15%. However, a reduced rate of 5% applies to interest from listed corporate bonds earned by Greek tax residents, thanks to changes introduced in Law 5193/2025[10].

Capital gains tax rates vary:

- EU-regulated funds — gains are typically exempt for individual investors;

- third-country funds — gains are usually taxed at 15%, unless a tax treaty applies.

Overall, that’s the lowest effective tax rates and the simplest compliance framework for fund investors, compared to Portugal and Hungary.

Special tax regime

Greece offers a non-domicile tax regime for wealthy individuals who choose to relocate and become Greek tax residents[11].

Key features include:

- Flat tax on foreign income: €100,000 per year. Instead of paying tax on global income under standard progressive rates, participants pay a fixed €100,000 per year — regardless of the actual amount of foreign income.

- Duration: up to 15 consecutive years.

- Family inclusion: close relatives can be added for €20,000 per person annually.

- Investment requirement: to qualify, applicants must invest at least €500,000 in Greece, such as in real estate, businesses, or bonds. This investment must be made within 3 years of entering the regime.

- Eligibility: applicants must not have been Greek tax residents in 7 of the last 8 years prior to applying.

Global income tax is levied on a progressive scale without these exemptions and can be as high as 45%.

What is the path to Greek citizenship after getting a Golden Visa?

Path to citizenship. Investors don’t need to live in the country permanently to maintain a residence permit. However, to qualify for Greek citizenship, they must reside in the country for at least 7 consecutive years.

The process begins with receiving a 5-year Golden Visa and relocating to Greece. After 5 years of continuous residence, the investor can either renew the residence permit or apply for EU long-term resident, LTR, status. This step is essential, as only holders of LTR can apply for citizenship.

Once the LTR status is granted and the investor has completed 7 years of legal and continuous residence in total, they become eligible to apply for a Greek passport through naturalisation. Applicants are required to:

- pass a Greek language proficiency test;

- pass a history exam;

- take an oath of allegiance;

- confirm they do not pose a threat to the life or health of Greek citizens;

- prove stable income;

- commit not to apply for unemployment benefits;

- pay an application fee of €700.

The main applicant’s minor children automatically receive Greece citizenship, provided that they permanently reside in the country.

Greece allows dual citizenship, so investors do not need to renounce their first passports.

Faster route. A foreigner can get Greece permanent residence and citizenship faster by marrying a Greek citizen. In this case, an application for permanent residence can be submitted after 3 years of living in the country and citizenship after 5 years.

With a Greek passport, you can visit 171 countries without visas

Key points about the Greece Golden Visa

- The Greece Golden Visa is a residency-by-investment program that allows investors and their families to obtain residence permits in Greece by making significant financial contributions to the country's economy.

- The primary route is purchasing real estate valued at a minimum of €250,000, though options exist for securities investments and bank deposits.

- Investors can earn returns of 4—5% from investment funds and up to 10% from real estate.

- Greece residency offers several benefits, such as tax optimisation opportunities, visa-free travel, and access to public healthcare.

- After 7 years of living in Greece, the investor may become eligible for citizenship, which includes the ability to hold dual citizenship.

Immigrant Invest is a licensed agent for citizenship and residence by investment programs in the EU, the Caribbean, Asia, and the Middle East. Take advantage of our global 15-year expertise — schedule a meeting with our investment programs experts.

Will you obtain residence by investment in Greece?

-

Master the residency process

-

Get expert tips and documents

-

Estimate costs accurately

Sources

- Source: Official Law 5038/2023: CHANGE OF THE CONDITIONS FOR GRANTING RESIDENCE PERMITS FOR INVESTMENT PURPOSES

- Source: Global Property Guide — Greece, 15 June, 2025

- Source: Greek Independent Authority for Public Revenue — Tax incentives for attracting new tax residents

- Source: Article 5B of LAW NO. 4172/2013 (ITC)

- Source: Numbeo, cost of living in Greece

- Source: CEOWORLD Magazine: Countries With The Best Health Care Systems, 2025

- Source: Legal Migration — April 2025, monthly statistical appendix

- Source: Οικονομικός Ταχυδρόμος, 20 March 2025

- Source: Proto Thema, 26 November 2024

- Source: Tax Updates: 25 April, 2025, KPMG Greece

- Source: Greek Independent Authority for Public Revenue — Tax incentives for attracting new tax residents