Summary

Many wealthy people are planning to move to Malta in order to transfer assets to the country and optimise taxation. In this article, we explain the conditions of taxation in Malta.

What are the main features of taxation in Malta?

Foreign nationals are generally required to pay tax when they spend over 183 days a year in Malta. A shorter stay can also result in tax residency, in which case the person may be regarded as having Maltese domicile. Investors can also obtain tax-resident status by joining the Global Residence Programme.

Malta income tax rates range from 0 to 35%, but individuals are entitled to tax deductions. The amount of the deduction depends on the marital status of the resident. For example, a single man without children with an annual income of more than €60,000 is eligible for a deduction of €9,400.

In addition to the personal income tax, individuals pay social security contributions funding state healthcare and pensions. Employees have 10% deducted from their salary, while employers match the payment. Self-employed people pay contributions at the rate of 15% directly through three provisional payments a year[1].

Malta does not levy taxes on gift, inheritance and, in some cases, on property[2].

35% is the corporate tax rate for tax-resident companies, but refunds can reduce the effective burden to 5—10%. An alternative option is the Final Income Tax Without Imputation regime, which applies a 15% corporate tax rate.

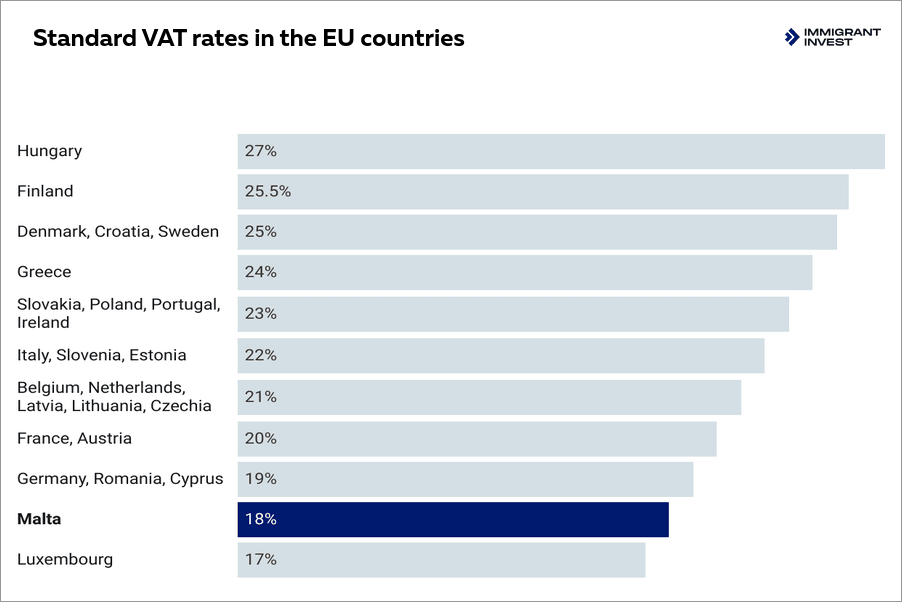

Below 20% is Malta’s VAT level, placing it among only five EU countries in this range. For comparison, the average basic VAT rate across the EU is 23.1%, while Hungary applies the highest rate at 27%[3].

Tax residence, domicile, and the remittance basis in Malta

In Malta, a person’s tax obligations depend on three key concepts: tax residence, domicile, and the remittance basis. These determine whether an individual is taxed on worldwide income or only on income arising in Malta or brought into Malta.

Residence vs. domicile

Tax residence is about physical presence and where someone habitually lives. An individual is considered a resident in Malta if they spend 183 days or more in the country in any calendar year.

Domicile is linked to a person’s long-term ties, origin, or permanent home. Changing domicile is possible but requires strong evidence of permanently severing ties with the home country and establishing Malta as the long-term base.

Malta’s tax system treats residents with and without Maltese domicile differently:

- residents with domicile in Malta are taxed on their worldwide income and capital gains;

- residents without a Maltese domicile pay taxes on the remittance basis.

Remittance basis

Under the remittance basis, Malta does not tax worldwide income automatically. Instead:

- foreign income is taxed only if it is remitted to Malta;

- foreign capital gains are not taxed, even if remitted;

- income arising in Malta is always taxable, regardless of remittance.

Albert Ioffe,

Legal and Compliance Officer, certified CAMS specialist

In addition to the remittance basis, Malta introduced an ORD-non-dom minimum tax rule to ensure that non-dom residents make a basic annual contribution to the Maltese tax system.

Under this rule, a non-dom applying the remittance basis and earning more than €35,000 in foreign income must pay a minimum of €5,000 in Maltese tax each year, even if no income is remitted to Malta.

Any tax already paid on Maltese-source income or on remitted foreign income is credited towards this amount. If the total falls short of €5,000, the individual pays the difference.

