Summary

In 2024, EU countries issued 3.5 million first residence permits to non-EU nationals — a clear signal of Europe’s global pull.

For Saudi citizens, the EU’s Golden Visa programs offer a unique entry point. A qualifying investment secures residence, visa-free Schengen access, and the long-term prospect of EU citizenship.

Explore which EU countries offer these visas — and how they differ in cost, benefits, and family coverage.

What is a Golden Visa and which EU countries are open to Saudi citizens in 2025?

A Golden Visa is a type of a residence permit granted in exchange for investment. It gives non-EU nationals the right to live in an EU country with family members and includes visa-free access to the Schengen Area. For Saudi citizens, it remains one of the most accessible paths to European residency.

In 2025, the following EU countries offer residency by investment open to Saudi citizens:

- Greece,

- Portugal,

- Italy,

- Hungary,

- Latvia,

- Malta,

- Cyprus.

Greece and Portugal remain the most sought-after Golden Visa destinations in 2025. These sunny southern European countries attract investors with their lifestyle, global familiarity, and established processes, reflected in application backlogs of over 50,000 in both countries[1].

Hungary and Latvia, by contrast, are rising contenders — less saturated and offering a different kind of experience. Rather than the Mediterranean pace of life, they reflect the more traditional character of Central and Northern Europe. These countries appeal to those who prefer classic European culture over tourist-heavy coastal settings.

Italy stands between the two trends. It blends the sunny lifestyle of Southern Europe with the elegance and heritage of the continent’s classic cultural centres. However, it remains less in demand than the leading southern programs.

Cyprus and Malta take a different approach. While not Golden Visa programs in the conventional sense, they grant permanent residency from the outset, offering immediate stability without the need for phased renewals.

Why are the EU Golden Visas gaining popularity among Saudi Arabians?

Reputation, solid investment returns, and strategic business access are what draw investors to the EU — including those from Saudi Arabia. Families are equally attracted by broad eligibility, healthcare and education access, the prospect of citizenship, and a refined lifestyle. With visa-free Schengen travel and no minimum stay required, the appeal is both practical and prestigious.

1. Long-term residence rights

Golden Visas offer residence permits valid for 2 to 10 years, with the option to renew indefinitely as long as the investment is maintained. This grants long-term security without forcing relocation — ideal for those who value flexibility but want a stable base in Europe.

2. Visa-free mobility in the Schengen Area

Holding residency in one Schengen country unlocks visa-free access across the entire Schengen Area for up to 90 days within any 180-day period. For Saudi Arabians, it means smooth travel for business, holidays, or family visits, without embassy paperwork or delays.

3. Reputational benefit

Getting EU residency helps build a strong international image. It shows that the investor has passed detailed checks and is trusted by European authorities. This adds weight in business circles and helps when working with banks, partners, and advisors. It also makes everyday matters — like opening accounts or dealing with financial services — easier, since EU documents are widely recognised.

4. Education and career opportunities for children

Public schools are free for legal residents, so Golden Visa families can enrol children at no cost once registered. Malta is the only country on this list with English as an official language and a matching state-school system. International schools charge tuition, typically from €5,000 per year.

To study at a university, non-EU students must pay tuition. Saudi applicants can reduce costs through scholarships and fee waivers. Italy is the strongest option, with DSU/EDISU regional grants and income-based fee waivers for non-EU students[2]. Erasmus Mundus, Marie Curie, and merit awards across the EU can also cut fees often up to 100%.

5. High-quality healthcare

Golden Visa holders gain access to each country’s public healthcare system and must also maintain private insurance under program rules. This dual access ensures reliable care throughout their stay.

The programs operate within some of the EU’s most highly rated healthcare systems. According to the OECD and European Commission’s Health at a Glance: Europe 2024 report, these systems rank among the best globally for accessibility and quality of outcomes[3].

6. Safety net for uncertain times

In an unpredictable world, an EU residence card offers more than lifestyle perks. It provides a secure fallback option — a foothold in a stable, rule-based environment that’s ready if circumstances at home shift unexpectedly.

EU countries rank among the safest in the world according to the Global Peace Index 2025, standing well ahead of Saudi Arabia’s 90th place[4]:

- Portugal — 7th;

- Hungary — 17th;

- Latvia — 22nd;

- Italy — 33rd;

- Greece — 45th.

