Summary

Portugal has closed its popular Non-Habitual Resident, or NHR, special tax regime and introduced a new framework in 2025: the IFICI tax regime, unofficially known as NHR 2.0.

In this expert guide, we explain the eligibility criteria, benefits, application process, required documents, and key differences between the NHR and IFICI regimes.

From NHR to IFICI: timeline of Portugal’s tax regime changes

Portugal’s approach to attracting foreign residents through favourable taxation has evolved significantly over the past 15 years.

2009: introduction of NHR

Portugal launched the Non-habitual Resident program to attract foreigners. NHR offered generous tax exemptions on foreign-sourced income and a 20% flat rate on certain Portuguese income. It quickly became a powerful magnet for retirees, investors, and remote workers.

Portugal’s Golden Visa program enjoyed strong popularity among international investors, in part thanks to the favourable tax regime that made relocation even more attractive.

Compared to countries like the UK, where top earners can face income tax rates of up to 45%, Portugal’s Non-habitual Resident regime offered a flat 20% rate on eligible income and exemptions on many foreign-sourced earnings. This sharp contrast meant that, for many global investors, moving to Portugal also delivered significant tax savings and long-term wealth protection.

2012—2018: peak popularity among pensioners and investors

NHR reached its peak during 2012—2018. Thousands of foreigners, particularly retirees from France, Italy, and Brasil, relocated to Portugal to enjoy a decade of tax-free pensions.

At first, pensions could be received tax-free, and since 2020 they have been taxed at a reduced flat rate of 10%.

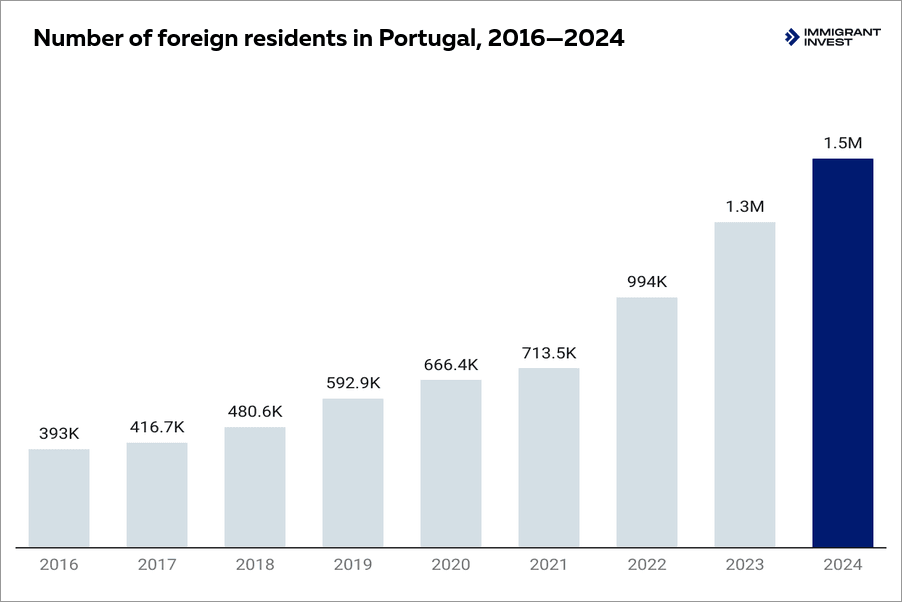

The number of foreign citizens residing in Portugal reached a record high of around 480,000, the highest figure since the creation of the Immigration and Borders Service, SEF, in 1976. By 2019, this number had already surpassed 500,000.

In addition to pensioners and investors, Portugal also attracted students, researchers, and skilled workers, contributing to the record growth of foreign residents

2020—2023: growing criticism and reforms

By attracting large numbers of foreign residents with favourable tax treatment, NHR increased demand for property.

As housing prices rose sharply in Lisbon, Porto, and coastal regions, public opinion turned against the NHR regime. This added pressure to a market already constrained by limited housing supply, pushing prices beyond the reach of many local families and deepening perceptions of social inequality.

At the same time, the fiscal cost of maintaining NHR became substantial. The annual budgetary expenditure linked to NHR tax exemptions exceeded €1.7 billion in 2024, the highest level since the regime’s creation.

Rising property prices and mounting tax losses fuelled political debate. The European Union also urged Portugal to align its tax policies more closely with EU principles. In response, the government gradually narrowed exemptions and prepared for deeper reform, culminating in the replacement of NHR with IFICI in 2025.

2025: Portugal’s new tax regime: IFICI

On January 1st, 2025, the NHR officially ended and was replaced by the IFICI Portugal tax regime, also referred to as NHR 2.0.

Instead of relying on passive capital such as pensions or real estate investment, the government now focuses on talent and innovation.

What is IFICI and why does it matter for foreign professionals?

The IFICI tax regime stands for Innovative Fiscal Incentive for Scientific Research and Innovation.