Main taxes in Malta for individuals

Legal entities in Malta pay two main taxes: corporate income tax and valued-added tax. Taxes on dividends, interests, royalties, and authorised capital are not charged.

Corporate income tax

The Malta corporate tax rate is 35%. However, the large share of it can be refunded, for example:

- 6/7 tax refund of the tax paid and the tax rate after refund is only 5% if the company is trading.

- 5/7 tax refund if the company received passive income and royalties.

- 2/3 tax refund if the company is subject to a double taxation treaty.

- 100% tax refund if the Maltese company is a holding company and owns an interest in a foreign company. Such a company belongs to the Participating Holding category.

To ensure that taxes can be refunded, they are distributed across five accounts. Tax refunds are made only from the first and second accounts:

- Final Tax Account.

- Maltese Taxed Account.

- Foreign Income Account.

- Immovable Property Account.

- Untaxed Account.

The return procedure is similar in all cases. First, the company pays taxes, then writes an application for a refund. The tax office considers the application within 14 days. When the application is approved, the refund is made in the same currency in which the taxes were paid.

In September 2025, Malta introduced the 15% Final Income Tax Without Imputation regime[4]. It offers an alternative to the traditional 35% corporate tax system with shareholder refunds. Under the new model, a company pays a fixed 15%, and no refunds are issued.

The tax payable under this regime cannot be lower than the effective tax due under the imputation system.

All profits taxed at 15% must be allocated to the Final Tax Account. Dividends paid out of profits not allocated to the Final Tax Account, as well as income already taxed under another final tax provision, are excluded.

Once elected, the regime must be maintained for 5 consecutive years.

Bank of Valletta is one of several Maltese banks that serve local companies. The average interest rate on business credit in Malta stands at about 3.82% per annum

Valued-added tax

Malta’s standard VAT rate is 18%, one of the lowest in the European Union. This rate applies to most goods and services unless a reduced rate or exemption is specifically provided. The reduced tax rates are as follows:

- 7% — hotel accommodation and certain tourism-related services;

- 5% — electricity, printed books and newspapers, medical equipment, certain food items, and some cultural or artistic services[5].

Some categories are exempt without credit, meaning no VAT is charged but businesses cannot reclaim input VAT:

- financial services;

- insurance services;

- education services;

- rental of immovable property for residential use;

- certain medical and health services.

Other supplies are zero-rated, where VAT is charged at 0% but input VAT is recoverable. This includes exports to non-EU countries and intra-EU supplies of goods to VAT-registered businesses in other member states.

What are the capital gain tax rates in Malta?

Capital gains in Malta are taxed differently for individuals and companies, and the outcome depends on residence, domicile, and the type of asset being sold.

For individuals

Residents who are domiciled in Malta are taxed on worldwide capital gains. The gains are added to their taxable income and taxed at progressive rates of up to 35%.

Residents who are non-domiciled are taxed only on Maltese-source capital gains.

Foreign capital gains are fully exempt, even if the proceeds are brought into Malta. Maltese-source gains, however, are taxed at the same progressive rates as other forms of income.

Non-residents are taxed only on gains arising from Maltese immovable property or from shares in companies that mainly own Maltese real estate. Most property transactions fall under a Final Property Transfer Tax of 8—12%, which replaces standard capital gains rules.

For companies

Maltese companies pay capital gains tax at the standard corporate rate of 35%, with an effective rate often reduced to 5—10% through Malta’s refund system. From 2025, companies may opt for a 15% final tax regime without refunds.

Gains on qualifying foreign shareholdings may be fully exempt under the participation exemption, making many foreign disposals tax-free for Maltese holding structures.

Foreign companies with a permanent establishment in Malta are taxed at 35% on gains linked to that establishment. Companies without a presence in Malta are taxed only on gains from Maltese property, typically at the 8—12% final tax rate.

What are the income taxes for individuals in Malta?

When calculating an individual’s taxable income, the following components are considered:

- wage;

- salary and other income received from labor activity;

- profit or income from business activities;

- dividends, interest, royalties and other investment income, including rental income;

- pensions and regular receipts.

The remuneration received by members of the board of directors is equal to ordinary income from employment. The remuneration received by a citizen of Malta is subject to taxation.

The income tax rate depends on the total income and marital status of the taxpayer[6]. There are three categories of residents: unmarried, married, and parents. Each computation reflects the cost of supporting a household, offering higher deductions where responsibilities are greater.

The single computation is used when the taxpayer is not married or is married but files separately and does not qualify as a parent under Maltese tax rules. In practice, this applies to most adults with no dependent children.

Income tax in Malta for a single person

The married computation is available only when two spouses file a joint tax return.

This computation provides a higher tax-free allowance and is often beneficial when one spouse earns significantly more than the other.

Income tax in Malta for a married person

A taxpayer can use the parent rates only if all of the following conditions are met:

- They maintain a dependent child who is under 18 or under 23 and in full-time education.