Malta and Cyprus are also regarded as safe places to live, having recorded the lowest homicide rates in the EU in 2023[5].

7. Asset protection and currency diversification

EU residency gives Saudi investors access to stable European markets and euro-denominated assets. This offers both portfolio diversification and a hedge against regional or currency-specific risk.

EU Golden Visa countries provide the following asset benefits for Saudi Arabians:

- Greece: long-term rental yields of up to 5%[6];

- Portugal: regulated investment funds with projected returns between 2 and 20% annually;

- Hungary: real estate funds projecting up to 6% per year;

- Malta: short-term rentals yielding 6—10%[7], with property prices growing by around 5.5%[8];

- Cyprus: 4—8% capital appreciation in 2024 and comparable yields from long-term leases[9].

8. Tax optimisation

EU residency can lead to tax residency, usually by spending at least 183 days a year in the country.

Since Golden Visa programs don’t require staying, this step is optional. For Saudi citizens — who currently pay no personal income tax at home — that means the choice to keep tax-free status or opt in to attractive regimes offered by some EU countries.

Greece, Portugal, and Italy offer favourable regimes for new tax residents, including Saudi Arabians:

- Greece applies a flat €100,000 tax on worldwide income for eligible newcomers[10];

- Italy offers a similar regime with a €200,000 flat tax, exemptions on foreign income, and limited inheritance and gift tax — only on assets held in Italy[11];

- Portugal’s new IFICI+ regime targets innovation-led investment with a 20% flat income tax, and in some cases, 0% on dividends and capital gains, for up to 10 years[12].

Business investors benefit from highly competitive corporate tax regimes in the EU. Hungary offers the lowest rate at 9%, followed by Cyprus at 12.5%, both well below the 20% corporate tax in Saudi Arabia.

Malta stands out with its full imputation system. While corporate profits are taxed at a headline rate of 35%, most shareholders receive a 6/7ths refund, bringing the effective tax rate down to around 5%[13].

9. Path to citizenship

After 5 to 11 years, depending on the country, Saudi Arabian investors can become full citizens of their chosen EU state.

Citizenship grants far more than residency: it comes with the ability to live, work, and study freely in any EU country, voting rights, and full protection under EU law as a citizen of the Union.

The difference in global mobility is especially significant. A Saudi passport allows visa-free access to 102 countries, while EU passports offer visa-free or visa-on-arrival access to over 170 destinations, including the US, Canada, the UK, Japan, and Ireland, where EU citizens either enter visa-free or with a simple electronic travel authorisation[14].

10. High quality of life

The EU offers a lifestyle upgrade that blends refined living with natural beauty. Rolling vineyards, Alpine peaks, and Mediterranean shores invite weekend escapes, while fresh, local produce fills daily life with flavour and seasonality.

From luxury boutiques to bespoke services, Europe’s premium lifestyle is understated yet world-class. A wide network of expat communities ensures a cosmopolitan rhythm to daily life. Expat populations make up around 10% in Greece and Italy, 16% in Portugal, 23% in Cyprus, and nearly 30% in Malta — with English commonly spoken across these hubs.

Life expectancy in the EU reached 81.7 years in 2024 — the highest level since records began. Italy leads the bloc with 84 years[15]

Which EU Golden Visa suits Saudi investors best?

Each EU Golden Visa program has its strengths, depending on investor priorities. Here’s a quick overview to help compare the best options for Saudi applicants:

- Greece remains the flagship for property-based strategies, thanks to high rental yields and market familiarity.

- Portugal leads in fund-based investment options, offering a regulated, diversified path.

- Italy combines speed, broad family eligibility, and routes suitable for business-minded applicants.

- Cyprus offers a structured path to permanent residence with stable capital appreciation.

- Malta stands out for permanent residency, English-language schooling, and wide family inclusion.

- Latvia is the most affordable and efficient option through its low-cost business route.

- Hungary offers a 10-year residence card upfront, with no need for renewals.

Comparison of EU investment residency options for Saudi Arabians

What are the investment options and minimum amounts for EU Golden Visas?

Investment routes and minimum thresholds vary significantly across EU countries. The most common options include real estate purchases, regulated investment funds, bank deposits, and business creation or expansion.

The lowest entry point is in Latvia, where a business investment can start from €50,000. On the other end of the scale, Italy offers the most expensive route — purchase of government bonds worth €2,000,000.