IFICI targets highly qualified professionals, researchers, and innovators in strategic sectors such as science, technology, healthcare, and green energy. Its goal is to attract talent and entrepreneurship rather than passive capital.

By narrowing eligibility, Portugal seeks to balance fiscal sustainability with the need to stay competitive in the global race for talent. For foreign professionals in key sectors, IFICI represents tax advantages.

Albert Ioffe,

Legal and Compliance Officer, certified CAMS specialist

The transition from the original NHR to the IFICI, or NHR 2.0, introduces several important changes. The original NHR offered broad tax benefits to a wide range of professionals, whereas the new regime specifically targets highly qualified individuals in scientific research and innovation.

Under the old NHR, most foreign-sourced income, including pensions, was exempt, but pensions are no longer included under IFICI.

3 benefits of Portugal’s IFICI regime

The IFICI Portugal tax regime was designed not only to attract global talent but also to offer tangible advantages for those who qualify. For foreign professionals, entrepreneurs, and researchers, the benefits are both financial and strategic.

1. 20% flat income tax. Eligible professionals can benefit from a reduced 20% flat tax rate on Portuguese-sourced employment and self-employment income, instead of the standard progressive rates that go up to 48%.

2. Double taxation relief. Certain categories of foreign-sourced income, such as dividends, royalties, and employment income, may qualify for exemptions or credits, which allows applicants to avoid double taxation under Portugal’s network of tax treaties.

3. 10-year validity. Once granted, IFICI status is valid for 10 consecutive years. It provides long-term tax stability and predictability for financial and residency planning.

Portugal IFICI tax regime eligibility criteria: who qualifies?

Basic requirements

Before looking at specific professions and sectors, applicants must meet the baseline conditions:

- Must become a Portuguese tax resident after January 1st, 2024.

- Cannot have been a Portuguese tax resident in the previous 5 years.

- Cannot have previously benefited from NHR or another special tax regime.

Educational and professional qualifications

IFICI targets highly educated individuals with proven professional expertise. To qualify, an applicant must demonstrate one of the following:

- at least a Level 6 European Qualifications Framework degree, Bachelor’s plus 3 years of relevant professional experience;

- Level 8 EQF degree, PhD/Doctorate, which removes the work experience requirement.

Eligible professions

Only specific categories of professionals are admitted under IFICI. These groups were selected because of their potential to contribute to scientific research, healthcare, and technological development in Portugal:

- university professors and researchers;

- medical doctors and healthcare specialists;

- professionals in physical sciences, mathematics, and engineering;

- ICT and technology specialists;

- senior executives and company directors, such as CEOs, board members, executive managers.

Company and sector criteria

Employment must be tied to a business or institution that contributes to Portugal’s strategic economic objectives. To ensure this, the employer must meet the following standards:

- Generate at least 50% of turnover from exports in the current or previous 2 years.

- Operates in one of the following sectors: extractive and transformative industries, information and communication, research and development, higher education, healthcare and related services.

Alternative qualification routes

Not all candidates fit neatly into the standard criteria. Portugal has therefore created additional pathways to allow certain specialists to qualify:

- R&D staff working under Portugal’s SIFIDE program;

- directors or employees of certified start-ups;

- researchers with PhDs integrated into national scientific networks;

- employees of organisations approved by IAPMEI or AICEP;

- professionals working in Azores or Madeira, under special regional rules.

These criteria make IFICI a far more selective framework than its predecessor, NHR. It focuses on professionals with advanced qualifications and companies that actively contribute to Portugal’s economy.

How to apply for IFICI Portugal: step-by-step guide with deadlines and expert tips

Applying for the IFICI Portugal tax regime requires careful preparation and timely submission of documents.

According to the experience of Immigrant Invest lawyers, the process usually takes between 2 and 3 months, provided that the applicant meets all eligibility requirements and submits a complete file from the start.

1—2 weeks

Obtain Portuguese tax identification number, NIF

This can be obtained at a local tax office or through legal representation in Portugal. The NIF is required for almost all subsequent steps, from opening a bank account to signing an employment contract.

This can be obtained at a local tax office or through legal representation in Portugal. The NIF is required for almost all subsequent steps, from opening a bank account to signing an employment contract.

Several months

Secure residency and proof of address

Applicants must demonstrate legal residence in Portugal. This involves applying for the appropriate visa or residence permit and providing proof of accommodation, such as a rental agreement or property purchase deed.

Applicants must demonstrate legal residence in Portugal. This involves applying for the appropriate visa or residence permit and providing proof of accommodation, such as a rental agreement or property purchase deed.

There are several pathways to obtain residence status in Portugal that can be combined with IFICI, depending on the applicant’s profile:

- The Golden Visa is popular among investors seeking residency by investment funds, business, or culture.

- The StartUp Visa is available to founders who want to launch innovative businesses in Portugal.

- The D2 Visa is designed for entrepreneurs and small business owners establishing a company in Portugal.

- The HQA Visa is tailored for entrepreneurs, researchers and innovators, closely aligned with IFICI’s target group.