- The child lives with the taxpayer or is maintained through court-ordered maintenance.

- The taxpayer is either unmarried or married but filing a separate tax return.

Parent rates are usually more favourable, with a higher tax-free threshold and a larger deduction.

Income tax in Malta for a parent

How to become a tax resident in Malta?

You must be in the country for more than 183 days a year and receive income in Malta to become a Maltese tax resident. If a person lives and earns income in another country but has a passport of Malta, then he is not considered a resident and does not pay Maltese taxes.

In addition, domicile status can be obtained in Malta. This is a person who spends less than 183 days a year in Malta, but considers the country his main place of residence and may intend on returning to spend the rest of his life there.

There are three conditions that must be met in order to obtain domicile status in Malta:

- Be over 18 years of age.

- To sever all ties with other countries, that is, not to live regularly and for a long time in another country.

- Provide compelling evidence that there is an intention to live in Malta permanently or indefinitely in the future.

Investors who participate in the Global Residence Programme, GRP, become Maltese tax residents during the application process. It is an obligatory step.

The Global Residence Programme requires investors to pay an annual tax of €15,000 or at a flat rate of 15%, depending on which one is higher. In addition, participants must pay an administration fee of €5,500—6,000 and buy or rent real estate for the required sum:

- renting — €8,750+ in the Gozo and southern Malta, €9,600+ in other parts of the country;

- purchasing — €220,000+ in the Gozo and south of Malta, €275,000+ in other regions.

When do tax liabilities arise?

A person is generally liable to pay taxes in Malta if they spend more than 183 days in the country within a year or if they acquire domicile status there. Certain other circumstances may also create tax obligations.

Using local accounts. If an investor opens accounts with local banks and receives income in them, they become a tax resident. However, simply opening a bank account in Malta does not make one liable for taxation.

Investing in local assets. Buying assets in Malta, such as rental property or a business, also creates tax obligations in the country.

Relocating a business. If an investor moves the head office of their company to Malta, they will be required to pay taxes in Malta.

How and when to pay taxes in Malta?

To pay taxes in Malta, an individual must first register with the Commissioner for Tax and Customs and obtain a tax identification number, TIN. With the TIN, they can file annual tax returns and make any provisional tax payments required during the year.

Payment methods

All tax payments are made to the Commissioner for Tax and Customs. Taxpayers may pay:

- through the CFR online portal;

- via internet banking using the payment reference in their assessment;

- through a licensed tax representative who handles filings and payments on their behalf.

Deadlines

Malta follows a calendar tax year from January 1st to December 31st. All individuals with taxable income, including employees, self-employed persons, investors and non-dom residents, must submit their annual tax return by June 30th of the following year.

Employees effectively pay tax throughout the year because income tax and social security contributions are withheld from their salary each month.

Self-employed individuals and companies make three provisional payments in April, August and December, and settle any remaining balance when filing their annual return.

GRP beneficiaries pay their tax once a year when they submit their annual return, ensuring they meet the programme’s minimum annual tax requirement.

Double taxation avoidance agreements

Malta has agreements on avoidance of double taxation with 81 different countries and territories[7].

The conditions of agreements may differ from country to country. But usually their provisions affect investors who:

- are tax residents of Malta and they are non-residents in another country but receive dividends or interest from that country’s companies;

- remain tax residents of another country under the 183-day rule and have Maltese holding and financial companies in their structure.

Key takeaways: features of the Maltese tax system

- To become a tax resident, the person must either spend over 183 days in Malta, obtain a domicile status, or participate in the Global Residence Programme.

- Tax rates in Malta are lower than in many EU countries. For instance, the income tax is up to 25%, while VAT is 18%.

- The corporate tax is 35%, but the company owners can apply for refunds.

- There are no important taxes for business in Malta: on royalties, interest, dividends.

- Individuals do not pay taxes on inheritance, gift, property, capital.

- To pay taxes in Malta, the person must obtain a Tax Identification Number and submit an annual tax return by June 30th of the following year.

Immigrant Invest is a licensed agent for citizenship and residence by investment programs in the EU, the Caribbean, Asia, and the Middle East. Take advantage of our global 15-year expertise — schedule a meeting with our investment programs experts.

Will you obtain residence by investment in Malta?

-

Master the residency process

-

Get expert tips and documents

-

Estimate costs accurately

Sources

- Source: Social security contribution rates on the MTCA website

- Source: PwC Malta confirms absence of inheritance and gift tax in Malta

- Source: Tax Foundation confirms EU VAT rates

- Source: Legal Notice 188 of 2025: implementation of the Final Income Tax Without Imputation regime

- Source: Worldwide Tax Summaries confirms Maltese VAT rates

- Source: MTCA confirms progressive bands up to 35%

- Source: List of countries with whom Malta has double taxation avoidance agreements