1. Greece — €250,000

Greece offers one of the most flexible investment options among EU Golden Visa programs. Applicants can qualify through several routes, including:

- Purchasing real estate worth €250,000, €400,000, or €800,000, depending on location and property type.

- Acquiring units in mutual or alternative investment funds starting at €350,000.

- Making a fixed-term bank deposit of €500,000 in a Greek financial institution.

- Signing a long-term lease or timeshare for tourist accommodation valued at €500,000.

- Investing €500,000 in a Greek company.

- Purchasing Greek government bonds of €500,000.

- Acquiring listed corporate or government bonds worth €800,000.

Real estate remains the leading investment route. In 2024, Greece recorded 28,694 residential property transfers, with foreign investment in real estate reaching €2.75 billion[16]. Nearly 40% of transactions now involve international buyers — many linked to the Golden Visa.

Example of real estate in Greece

Family eligibility. Dependants that can be included:

- a spouse or registered partner;

- unmarried children under 21;

- parents of the applicant and their partner.

Timeline and stay requirement. The Greece Golden Visa is one of the EU’s fastest residency options, with permits issued in as little as 4 months.

Greece grants a renewable 5-year residence permit with no stay requirement — investors aren’t required to live in or visit Greece regularly. However, the qualifying investment must be maintained for as long as the residence status is held.

Perks. Saudi Arabians can enjoy the following Greece Golden Visa benefits:

- Greece is the only country on the list with direct flights from Saudi Arabia. Riyadh—Athens flights take around 4 hours, with seasonal connections also available from Jeddah.

- Properties can be rented long-term, with yields of 4.5—10% annually.

- The property can be resold after 5 years and after an investor obtained long-term status, with capital gains averaging 7—9%.

Trusted by 5000+ investors

Will you obtain residence by investment in Greece?

2. Portugal — €250,000

To qualify for the Portugal Golden Visa, Saudi Arabians may choose one of the following five options:

- support for arts and culture — €250,000;

- investment in scientific research — €500,000;

- purchase of investment fund units — €500,000;

- establishing a company and creating 5 jobs — €500,000;

- creation of at least 10 jobs — no capital threshold.

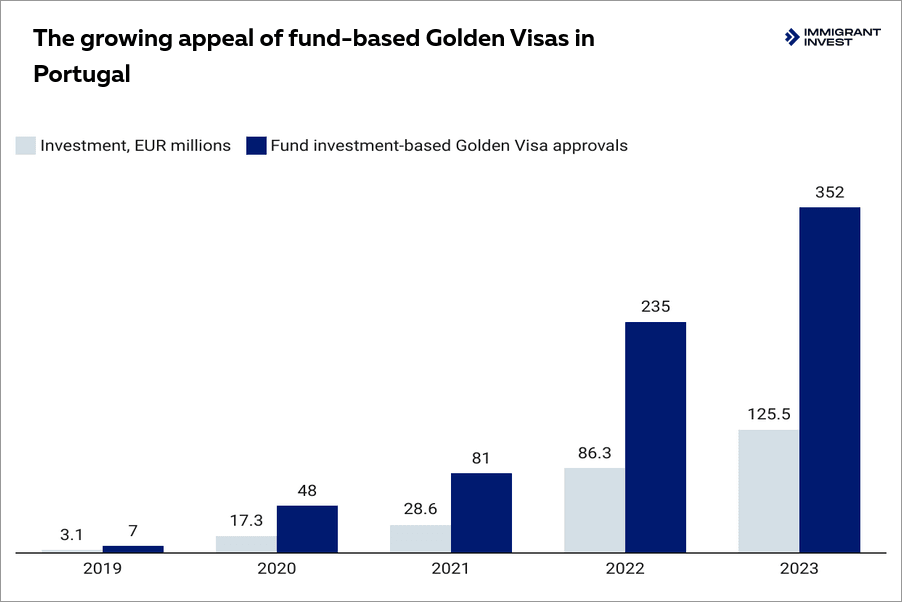

Investment funds dominate the market. In 2025, the majority of applicants opt for regulated Portuguese investment funds to qualify for the Golden Visa.

Family eligibility. The following family members can be included in the application:

- spouse or partner;

- children under 18;

- unmarried children aged 18 to 26 who are full-time students and financially dependent;

- parents who are over 65 or financially dependent on the investor.

