Summary

Qatar issues a title deed and a residency visa within days to foreign buyers of approved property starting at $200,000.

Investors also have the option to obtain permanent residency by purchasing approved property, provided they meet all other eligibility conditions.

What is the Qatar Golden Visa?

The so-called Qatar Golden Visa is the country’s official residency by investment program. It enables eligible foreigners to obtain temporary or permanent residency depending on the investment amount:

- Real estate investment of $200,000 grants a renewable residence permit[1].

- Real estate investment of $1,000,000 or more may qualify for permanent residency[2].

Qatar has no official “Golden Visa” webpage or brand. The country operates an Investor Residence Visa system, together with rules for permanent residency and foreign property ownership.

Relevant government sources where these statuses are administered and regulated include:

- permanent residency and application procedures — Ministry of Interior, MOI[3];

- Investor Residence Visa service — Hukoomi e-government portal[4];

- Law No. 10 of 2018 on permanent residence — Al Meezan legal portal[5];

- Cabinet Decision No. 28 of 2020, listing freehold zones open to non-Qataris — Aqarat Real Estate Regulatory Authority[6].

Elena Ruda,

Chief Development Officer at Immigrant Invest

Qatar does not offer citizenship by investment. Foreigners can obtain residency by investment, but this residence status does not lead to citizenship. Nationality is granted only in exceptional cases and after many years of lawful residence, cultural integration, and proven contribution to the country.

The Qatar Golden Visa serves as a path to long-term residence and financial security, appealing to investors who value stability, privacy, and a tax-efficient lifestyle in one of the Gulf’s fastest-growing economies.

Unlike Qatar Golden Visa, many other Golden Visa programs eventually lead to citizenship by naturalisation. For example, investors in Portugal, Greece, Hungary, and Cyprus can become eligible for citizenship after 7—11 years of legal residence.

Residency types and investment requirements

Qatar offers two main property-based investment routes. Both options require investment in approved freehold zones where foreign ownership is permitted.

Temporary residence permit in Qatar

Investors can obtain a renewable residence permit by purchasing approved real estate in a designated freehold area worth at least QAR 730,000, around $200,000.

The process is fast, residency and title can be issued within days once the property purchase is registered and verified. This pathway suits investors seeking flexibility and a base in Qatar without full relocation.

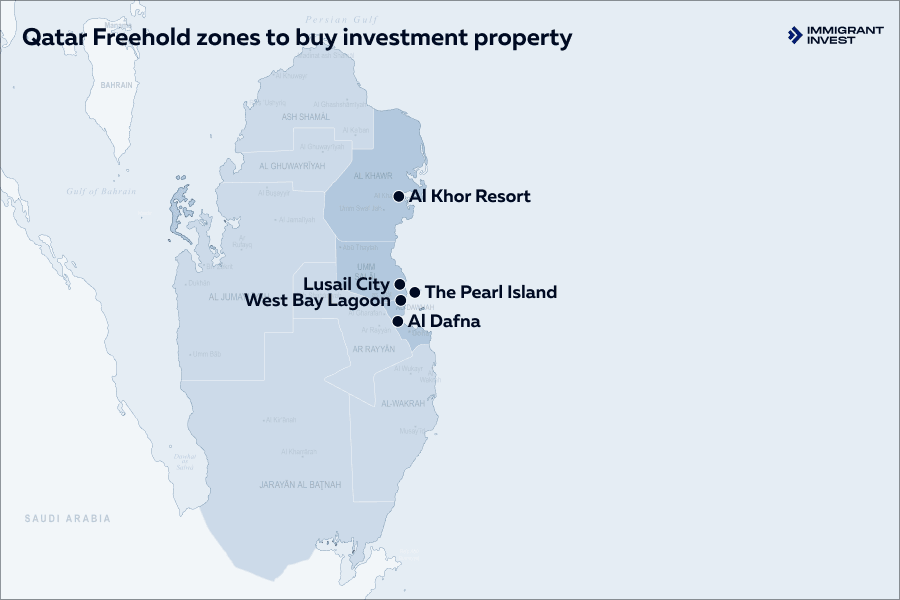

Property requirements. To qualify, the property must be in one of the designated freehold zones approved under Cabinet Decision No. 28 of 2020, including:

- The Pearl-Qatar;

- Lusail City;

- West Bay Lagoon;

- Al Dafna;

- Al Khor Resort.