- The Digital Nomad Visa is for remote workers with foreign income, though less directly relevant to IFICI unless combined with eligible local employment.

Applicants must demonstrate legal residence in Portugal. This involves applying for the appropriate visa or residence permit and providing proof of accommodation, such as a rental agreement or property purchase deed.

Applicants must demonstrate legal residence in Portugal. This involves applying for the appropriate visa or residence permit and providing proof of accommodation, such as a rental agreement or property purchase deed.

There are several pathways to obtain residence status in Portugal that can be combined with IFICI, depending on the applicant’s profile:

- The Golden Visa is popular among investors seeking residency by investment funds, business, or culture.

- The StartUp Visa is available to founders who want to launch innovative businesses in Portugal.

- The D2 Visa is designed for entrepreneurs and small business owners establishing a company in Portugal.

- The HQA Visa is tailored for entrepreneurs, researchers and innovators, closely aligned with IFICI’s target group.

- The Digital Nomad Visa is for remote workers with foreign income, though less directly relevant to IFICI unless combined with eligible local employment.

3—4 weeks

Collect professional and academic documents

You must gather proof of your academic qualifications and professional background. Employment contracts, start-up certificates should also be prepared at this stage.

You must gather proof of your academic qualifications and professional background. Employment contracts, start-up certificates should also be prepared at this stage.

2—3 weeks

Submit application to the Portuguese Tax Authority

With all documents ready, you can submit your application to the Portuguese Tax Authority, Autoridade Tributária e Aduaneira. The application must include identification, residency proof, academic and professional documents, and confirmation of eligible employment or business activity.

With all documents ready, you can submit your application to the Portuguese Tax Authority, Autoridade Tributária e Aduaneira. The application must include identification, residency proof, academic and professional documents, and confirmation of eligible employment or business activity.

4—6 weeks

Verification and approval

The Tax Authority verifies whether you meet all eligibility criteria. This may involve checking your employment, confirming qualifications, and validating approvals from official bodies. Missing or incomplete documentation is a common reason for delays, so professional guidance is highly recommended.

The Tax Authority verifies whether you meet all eligibility criteria. This may involve checking your employment, confirming qualifications, and validating approvals from official bodies. Missing or incomplete documentation is a common reason for delays, so professional guidance is highly recommended.

Documents required for Portugal IFICI

Applying for the IFICI Portugal tax regime requires a complete set of documents that prove your identity, tax residency status, qualifications, and professional activity.

Documents for personal identification

To prove your identity and legal stay in Portugal, you will need:

- valid passport;

- residence permit in Portugal;

- Portuguese tax identification number.

Documents for professional and academic background

Because IFICI is designed for highly qualified professionals, applicants must provide evidence of their education and expertise:

- degree or diploma, minimum EQF Level 6;

- certificates of professional qualifications;

- proof of work experience, like employment history, contracts, CV with supporting references.

Documents for employment or business activity

To demonstrate engagement in eligible professional activity within Portugal, the applicant must provide proof of their work or business. This can be an employment contract with a Portuguese company operating in an eligible sector, evidence of business registration in Portugal, or confirmation of start-up certification.

In some cases, applicants may also need to show approval of a research and development project under the SIFIDE program or validation from government bodies such as IAPMEI or AICEP, depending on the qualification route.

Documents for proof of residence and financial standing

Applicants are expected to demonstrate stability and integration in Portugal:

- proof of accommodation, rental contract or property deed;

- health insurance valid in Portugal;

- recent bank statements or financial means, if requested by authorities.

These documents confirm eligibility and help the tax authorities and immigration services verify that applicants meet the program’s strict criteria. Missing or incomplete paperwork is one of the most common reasons for delays or rejections, which is why expert guidance is strongly recommended.

Final thoughts on Portugal new tax regime

- The replacement of NHR with the IFICI Portugal regime, or NHR 2.0, marks a turning point in the country’s approach to attracting foreigners.

- For eligible applicants, IFICI provides a 20% flat tax rate, relief from double taxation, and 10 years of stability.

- IFICI focuses on attracting top professionals, researchers, and innovators in science, technology, healthcare, and green energy.

- Portugal Golden Visa holders can also benefit from IFICI if they meet the regime’s eligibility criteria.

- IFICI aligns Portugal with European policy goals by directing tax benefits to innovation, science, and sustainable growth.

Immigrant Invest is a licensed agent for citizenship and residence by investment programs in the EU, the Caribbean, Asia, and the Middle East. Take advantage of our global 15-year expertise — schedule a meeting with our investment programs experts.

Will you obtain residence by investment in Portugal?

-

Master the residency process

-

Get expert tips and documents

-

Estimate costs accurately

Sources

- Source: The number of foreigners residing in Portugal, Minister of Internal Affairs, Portugal

- Source: NHR 2.0: Portugal's tax incentive, Idealista

- Source: IFICI Regulation, Government Order No. 352/2024/1