Timeline and stay requirement. The process takes around 12 months. The initial residence permit is valid for 2 years and can be renewed. To keep the status, the holder must spend just 7 days per year in Portugal.

Perks. Portugal offers key advantages for Saudi investors:

- Fund returns range from 2—20% annually, with quarterly or annual dividends.

- The most straightforward path to citizenship in the EU after 5 years, requiring only 7 days of presence per year.

- Work allowed for Golden Visa holders in Portugal, unlike Greece where it’s not permitted.

Trusted by 5000+ investors

Will you obtain residence by investment in Portugal?

3. Italy — €250,000

Italy Golden Visa offers four qualifying routes:

- Investment in an innovative startup — €250,000.

- Investment in an Italian company — €500,000.

- Donation to a philanthropic initiative — €1,000,000.

- Purchase of Italian government bonds — €2,000,000.

Family eligibility. Saudi investors may include a spouse, children under 18, and unmarried adult children who are financially dependent and have no children of their own, as well as parents.

Parents may be included if they are financially dependent and have no other children in their country of origin or provenance; or if they are over 65 and other children cannot support them due to documented serious health reasons.

Timeline and stay requirement. The process can take as little as 4 months. Italy issues an initial 2-year residence permit, renewable for 3 years. Thereafter, it may be renewed indefinitely while the investment and legal requirements are maintained. There is no minimum stay to keep the permit.

Perks. Key advantages for Saudi investors in Italy include:

- Strategic business environment: the 3rd-largest economy in the eurozone and 8th globally, and the 8th-largest exporter[17].

- The only investment program, where children of any age can be included.

- Fast processing time.

4. Hungary — €250,000

Hungary Golden Visa offers two distinct investment routes for obtaining residency:

- Purchase of units in a real estate fund — €250,000;

- Non-refundable donation to an institution of higher learning — €1,000,000.

Approved funds allocate at least 40% of capital to Hungarian real estate, including residential projects, logistics hubs, hotels, and commercial developments. It is currently the most cost-effective fund-based residency route in the EU.

Family eligibility. Saudi Arabians can include the following family members in the Hungary Golden Visa application:

- spouse or registered partner;

- children under 18;

- parents who rely financially on the investor and receive no income other than a pension.

Timeline and stay requirement. The Hungary Golden Visa involves a slightly more complicated process, with residency granted in at least 5 months. The investor must first obtain a 6-month Guest Investor Visa, then travel to Hungary, complete the investment, and apply for the residence permit.

The program offers the longest initial validity among EU options: a 10-year residence permit, renewable once for another 10 years. There is no physical presence requirement.

Perks. Hungary Golden Visa stands out with several notable advantages for Saudi Arabians:

- 10-year residence permit granted upfront.

- Projected fund returns of up to 6% annually.

- Central-Eastern Europe’s 2nd highest FDI-to-GDP ratio — ideal for investment.

Trusted by 5000+ investors

Will you obtain residence by investment in Hungary?

5. Latvia — €50,000

Latvia Golden Visa offers Saudi investors three qualifying routes:

- Equity investment into the share capital of a Latvian company — €50,000.

- Purchase of real estate in Riga or within a 30 km radius — €250,000.

- Fixed-term bank deposit with a Latvian credit institution — €280,000.

Financial requirement. Applicants must also show proof of sufficient savings to cover living expenses in Latvia, demonstrated by a personal bank account balance:

- €26,640 for real estate applicants;

- €8,880 for those applying through equity or deposit options.

For family members, additional funds are required: €8,880 for a spouse and €2,664 for each dependent child.

Family eligibility. The Latvia Golden Visa allows Saudi Arabians to include their spouse and children under 18 in a single application.

Timeline and stay requirement. Latvia offers one of the quickest routes to EU residency, with applications processed in 3 to 6 months, depending on the investment type.

The residence permit is valid for 5 years and can be renewed indefinitely as long as the investment is maintained. While year-round presence isn’t required, investors must visit at least once a year to renew their residence card and provide biometrics.

Perks. Latvia offers practical benefits for Saudi investors seeking flexibility and speed:

- Lowest investment threshold among listed countries.

- Fastest processing time with real estate — around 3 months.