The investment may be in an apartment, villa, or commercial unit, provided the value meets or exceeds the threshold and ownership is fully registered in the investor’s name.

Conditions and maintenance. Applicants must prove a clean police record, undergo a medical check in Qatar, maintain valid health insurance, and demonstrate a lawful source of funds.

To preserve status at this lower tier, the investor is expected to spend about 90 days per year in Qatar. Residency can be renewed as long as the investment is maintained and the property remains in good legal standing.

Benefits of this option. The temporary residence permit grants the right to live, work and study in Qatar, access to public healthcare and education, and the ability to sponsor a spouse and dependent children. It is the simplest way for non-Qataris to gain residency and property ownership simultaneously.

Permanent residency in Qatar

Investors who purchase property worth at least QAR 3,650,000, around $1,000,000, become eligible for permanent residency under Law No. 10 of 2018.

Permanent status provides more stability and broader rights than the standard residence permit and is generally intended for long-term residents who contribute significantly to Qatar’s economy.

Property requirements. The property must also be located within one of the government-designated freehold zones. Purchases in premium developments such as The Pearl-Qatar and Lusail Marina District often qualify. The property must be fully owned, not leased, and properly registered with the Ministry of Justice.

Conditions and verification. The investor must provide documentation confirming the purchase price, proof of funds, medical and police clearances, and insurance.

For this higher tier, there is no mandatory residence requirement.

Benefits of permanent residency. Permanent residents enjoy extended rights, including free access to public healthcare and education, ownership of additional properties in approved zones, and the ability to sponsor family members with fewer financial restrictions.

Comparison of Qatar residency options by investment

Who qualifies for the Qatar Golden Visa and what are the requirements?

Applicants qualify by making an investment, passing background and health checks, and keeping all records accurate and up to date. Families can be sponsored if income and housing standards are met, with clear rules on presence for the lower tier.

Main investor eligibility

Core conditions investors must meet:

- buy approved freehold real estate from $200,000 or meet the higher thresholds where applicable;

- show a lawful source of funds and full proof of payment;

- hold a clean police record for every country of long-term residence;

- complete a medical check in Qatar and keep valid health insurance for all applicants;

- hold a valid passport and provide certified Arabic translations where required;

- keep suitable accommodation in Qatar documented by title or lease.

Applicants must keep the qualifying investment compliant with Qatari law, with clear evidence of ownership and payment history on file.

For the lower property tier, they typically maintain at least 90 days of presence in Qatar each year to preserve status. Dates, renewals and any changes in personal details are monitored and updated with the authorities in good time.

Family members you can include

The main investor may include relatives in the application, provided that income and housing requirements are met. Eligible family members who can be sponsored are:

- spouse;

- dependent children.

To sponsor family members, the main applicant must demonstrate sufficient income and suitable housing in Qatar. The minimum requirements include a monthly income of QAR 10,000, or $2,750 and a registered residential address with adequate space for the family.

Documents checklist

Your file must be complete, consistent and properly attested to avoid delays or refusals. Prepare a full dossier with:

- Passport copies for all applicants with adequate validity.

- Police clearance certificates issued recently for each adult.

- Medical clearance results issued in Qatar.

- Title deed or sale and purchase agreement for property buyers.

- Health insurance policies valid in Qatar for all applicants.

- Civil status documents legalised and translated into Arabic.

- Proof of funds and payment transfers for the investment.

Health and security checks

Qatar screens all applicants for public safety and health, and you must keep insurance active at all times. Checks you should expect:

- fingerprints and background screening for each adult;

- medical examinations in Qatar for all applicants;

- ongoing requirement to maintain comprehensive health insurance.

Renewals and ongoing compliance

Residence remains renewable when the investor maintains the qualifying asset, keeps documents current, and meets any presence rules.

For the higher-value property option that makes a buyer eligible for permanent residency at $1,000,000, there is no mandatory residence requirement for renewals.

For the lower property route at $200,000, the status is typically preserved by spending at least 90 days in Qatar each year.

What are the 7 benefits of the Qatar Golden Visa?

Qatar pairs fast property-based residency with zero personal income tax, strong public services and a stable, investor-friendly environment. Below are the advantages that matter most to investors and their families.