- No holding period — property can be sold at any time, ideal for those who may need to return home permanently. Other countries require a minimum holding term.

Trusted by 5000+ investors

Will you obtain residence by investment in Latvia?

6. Malta — €169,000

The Malta Permanent Residence Programme, MPRP, is not a Golden Visa, but it offers permanent residency from the start in return for a real estate commitment and meeting several financial conditions.

Applicants can either rent a property for at least €14,000 per year with a minimum 5-year lease, or buy a property valued at a minimum of €375,000.

The total minimum cost starts at €169,000 for the rental route and €474,000 for property purchase. This includes:

- purchasing or renting real estate in Malta;

- contribution fee of €37,000;

- administrative fee of €60,000;

- charitable donation of €2,000.

Examples of real estate in Malta

Financial requirement. Saudi applicants must also demonstrate sufficient financial means in one of two ways: €500,000 in total assets, including at least €150,000 in liquid financial assets, or €650,000 in total assets, with a minimum of €75,000 in liquid financial assets.

Family eligibility. The application may include:

- spouse;

- children under 18;

- unmarried children aged 18 to 29 who are principally dependent on the main applicant;

- parents and grandparents who are also principally dependent.

An administrative fee of €7,500 applies to each dependent over 18, excluding spouses.

Timeline and stay requirement. The process takes at least 6 months. Residency is granted permanently from the outset, though residence cards must be renewed every 5 years.

There is no obligation to reside in Malta, but for the first 5 years, investors must complete an annual compliance check to confirm they continue to meet the programme’s conditions. After that, they must maintain a residential address in Malta — owned or rented — without a required minimum value.

Perks. Saudi investors benefit from several key advantages in Malta:

- Among the lowest total costs in the EU, with no minimum stay requirement.

- One of the most generous age limits for children.

- English is one of the official languages.

7. Cyprus — €300,000

Cyprus offers four investment pathways, each requiring a minimum outlay of €300,000. Investors can either:

- buy residential or commercial property;

- acquire shares in local companies;

- or subscribe to units in Cyprus-based investment funds.

When opting for residential property, investors may purchase up to two new units, as long as the total value meets the threshold. The standard VAT rate is 19%, but buyers may qualify for a reduced 5% VAT if the property serves as their sole home in Cyprus and is not used for rental purposes.

Examples of real estate in Cyprus

Financial requirement. Saudi Arabians must also prove a minimum annual income of €50,000, earned legally. If a spouse is included, this rises by €15,000, and by €10,000 for each dependent child added to the application.

Family eligibility. The main applicant can include:

- spouse or partner;

- children under 18;

- unmarried children under 25 who are financially dependent students;

- children of any age with physical or mental disabilities.

Timeline and stay requirement. The process takes around 9 months. The status granted is permanent from the start, with residence cards valid for 10 years. To keep the status active, the applicant must visit Cyprus at least once every two years.

Perks. Saudi investors enjoy several practical advantages with Cyprus residency:

- Long-term status at once without passing a language test.

- Property rental is permitted, with yields averaging 4—6% annually.

- Low corporate tax rate — 12.5%.

What are the current EU Golden Visa requirements for Saudi Arabians?

To qualify for an EU Golden Visa, Saudi applicants must meet the following requirements:

- be over 18;

- have a clean criminal record;

- be capable of confirming the legality of income;

- make a qualifying investment under the chosen country’s rules and maintain it for the required period;

- pass Due Diligence check;

- have no Schengen entry bans or sanctions.

If the applicant invests in Portugal, the investment funds must originate from outside the country.

Which documents do Saudi citizens need for the EU Golden Visa?

Сore documents for any Golden Visa in the EU include:

- Valid passport.

- Criminal record certificate from Saudi Arabia and any country of recent residence.

- Proof of clean source of funds, such as bank statements, tax returns, salary slips.

- Proof of investment, such as fund subscription agreement and payment receipt, property contract, or company incorporation and job-creation evidence.

- Proof of funds for living expenses.

- Comprehensive health insurance covering the Schengen Area.

- Proof of address and accommodation.

- Power of attorney, if an authorised representative submits.

- Government fee payment receipts.

- Marriage certificate or registered partnership proof.

- Birth certificates for children; for adult dependants, proof of study and financial dependence if required.

- Consent letters for minors travelling without one parent, if applicable.