1. Residence rights and family sponsorship

Successful applicants receive the right to live, work and study in Qatar, with access to public healthcare and education.

Investors can sponsor a spouse and dependent children once they show a stable income and suitable housing. This makes relocation practical for whole families rather than just the main applicant.

2. Residence permit in 24 hours

For approved real-estate purchases from $200,000, title and residency can be issued rapidly once registration is complete. It is a much quicker route than the standard employment-sponsored residence permit, which often involves employer sponsorship, visa renewal each year, and usually takes several months for processing.

Qatar is ranked 1st globally for ease of real estate registration for foreigners. Key advantages for investors include:

- ownership documents and architectural plans can be issued within 24 hours;

- registration fees are the lowest in the region, at just 0.01% of construction costs;

- licensing fees remain minimal, and a fully electronic building permit system streamlines approvals;

- simplified processes for transitioning between real estate projects.

3. Zero income tax and pro-business setting

Qatar does not levy personal income tax[7], which is a clear advantage for entrepreneurs, consultants and globally mobile professionals. Company formation is straightforward through recognised frameworks, and corporate tax is predictable, supporting long-term planning and efficient remuneration structures.

4. Property market development

Qatar’s real estate sector recorded QAR 8.9 billion, about $2.45 billion, in property transactions during the second quarter of 2025, marking a 29.8% rise compared with the same period last year. The increase was largely driven by a 114% surge in residential property sales.

Qatar’s property market has experienced notable cycles over the past decade. After a sharp surge in 2014—2015, when prices rose by more than 30%, the market entered a correction phase, with several years of decline between 2016 and 2020. A moderate recovery followed in 2021–2023, supported by post-World Cup development projects and renewed foreign investment.

Despite short-term volatility, the long-term trend indicates a gradual stabilisation of the housing sector, with renewed growth potential as the country expands its freehold zones and streamlines property-ownership procedures for foreign buyers.

Here is the chart of annual nominal percentage changes in house prices in Qatar, based on data from Global Property Guide[8]

5. Political stability and personal security

Low crime, robust institutions and a consistent policy direction create a stable base for capital and family life. For investors managing international assets and travel, this predictability reduces country risk and supports multi-year residency planning without frequent rule shocks.

Qatar ranks 27th globally out of 163 countries and is 1st in the Middle East & North Africa region for peacefulness[9].

6. Healthcare and international schooling

Residents access high-quality hospitals and clinics, with comprehensive private plans widely available. Examples include:

- Hamad Medical Corporation — Qatar’s largest public healthcare network with specialised hospitals in Doha[10];

- Sidra Medicine, a world-class facility for women’s and children’s health;

- Aspetar, an internationally accredited orthopaedic and sports medicine hospital.

Leading private providers such as Doha Clinic Hospital, Al-Ahli Hospital, and Aster Medical Centre also offer premium services for residents and expatriate families.

A broad network of international schools offers British, American and IB curricula. American School of Doha, offering a US program with Advanced Placement courses; and Swiss International School Qatar and ACS Doha International School, both accredited for the International Baccalaureate.

Many also feature partnerships with UK and US universities, ensuring continuity in education for expatriate families.

7. Connectivity to Gulf and global markets

A central location, extensive air links and regional business ties make Qatar an efficient base for operations across the GCC and beyond. This connectivity shortens travel times to key hubs and supports cross-border trading, consulting and family mobility.

Al Waab is one of Doha’s most desirable neighbourhoods for families. It offers spacious villas, international schools, and easy access to parks and shopping centres

How to apply for a Qatar Golden Visa?

Based on Immigrant Invest lawyers’ experience, well prepared Golden Visa applications are typically processed within 1—3 months, as most steps are completed online through the official portal.

Below is a step-by-step overview of the process with approximate timeframes.

1—2 weeks

Choose and verify an eligible property

The applicant begins by selecting real estate in an approved freehold zone such as The Pearl-Qatar, Lusail City, or West Bay Lagoon. The property must meet the minimum investment threshold for a temporary or for permanent residency eligibility.

Legal and technical Due Diligence is conducted to confirm that the property qualifies for full foreign ownership.

The applicant begins by selecting real estate in an approved freehold zone such as The Pearl-Qatar, Lusail City, or West Bay Lagoon. The property must meet the minimum investment threshold for a temporary or for permanent residency eligibility.

Legal and technical Due Diligence is conducted to confirm that the property qualifies for full foreign ownership.

1—2 weeks

Purchase completion and title registration

Once the sale and purchase agreement is signed and payment is made, the transaction is registered with the Ministry of Justice. A title deed is typically issued within a few days, officially confirming ownership and enabling the investor to proceed with the residence application.

Once the sale and purchase agreement is signed and payment is made, the transaction is registered with the Ministry of Justice. A title deed is typically issued within a few days, officially confirming ownership and enabling the investor to proceed with the residence application.

1—2 weeks

Document preparation and attestation

The applicant compiles all required documents, including valid passports, police clearance certificates, medical reports, proof of health insurance, and financial statements. Civil status documents for family members must be legalised and translated into Arabic by a certified translator. Proper attestation at this stage prevents delays in later steps.

The applicant compiles all required documents, including valid passports, police clearance certificates, medical reports, proof of health insurance, and financial statements. Civil status documents for family members must be legalised and translated into Arabic by a certified translator. Proper attestation at this stage prevents delays in later steps.

1—2 weeks

Online application submission

The investor submits the application through the Investor Residence Visa service on hukoomi.gov.qa or the Ministry of Interior portal. All documentation and receipts are uploaded, and official fees are paid. Initial verification generally takes 10 to 15 working days, depending on case complexity.

The investor submits the application through the Investor Residence Visa service on hukoomi.gov.qa or the Ministry of Interior portal. All documentation and receipts are uploaded, and official fees are paid. Initial verification generally takes 10 to 15 working days, depending on case complexity.

1 week

Biometric registration and medical verification

After preliminary approval, the applicant undergoes fingerprinting and a health examination in Qatar. The authorities verify identity, insurance coverage, and all data provided in the application.

After preliminary approval, the applicant undergoes fingerprinting and a health examination in Qatar. The authorities verify identity, insurance coverage, and all data provided in the application.

1 week

Issuance of the residence permit and Qatar ID

Upon final approval, the residence permit and Qatar ID card are issued. For investors at the $200,000 tier, the residence permit is typically valid for one year and can be renewed. Those meeting the $1,000,000 threshold may receive permanent residency status after verification.

Upon final approval, the residence permit and Qatar ID card are issued. For investors at the $200,000 tier, the residence permit is typically valid for one year and can be renewed. Those meeting the $1,000,000 threshold may receive permanent residency status after verification.

2–4 weeks

Family sponsorship and renewals

Following issuance of the main applicant’s residence card, family members may be sponsored. The process requires submission of attested civil documents and proof of income. Family applications are usually processed within two to four weeks.

To maintain status, residence cards and health insurance must be renewed before expiry, and the investment must remain in compliance with Qatari property laws.

Following issuance of the main applicant’s residence card, family members may be sponsored. The process requires submission of attested civil documents and proof of income. Family applications are usually processed within two to four weeks.

To maintain status, residence cards and health insurance must be renewed before expiry, and the investment must remain in compliance with Qatari property laws.

How to avoid refusal and ensure compliance when relocating to Qatar?

The strongest applications are those that are error-free, fully attested, and supported by evidence of stable income and lawful funds. By treating each requirement as a compliance step, investors ensure approval and protect their long-term residency in Qatar’s stable, high-growth environment.

Common reasons for refusal

Most rejections are linked to preventable technical or procedural errors rather than the investment itself:

- incomplete documentation or missing attestations from home-country authorities;

- inconsistencies in names, birth dates or passport details across documents;

- unverified property ownership or failure to prove full payment and registration;

- Insufficient income to support family sponsorship;

- expired medical or police clearances, which must be recent and issued within six months;

- use of unlicensed agents or unofficial translation services, which can invalidate submissions.

Careful preparation, accurate translations, and professional guidance help investors secure approval smoothly and maintain status long term.

Best practices for a successful application

Experienced lawyers, such as the experts at Immigrant Invest, recommend the following strategies:

- Conduct pre-verification of property in freehold zones before signing any purchase agreement.

- Work with licensed translators and notaries recognised by the Qatari Embassy or consulate.