All documents must be apostilled and translated into the destination country’s official language.

How does the Golden Visa application process work in the EU, step-by-step?

The application process differs by country but generally includes a preliminary Due Diligence check, document collection, investment fulfilment, and biometrics submission. The key variation lies in when the investment is made — some countries require it before applying, others after.

Country-specific steps:

- Greece and Portugal require a local tax ID before document preparation.

- Portugal also requires a local bank account.

- Hungary and Latvia require a D visa for entry.

- Italy requires obtaining Nulla Osta — a certificate of absence of obstacles for obtaining an investor visa, — and the investor visa itself.

Processing times range from 3 to 12 months, depending on the country and chosen route.

1 day

Preliminary Due Diligence

A certified Anti Money Laundering Officer conducts a preliminary Due Diligence check. It lets spot possible issues and reduce the rejection risk to 1%.

Immigrant Invest signs an agreement with a Saudi investor after the preliminary Due Diligence check. If there are risks, we offer an alternative solution: clarify the situation in an affidavit or choose another program.

A certified Anti Money Laundering Officer conducts a preliminary Due Diligence check. It lets spot possible issues and reduce the rejection risk to 1%.

Immigrant Invest signs an agreement with a Saudi investor after the preliminary Due Diligence check. If there are risks, we offer an alternative solution: clarify the situation in an affidavit or choose another program.

2+ weeks

Preparation of documents

Applicants collect and legalise the required paperwork. At this stage, an assigned Immigrant Invest lawyer supports the applicant throughout the entire process, including gathering the necessary documents, ensuring proper certification where required, and meeting all translation requirements.

Applicants collect and legalise the required paperwork. At this stage, an assigned Immigrant Invest lawyer supports the applicant throughout the entire process, including gathering the necessary documents, ensuring proper certification where required, and meeting all translation requirements.

1+ months

Fulfilling the investment condition

Applicants must make the required investment according to the country’s rules. In Greece, Portugal, Hungary, Cyprus, and Latvia, the investment is made before applying, while Malta and Italy allow investment after pre-approval.

Applicants must make the required investment according to the country’s rules. In Greece, Portugal, Hungary, Cyprus, and Latvia, the investment is made before applying, while Malta and Italy allow investment after pre-approval.

Up to 6 months

Applying for residence permit

Once the documents are ready and the investment is made or pre-approved, the application is submitted to the immigration authority or local consulate.

Once the documents are ready and the investment is made or pre-approved, the application is submitted to the immigration authority or local consulate.

Up to 1.5 months

Biometric submission and receiving residency cards

The main applicant and their family members over the required age, usually 17 years old, must submit fingerprints and biometric photos in person. This usually happens at the immigration office in the destination country.

Residency cards may either be collected in person at the immigration office or delivered to the applicant’s registered address, depending on the country’s procedures and the applicant’s circumstances.

The main applicant and their family members over the required age, usually 17 years old, must submit fingerprints and biometric photos in person. This usually happens at the immigration office in the destination country.

Residency cards may either be collected in person at the immigration office or delivered to the applicant’s registered address, depending on the country’s procedures and the applicant’s circumstances.

Are there any risks or reasons for refusal of the EU Golden Visa?

An EU Golden Visa application can be refused if certain legal, financial, or procedural conditions are not met. Common grounds include:

- Background and security — criminal record, sanctions, adverse media, or concerns related to public order or health.

- Funds and investment — unclear source of funds, non‑qualifying assets, or investment below the minimum amount.

- Documentation — false, inconsistent, or improperly legalised or translated documents.

- Process and eligibility — missing insurance, failure to meet core requirements, or misstatements on tax or residency.

- Immigration history — past visa refusals and overstays, deportations, or Schengen alerts.

- Public-interest discretion — authorities may refuse on national-interest or security grounds even if formal criteria are met.

- Banking and KYC — failure to open a local account or pass bank Due Diligence checks.

What are the obligations for Saudi holders of EU investment visas?

Here’s what Saudi holders of EU investment visas are required to keep doing to stay compliant:

- Maintain the qualifying investment for the full holding period.

- Renew residence on time: after 5 years in Greece and Latvia, 2 years — in Portugal and Italy, 10 years — in Hungary.

- Meet presence rules to preserve status and future citizenship eligibility.

- Keep documents compliant.