- Submit a complete digital file with clear, legible scans — unclear copies often trigger rejections.

- Maintain consistency between all spellings and document versions.

- Seek professional legal review before submission to avoid procedural errors and delays.

What are the tax advantages of living in Qatar?

Qatar is one of the most tax-efficient countries in the world, offering zero or law taxes, and extensive international tax treaties that protect investors from double taxation.

0% personal income tax

Residents of Qatar enjoy complete exemption from personal income tax. Salaries, wages, dividends, interest, and capital gains earned by individuals are not subject to tax, regardless of whether the income is generated domestically or abroad. This policy makes Qatar particularly attractive for high-net-worth individuals seeking to optimise after-tax income.

10% corporate taxation

The standard corporate income tax rate is 10% on net profits from business activities conducted in Qatar[11]. The system is straightforward and transparent, applying primarily to non-Qatari owned entities.

Companies established under the Qatar Financial Centre may benefit from flexible tax frameworks, foreign ownership rights, and access to international arbitration mechanisms.

Double taxation avoidance agreements

Qatar has signed more than 80 Double Taxation Avoidance Agreements with countries across Europe, Asia, and North America, including the United States, the United Kingdom, France, India, and Singapore[12].

These treaties prevent residents and investors from being taxed twice on the same income and promote the free movement of capital and profits.

Exemptions from wealth, inheritance and capital gains taxes

There are no wealth, inheritance, or capital gains taxes on most personal assets in Qatar.

Property owners do not pay annual property tax, and there are no taxes on capital appreciation or asset transfers, except minimal administrative fees during registration.

Potential drawbacks of Qatar residence permit

While Qatar offers strong economic and lifestyle advantages, several practical and cultural factors should be considered before relocating.

No direct path to citizenship. The investor visa grants renewable residency or, at higher levels, eligibility for permanent residency, but it does not lead to Qatari citizenship. Nationality remains reserved for rare, exceptional cases.

Climate and cost of living. Qatar’s desert climate means long, hot summers with high humidity, which can limit outdoor activity. The cost of imported goods, premium housing and private schooling is also relatively high compared with many other destinations.

Cultural and language adjustment. Arabic is the official language, and a basic level is required for permanent residency. The country’s social norms are conservative, which may require adaptation for some expatriate families.

Is the Qatar Golden Visa worth it for global investors?

- The Qatar Golden Visa stands out as one of the most strategically designed residency options in the Gulf. It blends tangible property ownership with fast-track residency, and a clear legal base.

- Qatar offers one of the world’s most favourable fiscal regimes: 0% income tax, no wealth or inheritance tax, and predictable corporate taxation at 10 percent. Combined with more than 80 double taxation agreements, these features make the country particularly attractive for entrepreneurs, business owners, and international families structuring assets globally.

- Qatar ranks 1st in the Middle East for safety and political stability and 27th globally in the Global Peace Index.

- Residents enjoy modern infrastructure, premium healthcare, international education, and connectivity across the Gulf, Europe, and Asia. For families, the ability to sponsor dependents and access long-term residence adds an extra layer of certainty.

- Qatar Golden Visa is not a citizenship route. However, those seeking a faster or more direct path to a second passport can explore other programs worldwide.

Immigrant Invest is a licensed agent for citizenship and residence by investment programs in the EU, the Caribbean, Asia, and the Middle East. Take advantage of our global 15-year expertise — schedule a meeting with our investment programs experts.

Ultimate comparison of Golden Visa programs

-

Master the residency process

-

Get expert tips and documents

-

Estimate costs accurately

Sources

-

Source: Qatar Golden Visa, The Economic Times

-

Source: Real estate investment options, Qatar RERA

-

Source: Permanent residency, Ministry of Interior, Qatar

-

Source: HOKOOMI, Qatar e-Government

-

Source: Law No. 10 of 2018, Al Meezan

-

Source: Al Meezan, Decision 28/2020

-

Source: Income Tax Law and Regulation, General Tax Authority

-

Source: Qatar home-price trends, Global Property Guide

-

Source: Qatar ranking, Global Peace Index 2025

-

Source: Hamad Medical Corporation, Ministry of Public Health

-

Source: Income Tax Law and Regulation, General Tax Authority

-

Source: List of DTAs, Qatar Financial Centre