- Report material changes such as marital status, dependants, address, or source of funds.

- Observe tax and residence rules.

- Keep a clean record.

Albert Ioffe,

Legal and Compliance Officer, certified CAMS specialist

We remind our clients to renew their residence permits when required and assist with preparing all the necessary documentation. We also help them register for tax residency and open bank accounts.

Later, we guide them through the process of obtaining permanent residence and citizenship, providing full support with the application.

When and how can Saudi investors get EU permanent residency or citizenship?

EU citizenship timelines vary by country — from 5 to 11 years — and some routes include a mandatory permanent residence step while others do not.

Eligibility. To qualify for citizenship, applicants are usually required to:

- reside in the country for most of each year during the qualifying period;

- pass a language exam and demonstrate basic knowledge of the country’s culture, constitution, or history;

- take an oath or pledge of allegiance;

- maintain a clean criminal record and pose no threat to public order or national security;

- show legal, stable income and secure long-term accommodation;

- be tax-compliant and hold valid health insurance.

Stay requirement. Most EU countries require continuous residence, meaning the applicant must live in the country for the majority of each year throughout the qualifying period.

Portugal is the key exception: under its Golden Visa program, investors may qualify for citizenship after 5 years with as little as 7 days of presence per year.

Permanent residency and citizenship in the EU

Summary: what should Saudi Arabians know about the EU Golden Visas?

- Saudi nationals can obtain EU Golden Visas, issued for 2 to 10 years and renewable indefinitely as long as the qualifying investment is maintained.

- Popular options include Greece, Portugal, and Italy, each requiring a minimum investment of €250,000.

- Investments can generate returns — either through fund yields, rental income, or resale value of real estate.

- Malta and Cyprus offer permanent residence from the outset, with minimum thresholds of €169,000 and €300,000 respectively.

- EU Golden Visa provides a full lifestyle upgrade: visa-free access across the Schengen Area, access to European healthcare and education, tax optimisation, and a path to citizenship in 5 to 11 years.

Immigrant Invest is a licensed agent for citizenship and residence by investment programs in the EU, the Caribbean, Asia, and the Middle East. Take advantage of our global 15-year expertise — schedule a meeting with our investment programs experts.

Ultimate comparison of Golden Visa programs

-

Master the residency process

-

Get expert tips and documents

-

Estimate costs accurately

Sources

- Source: Bloomberg — Portugal, Hellenic Ministry of Migration and Asylum — Greece: Golden Visa backlog in 2018—2022 and 2021—2025

- Source: EDISU Piemonte — Scholarships

- Source: OECD — Health at a glance: Europe 2024

- Source: Global Peace Index 2025

- Source: Eurostat News, 23 April 2025

- Source: Global Property Guide — Rental yields in Greece

- Source: Airbtics — Best Rental Property Markets Malta in 2025

- Source: Malta National Statistics Office — Residential Property Price Index, Q2 2025

- Source: Global Property Guide — Cyprus’s Residential Property Market Analysis 2025

- Source: Tax incentives in order to attract new tax residents under articles 5A, 5B & 5 °C of LAW NO. 4172/2013

- Source: PwC — Global Tax Summaries: Italy

- Source: The Portugal News, February 21, 2025

- Source: WhosWho.mt, Malta’s first business search engine and corporate networking platform, 14 February 2024

- Source: Passport Index

- Source: Eurostat — EU life expectancy in 2024

- Source: Οικονομικός Ταχυδρόμος, a Greek business and economics news outlet, 4 May 2025

- Source: Italian Trade Agency — Invest in Italy

- Source: European Commission — Long-term resident status in the EU

- Source: IAVE — Instituto de Avaliação Educativa (Portugal)

- Source: Government of Greece — Ministry of the Interior: Participation in the PEGP (Certificate of Adequacy of Knowledge for Naturalisation) exams

- Source: Ministero dell’Interno (Italia) — Guida alla cittadinanza italiana

- Source: Embassy of Hungary in The Hague — Ministry of Foreign Affairs and Trade: Simplified naturalization

- Source: Office of Citizenship and Migration Affairs Republic of Latvia — Examinations determined in the Citizenship Law

- Source: UNHCR — Maltese citizenship

- Source: Cyprus’s Ministry of the Interior — Acquisition of Cypriot Citizenship By Naturalization